Please use a PC Browser to access Register-Tadawul

Assessing Flywire (FLYW) Valuation After New TenPay Global Partnership Expands Asian Education Payments Reach

Flywire Corp. FLYW | 11.40 | +1.33% |

Flywire (FLYW) just took another deliberate step into Asian education payments by partnering with TenPay Global so Chinese students can use Weixin Pay for tuition at universities in South Korea and Malaysia.

The TenPay Global deal lands at a time when sentiment on Flywire is still cautious, with the share price at $14.77 and a year to date share price return of negative 26.52 percent. However, the 90 day share price return of 10.64 percent and 7 day share price return of 9.49 percent suggest short term momentum is starting to rebuild, while the 1 year total shareholder return of negative 30.10 percent underlines how far confidence has to recover.

If this kind of cross border payments story interests you, it might be worth seeing what else the market is rewarding in high growth tech and AI stocks as another source of potential ideas.

With Flywire still loss making but growing revenue, and the stock trading slightly below analyst targets after a long drawdown, is this renewed momentum signaling a mispriced growth story, or is the market already discounting its next leg higher?

Most Popular Narrative: 11% Undervalued

With Flywire closing at $14.77 against a narrative fair value of $16.59, the story leans toward mispricing and sets up ambitious long term assumptions.

Ongoing investment in proprietary technology, AI driven automation, and integration capabilities is yielding significant platform efficiencies (e.g., 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service). These efficiencies underpin Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Curious how those efficiency gains supposedly transform modest revenue growth into outsized earnings power and a richer future multiple than the wider sector? The full narrative unpacks the margin trajectory, the growth runway, and the valuation math that bridge today’s tiny profits with a very different earnings profile a few years out.

Result: Fair Value of $16.59 (UNDERVALUED)

However, sustained visa scrutiny in key education markets, as well as intensifying cross border payments competition, could derail those upbeat growth and margin expectations.

Another Lens on Value

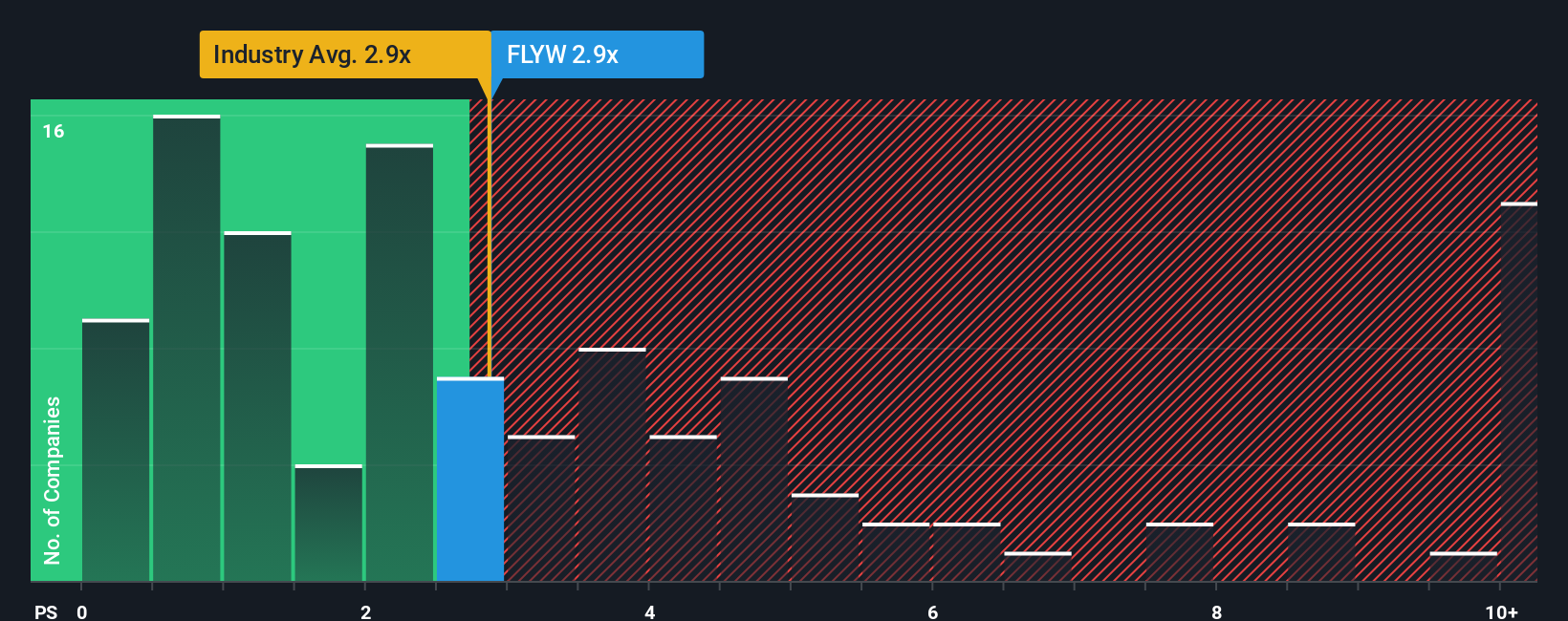

On simple sales-based metrics, Flywire appears less forgiving. The stock trades on a 3.1x price-to-sales ratio, richer than both peers at 3.0x and the broader US diversified financials at 2.6x, and well above a 2.3x fair ratio that the market could drift toward if growth disappoints.

Build Your Own Flywire Narrative

If you are not fully convinced by this take or prefer to dig into the numbers yourself, you can build a custom view in minutes, Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Flywire.

Looking for more investment ideas?

Before the next market move leaves you watching from the sidelines, put Simply Wall Street’s screener to work and line up your next round of high conviction ideas.

- Target faster potential upside by scanning these 3614 penny stocks with strong financials that already back their low prices with real financial strength instead of pure speculation.

- Position your portfolio for the next productivity boom by reviewing these 26 AI penny stocks that are building real revenue from artificial intelligence, not just hype.

- Lock in potential bargains by tracking these 908 undervalued stocks based on cash flows where cash flow strength and depressed prices may be setting up tomorrow’s standout winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.