Please use a PC Browser to access Register-Tadawul

Assessing First Watch Restaurant Group (FWRG) Valuation After Record Expansion And Traffic Growth

First Watch Restaurant Group, Inc. FWRG | 15.92 | +1.86% |

First Watch Restaurant Group (FWRG) has put expansion at the center of its latest update, reporting record preliminary 2025 operational results that include 64 new restaurants across 23 states, as well as same-restaurant sales and traffic growth.

The strong preliminary 2025 update and fresh Boston opening come after a mixed share price pattern, with a 7.81% year to date share price return but a 10.77% decline in 1 year total shareholder return. This suggests near term momentum is improving while longer term performance has been more muted.

If this kind of expansion story has your attention, it could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With shares up 7.8% year to date but showing a 10.8% decline over 1 year, and the stock trading about 34% below the average analyst target, you have to ask: is there a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 24.7% Undervalued

With First Watch Restaurant Group last closing at US$16.57 and the most followed narrative pointing to fair value at US$22, the gap hinges on some punchy growth assumptions and margin improvement.

The brand's alignment with increasing consumer demand for health-conscious, fresh, and made-to-order daytime dining, plus continued menu innovation and digital investments (waitlist automation, nutrition filters), is likely to drive higher in-store traffic, check growth, and strong long-term same-restaurant sales.

Curious what kind of revenue climb and margin reset would need to back that price? The narrative leans on fast compounding earnings and a premium future earnings multiple. Want to see how those ingredients are mixed together to reach that fair value?

Result: Fair Value of $22 (UNDERVALUED)

However, there are real swing factors here, including sustained cost inflation and any stumble in new site selection or ramp up that could quickly challenge today’s optimism.

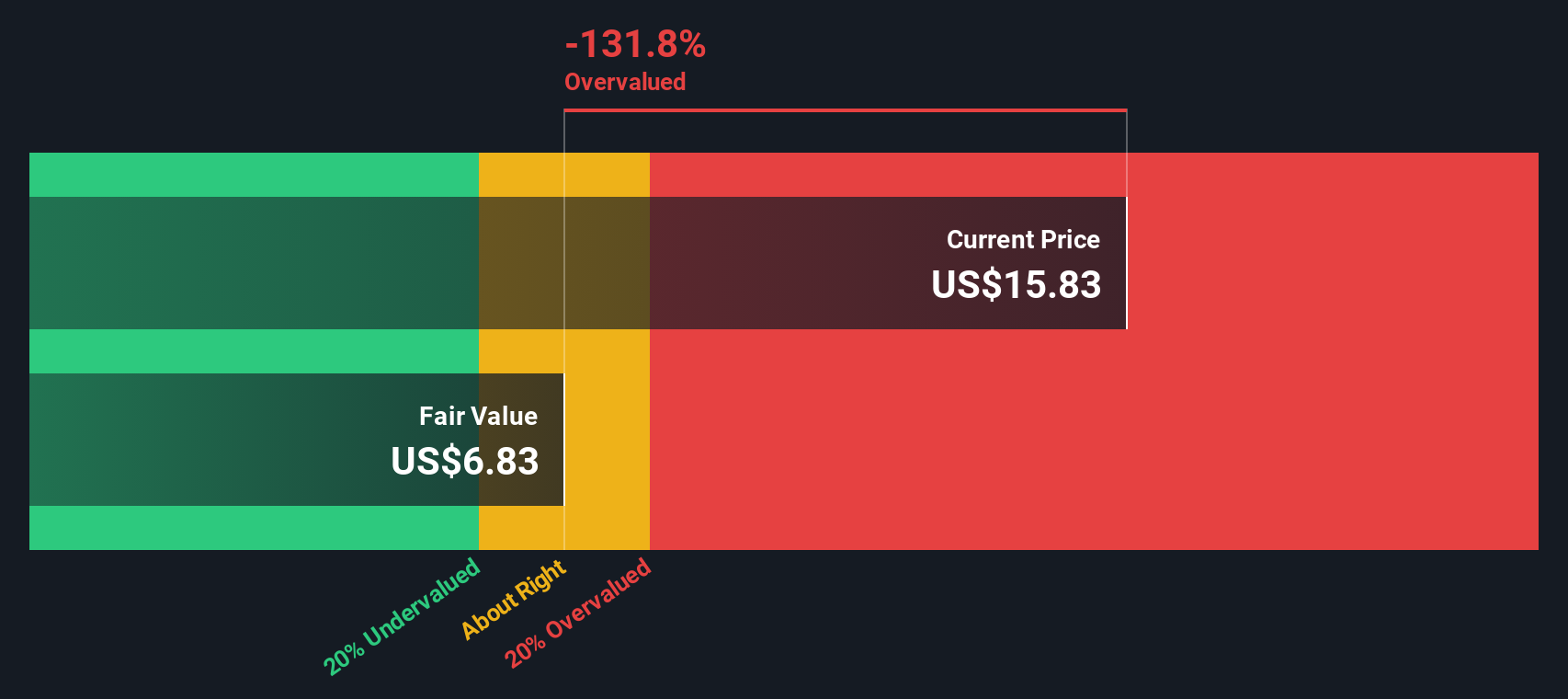

Another View: DCF Flips The Story

Analysts as a group see upside from today’s price, but our DCF model takes a much tougher stance. On this view, First Watch Restaurant Group at US$16.57 screens as expensive, with fair value at just US$4.12. This points to a very different risk profile.

If the SWS DCF model is this cautious while the consensus narrative leans on growth and margin recovery, which set of assumptions feels closer to how you see the next few years playing out?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Watch Restaurant Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Watch Restaurant Group Narrative

If you look at the numbers and come to a different conclusion, you can stress test every input yourself and shape a custom view in minutes, then Do it your way.

A great starting point for your First Watch Restaurant Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If this kind of side by side valuation work helps you think clearly about risk and reward, do not stop at a single stock when you can scan the whole market.

- Spot potential value plays early by checking out these 875 undervalued stocks based on cash flows that align with your view on cash flows and quality.

- Ride powerful tech trends by reviewing these 24 AI penny stocks that are building real businesses around artificial intelligence.

- Boost your income focus by scanning these 12 dividend stocks with yields > 3% and weigh yield, balance sheets, and payout consistency side by side.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.