Please use a PC Browser to access Register-Tadawul

Assessing Flywire (FLYW) Valuation As Leadership Shifts Toward Product And Education Software Focus

Flywire Corp. FLYW | 11.23 | 0.00% |

Leadership shift puts Flywire’s product focus in the spotlight

Flywire (FLYW) has reshaped its leadership, moving longtime Chief Technology Officer David King into a new Chief Product Officer and Co President of Global Education role, while beginning a search for a replacement CTO.

For you as an investor, this shift puts product strategy, software differentiation, and AI enabled workflows at the center of the Flywire story, particularly in its Education vertical where King has extensive software experience.

Flywire’s leadership reshuffle comes after a mixed year in the market, with a 1-year total shareholder return decline of 28.38% and a 3-year total shareholder return decline of 49.07%. The recent 30-day share price return decline of 5.11% suggests momentum has been fading ahead of this product-focused transition.

If this product pivot has you thinking about where else software and AI are reshaping payments, it could be a good time to scan high growth tech and AI stocks for other ideas riding similar themes.

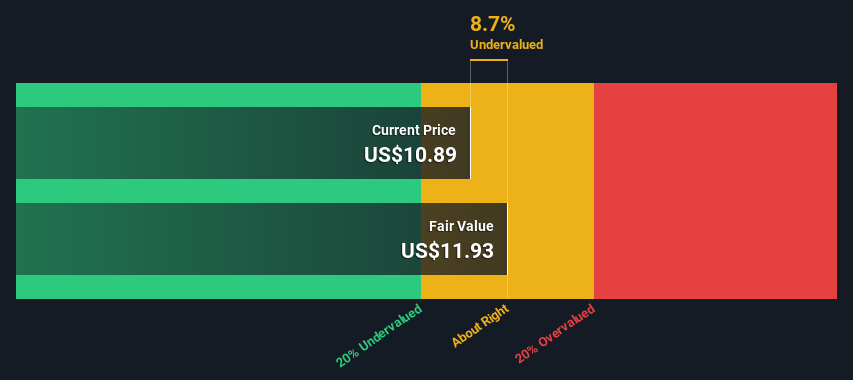

With shares down sharply over 1 and 3 years, trading at a small intrinsic discount of about 4% and roughly 25% below the average analyst target, you have to ask: is there a genuine entry point here, or is the market already baking in the next leg of growth?

Most Popular Narrative: 17.2% Undervalued

With Flywire closing at $13.73 against a most followed fair value estimate of $16.59, the prevailing narrative sees meaningful upside tied closely to execution.

Ongoing investment in proprietary technology, AI driven automation, and integration capabilities is yielding significant platform efficiencies (e.g., 25% operational cost improvements, 90% automated payment matching, and 40% automated customer service), underpinning Flywire's ability to maintain or increase net margins and deliver stronger earnings leverage as scale increases.

Want to see what those efficiency gains are assumed to do to revenue, margins, and earnings over time? The key moving pieces are baked into that $16.59 fair value, along with a specific future profit multiple and discount rate that could surprise you when you see the exact mix.

Result: Fair Value of $16.59 (UNDERVALUED)

However, you still have to weigh visa and regulatory uncertainty in key education markets, as well as the risk that lower margin travel or B2B volumes pressure profitability.

Another View: Richer on Sales Than It Looks on Cash Flows

Our DCF model suggests Flywire is trading about 3.8% below its estimated fair value of $14.27, which points to a small discount. That sits awkwardly next to a P/S of 2.9x versus a fair ratio of 2.2x and an industry average of 2.7x. This raises the question of which signal you trust more.

Build Your Own Flywire Narrative

If the numbers here do not fully match your view of Flywire, you can test each assumption yourself and build a fresh perspective in minutes, starting with Do it your way.

A great starting point for your Flywire research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Flywire sits on your watchlist now, do not stop there. Widen your options and let fresh ideas challenge your thinking before your next move.

- Spot potential value plays early by scanning these 864 undervalued stocks based on cash flows that price in expectations differently to the market.

- Ride the AI payment and data trend by checking out these 24 AI penny stocks shaping how software and automation reshape finance and beyond.

- Tap into digital asset themes through these 18 cryptocurrency and blockchain stocks where equity stories tie directly to blockchain infrastructure and services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.