Please use a PC Browser to access Register-Tadawul

Assessing Gemini Space Station (GEMI) Valuation After A Steep Three Month Share Price Pullback

Gemini Space Station, Inc. Class A GEMI | 8.05 | -3.42% |

Why Gemini Space Station Is Back on Investor Radar

Gemini Space Station (GEMI) has caught investor attention after a sharp pullback, with the stock showing a 1.8% one day decline and deeper losses over the past week and month.

With the share price at US$10.07 and returns of a 7.9% decline over the past week, an 11.4% decline over the past month, and a 49.0% decline over the past 3 months, many investors are reassessing how this crypto platform’s fundamentals line up against recent sentiment.

That 49.0% three month share price return decline comes on top of a more modest year to date share price return decline of 2.8%, which suggests recent momentum has been fading even as crypto related platforms remain in focus.

If this kind of volatility has you looking wider than a single crypto platform, it could be a good time to scan the market using fast growing stocks with high insider ownership.

With revenue growth alongside a sizeable net loss of US$468.984 million and a share price well below the US$19.25 analyst target, is GEMI now trading at a discount, or is the market already pricing in future growth?

Most Popular Narrative: 32.9% Undervalued

With Gemini Space Station last closing at $10.07 and the most followed narrative pointing to a fair value of $15.00, investors are weighing a sizeable implied gap.

Although Gemini’s integrated super app vision and investments in prediction markets, tokenized stocks and multichain support could diversify and scale high margin fee streams over time, the upfront technology, marketing and stock based compensation required to build and defend this platform may outpace near term revenue growth and delay operating margin expansion.

Want the full picture behind that $15.00 fair value? The narrative leans on rapid top line expansion and a sharp profit margin shift that only the detailed forecasts spell out.

Result: Fair Value of $15.00 (UNDERVALUED)

However, this hinges on Gemini turning a US$468.984 million net loss and heavy credit card and staking spend into sustainable margins, which may never fully materialise.

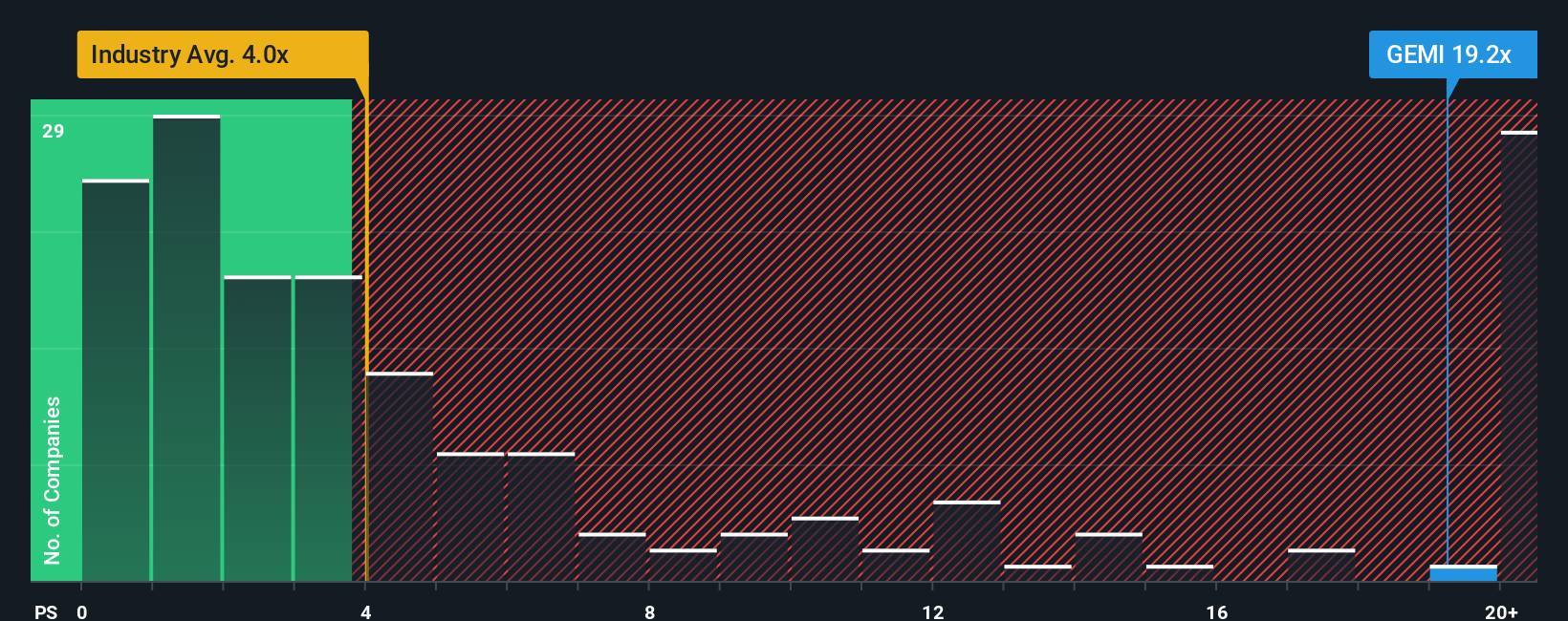

Another View: Pricing Looks Rich on Sales

The fair value narrative points to GEMI looking undervalued at $15.00, but its current P/S of 7.3x is far higher than both the US Capital Markets industry at 4.1x and peers at 2.8x. That kind of gap heightens valuation risk if revenue growth or sentiment slips. The question is which signal you put more weight on.

Build Your Own Gemini Space Station Narrative

If you are not on board with this framing or simply want to test your own view against the same numbers, you can build a custom thesis yourself in just a few minutes by starting with Do it your way.

A great starting point for your Gemini Space Station research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Gemini Space Station feels like just one piece of the puzzle, broaden your watchlist now so you are not relying on a single story.

- Target potential income by scanning these 12 dividend stocks with yields > 3% that might suit a more cash focused approach.

- Explore growth themes in technology by reviewing these 24 AI penny stocks related to artificial intelligence.

- Look for possible mispriced opportunities by checking these 878 undervalued stocks based on cash flows that may offer more compelling entry points based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.