Please use a PC Browser to access Register-Tadawul

Assessing Floor & Decor (FND) Valuation After A 26% Monthly Share Price Surge

Floor & Decor FND | 68.99 | +4.34% |

Why Floor & Decor Holdings (FND) Is On Investors’ Radar

Floor & Decor Holdings (FND) has drawn attention after a strong month, with the share price return sitting around 26% and roughly 7% over the past week. This recent performance is inviting closer scrutiny of what is driving sentiment.

That 25.69% 1 month share price return to about $76.07 comes after a 20.80% year to date share price return, yet the 1 year total shareholder return of 23.77% decline shows that recent momentum contrasts with weaker longer term outcomes.

If FND’s move has caught your eye, it can be helpful to see what else is moving in retail and consumer names through fast growing stocks with high insider ownership.

With FND now trading close to recent analyst targets after a 26% jump in a month, the key question is whether the recent weakness in longer term returns indicates an undervalued entry point, or whether the market is already pricing in future growth.

Most Popular Narrative: 2.2% Undervalued

The most followed narrative puts Floor & Decor Holdings’ fair value at about $77.82 versus the last close of $76.07, centering the debate on how sustainable its growth and margins can be.

Enhanced supply chain agility, direct global sourcing, and diversification of inbound product (with a growing mix of U.S.-made goods), coupled with proven tariff mitigation strategies, are expected to safeguard gross margins and reduce volatility in earnings, even amid ongoing macro and trade uncertainties.

Curious what earnings path and profit profile are baked into that fair value, and why the future P/E sits far above the sector norm? The narrative leans on specific revenue growth, margin expansion, and valuation multiple assumptions that paint a very different picture from today’s share price. The numbers behind that story are where things get interesting.

According to the narrative built on analyst expectations, the valuation hangs on a combination of steady revenue growth, slightly higher profit margins, and a future earnings multiple that stays well above the broader US Specialty Retail industry. Revenue is projected to climb each year, profitability is expected to edge higher, and by 2028 the company would still be trading on a P/E that is materially richer than the sector’s current average, all discounted back using a 9.17% rate.

Result: Fair Value of $77.82 (ABOUT RIGHT)

However, there is still a real risk that weaker housing activity and aggressive store expansion could pressure comps, margins, and returns if demand stays subdued.

Another View: Multiples Paint A Tougher Picture

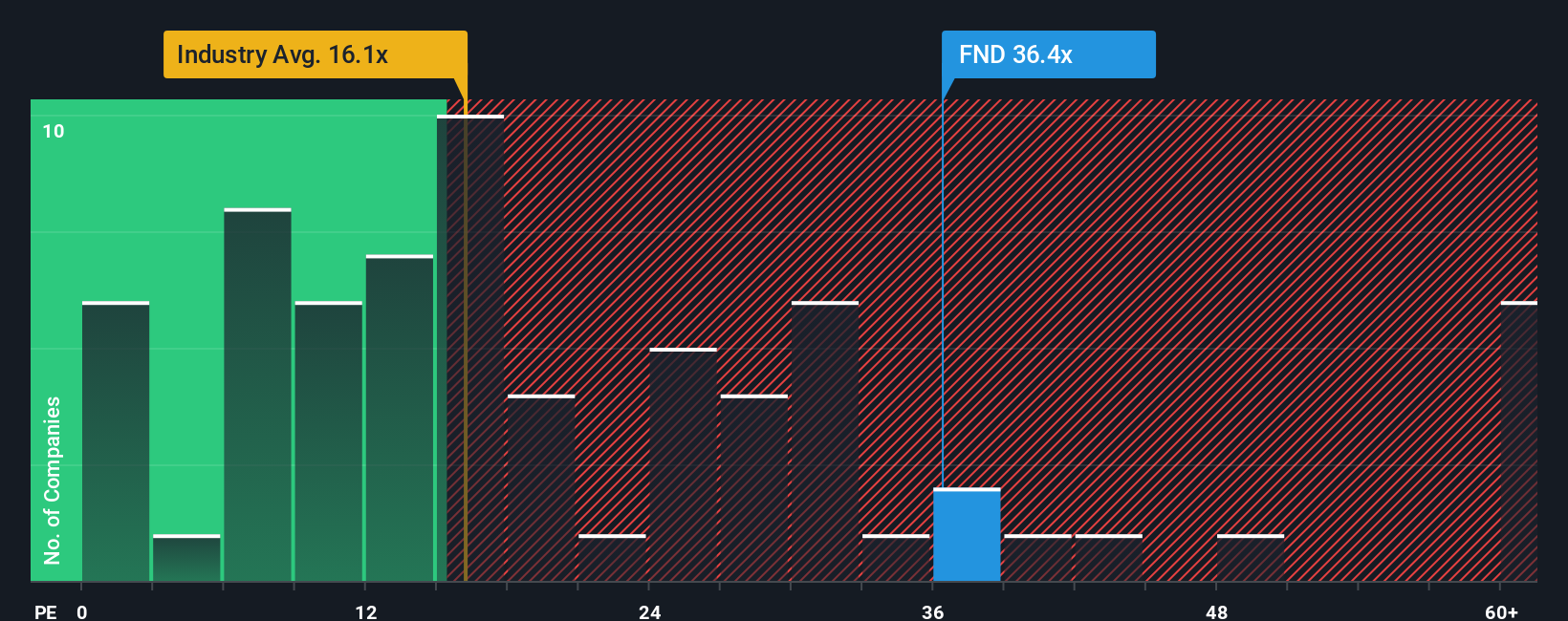

The fair value narrative pegs Floor & Decor Holdings as only about 2.2% undervalued, yet its current P/E of 37.8x sits far above the US Specialty Retail industry at 21x, peers at 14.6x, and even the SWS fair ratio of 17.2x. That kind of gap can mean valuation risk if growth or margins disappoint, so how comfortable are you paying more than double the fair ratio for this story?

Build Your Own Floor & Decor Holdings Narrative

If you interpret the numbers differently or prefer to rely on your own assumptions, you can create a personalised view in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for more investment ideas?

If you stop with just one company, you could miss other opportunities that better fit your goals, risk comfort, and interest in specific themes and sectors.

- Spot potential value opportunities early by scanning these 863 undervalued stocks based on cash flows that currently trade at discounts based on their cash flow profiles.

- Tap into the AI trend by checking out these 24 AI penny stocks that focus on artificial intelligence across different parts of the market.

- Target income-focused ideas by reviewing these 12 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.