Please use a PC Browser to access Register-Tadawul

Assessing Floor & Decor Holdings (FND) Valuation As Expansion Plans And Analyst Commentary Refocus Investor Attention

Floor & Decor FND | 68.99 | +4.34% |

Analyst commentary has put Floor & Decor Holdings (FND) back in focus, as investors react to its long record of comparable store sales growth and its plans to expand from 262 locations to a 500 store footprint.

There has been a sharp pullback in the very near term, with a 3.51% 1 day and 7.63% 7 day share price decline, but that sits against a 30 day share price return of 11.88% and a 1 year total shareholder return of 32.13% decline. This suggests that recent optimism around store expansion may be rebuilding some momentum after a tougher stretch for long term holders.

If Floor & Decor’s recent moves have caught your eye, this can be a good moment to broaden your watchlist and check out fast growing stocks with high insider ownership.

With shares pulling back over the past week but still higher over 30 days, and the stock trading about 12% below analyst price targets, the key question is simple: Is Floor & Decor undervalued today, or is future growth already priced in?

Most Popular Narrative: 10.3% Undervalued

Floor & Decor’s most followed narrative pegs fair value at about $77.27 per share, above the last close at $69.32, which frames the current debate around the stock.

The analysts have a consensus price target of $83.864 for Floor & Decor Holdings based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $100.0, and the most bearish reporting a price target of just $60.0.

Curious what has to happen between now and the late 2020s for that fair value to make sense? Revenue, margins, and a rich future earnings multiple all sit at the heart of this story. The narrative spells out a clear path, but the assumptions behind it are anything but modest.

Result: Fair Value of $77.27 (UNDERVALUED)

However, the story can change quickly if housing turnover stays weak and aggressive store expansion leads to softer store economics and pressure on margins.

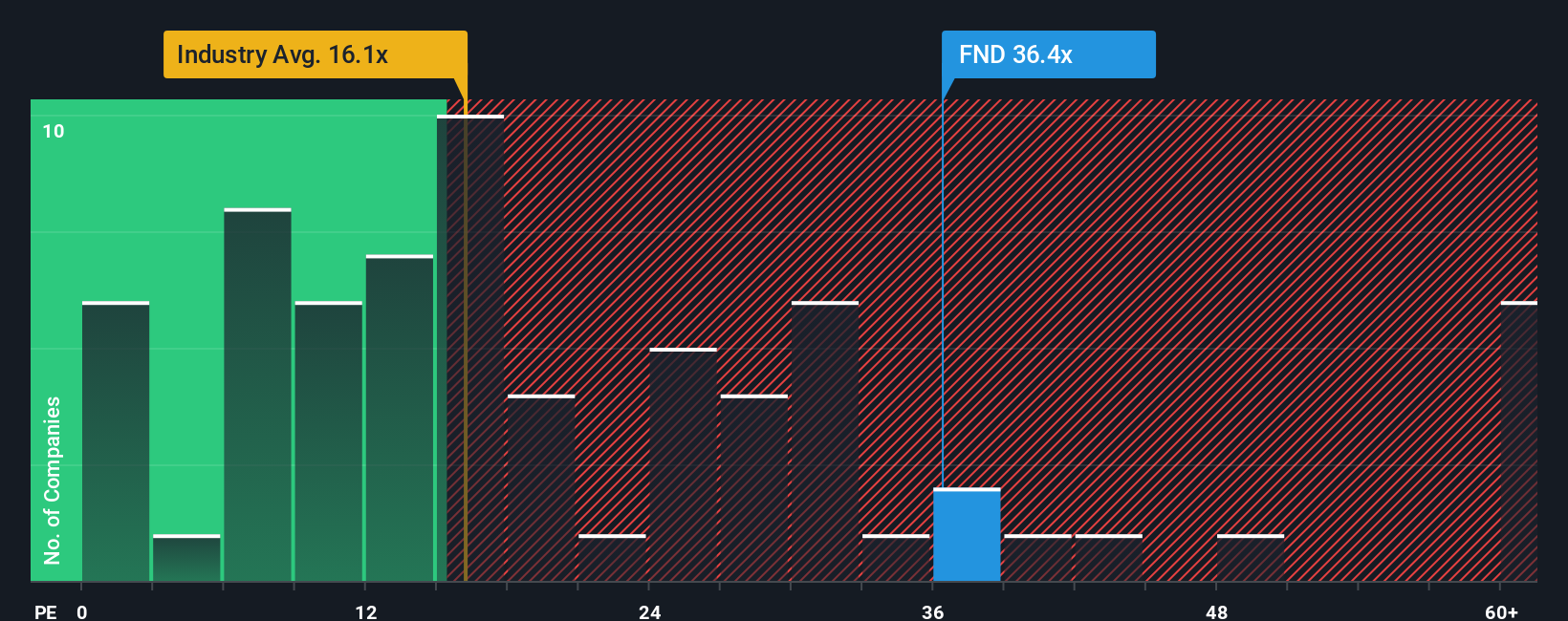

Another View: Rich P/E Raises A Different Question

That 10.3% gap to fair value sits awkwardly next to the current P/E of 34.5x, which is almost double both the Specialty Retail industry average of 20x and the fair ratio of 17.9x. For you, that premium can look less like a cushion and more like valuation risk. Which story feels more convincing?

Build Your Own Floor & Decor Holdings Narrative

If parts of this story do not quite fit how you see the company, you can always test the numbers yourself and Do it your way in just a few minutes.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Floor & Decor Holdings.

Looking for more investment ideas?

If Floor & Decor is on your radar, do not stop there. A wider set of ideas can help you spot opportunities you might otherwise miss.

- Scan for value focused opportunities by checking out these 878 undervalued stocks based on cash flows that may line up better with your return and risk expectations.

- Tap into growth themes by reviewing these 25 AI penny stocks that could benefit from ongoing adoption of artificial intelligence across different industries.

- Strengthen your income watchlist by looking at these 14 dividend stocks with yields > 3% that can add potential yield alongside capital gains prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.