Please use a PC Browser to access Register-Tadawul

Assessing First Interstate BancSystem (FIBK) Valuation As Analyst Optimism Builds Ahead Of Earnings

First Interstate BancSystem, Inc. FIBK | 36.66 | -4.08% |

First Interstate BancSystem (FIBK) is drawing fresh attention as several analysts turn more optimistic on the regional bank, citing improving sector conditions and loan growth prospects in connection with its upcoming quarterly earnings report.

The recent analyst upgrades and upcoming earnings call sit against a stronger price backdrop, with a 23.58% 90 day share price return and a 25.47% 1 year total shareholder return suggesting momentum has been building rather than fading.

If this banking move has your attention, it could be a good moment to broaden your search with fast growing stocks with high insider ownership that might surface your next idea.

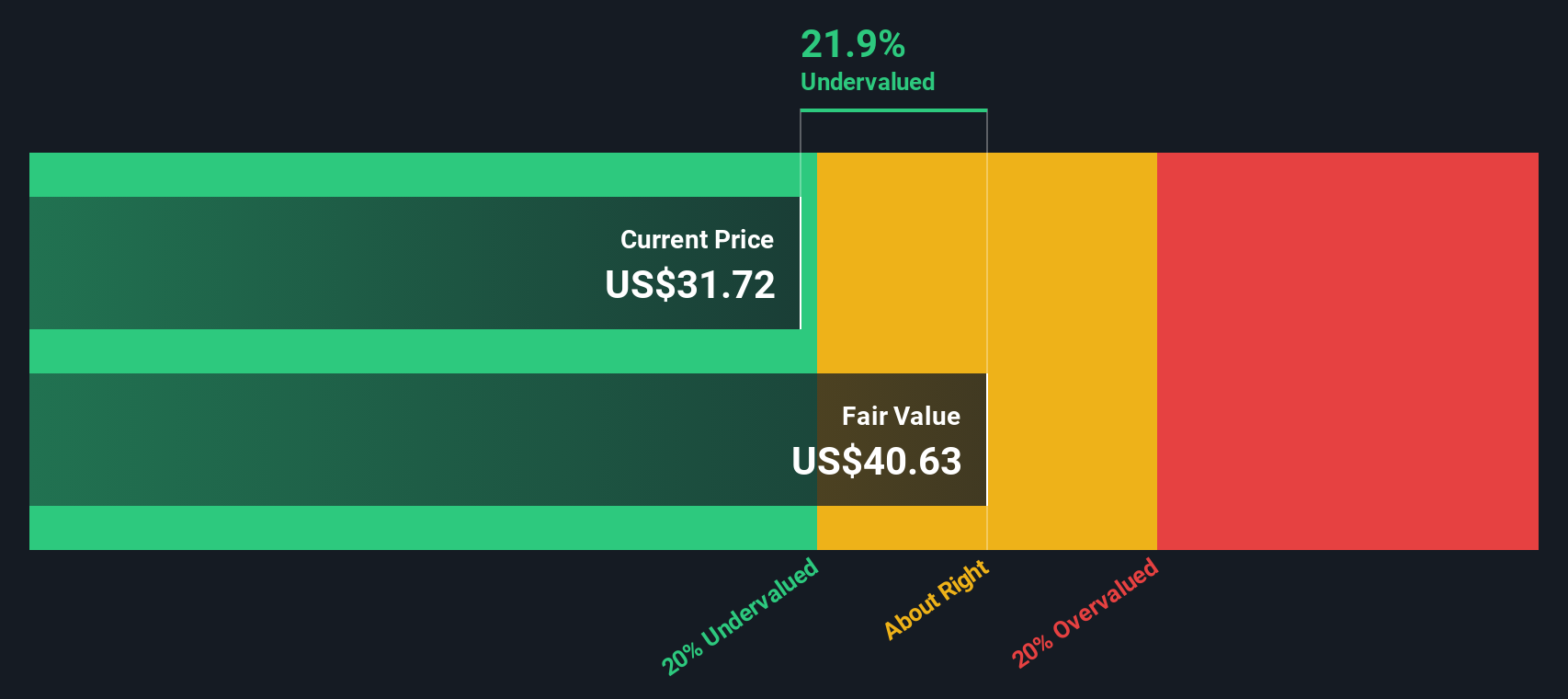

With First Interstate BancSystem trading near its latest analyst price target yet still showing an estimated 17.66% intrinsic discount, the key question is whether there is still an opportunity here or if the market is already pricing in future growth.

Most Popular Narrative: 5.7% Overvalued

Compared with First Interstate BancSystem's last close of US$37.52, the most followed narrative lines up to a fair value of US$35.50, suggesting the recent price strength may already reflect a lot of the expected progress.

Strong capital and liquidity levels, further enhanced by the Arizona and Kansas branch transaction, give the company multiple options for value creation (for example, share repurchases, organic investment, or future M&A), increasing flexibility to support shareholder returns and earnings growth through 2026 and beyond.

Want to see what kind of revenue path and margin reset needs to happen for this valuation to hold up? The narrative leans heavily on faster earnings growth, a higher profitability profile, and a lower future earnings multiple than many banks trade on today. Curious how those assumptions all fit together to back into that fair value line?

Result: Fair Value of US$35.50 (OVERVALUED)

However, this story still hinges on reversing loan runoff and keeping criticized credits in check; any stumble there could quickly challenge the current fair value narrative.

Another View: DCF Points to Undervaluation

While the popular narrative pegs First Interstate BancSystem as about 5.7% overvalued at US$37.52 versus a US$35.50 fair value, our DCF model arrives at a fair value of US$45.57. That gap suggests the current price could still leave meaningful upside on the table, if the cash flow path holds.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Interstate BancSystem for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 876 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Interstate BancSystem Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in minutes with Do it your way.

A great starting point for your First Interstate BancSystem research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

If First Interstate BancSystem has sharpened your thinking, do not stop here. Your next strong idea could already be sitting in another corner of the market.

- Spot potential mispricings by scanning these 876 undervalued stocks based on cash flows, where cash flow based opportunities are already filtered for you.

- Ride major tech shifts earlier by tracking these 28 AI penny stocks that tie real businesses to artificial intelligence themes.

- Tap into income-focused opportunities with these 11 dividend stocks with yields > 3% if you want yields above 3% working for your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.