Please use a PC Browser to access Register-Tadawul

Assessing Glaukos (GKOS) Valuation After FDA Approval For Repeat iDose TR Use

Glaukos Corp GKOS | 120.27 | +2.71% |

FDA approval for repeat iDose TR use reshapes the story

Glaukos (GKOS) just secured FDA approval to allow repeat administration of its iDose TR implant, supported by clinical data demonstrating safety and tolerability. This directly addresses the needs of chronic glaucoma treatment and patient compliance.

Glaukos shares trade at US$119.38 after a 30 day share price return of 7.82% and a 90 day share price return of 38.89%, while the 1 year total shareholder return of 23.51% contrasts with a much stronger 3 year total shareholder return of 139.19%. This suggests longer term holders have seen meaningfully different outcomes from more recent investors as the market absorbs events like the iDose TR repeat use approval and recent insider option exercises and sales.

If this FDA decision has you rethinking opportunities in eye care and beyond, it could be a good moment to scan other healthcare stocks that might fit your watchlist next.

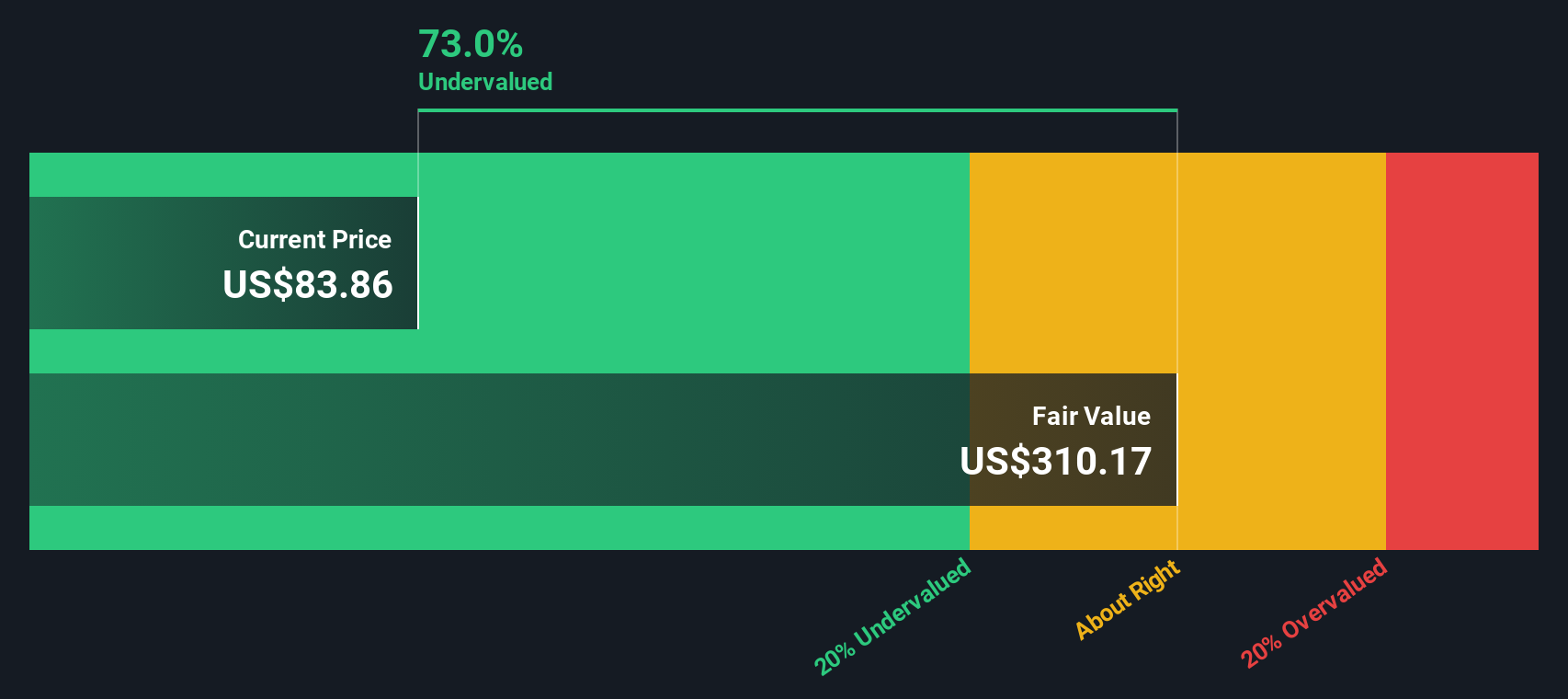

Glaukos now trades at US$119.38 with an indicated intrinsic discount and a value score of 2, along with strong multi year returns already on the board. This raises the question of whether there is still a mispricing here or if the market is already accounting for future growth.

Most Popular Narrative: 6.2% Undervalued

Glaukos' most followed narrative pegs fair value at about $127.31 per share, a touch above the current $119.38 price, which frames the latest FDA news in a valuation context.

Strong ongoing adoption and utilization of iDose TR, a first of its kind procedural pharmaceutical with a unique profile, suggests the early stages of a paradigm shift toward interventional glaucoma therapies, a substantial long term opportunity given the aging population and rising prevalence of glaucoma, likely driving robust multi year revenue and market expansion.

Curious what sits behind that premium fair value? The narrative leans heavily on double digit revenue compounding, margin lift and a future earnings multiple that assumes Glaukos keeps executing. The full breakdown spells out exactly how those pieces fit together.

Result: Fair Value of $127.31 (UNDERVALUED)

However, this hinges on sustained product uptake and reimbursement support. Setbacks in clinical results, policy decisions or competitor moves could quickly challenge that upside story.

Another angle on Glaukos' valuation

Our DCF model suggests a fair value of about $278.51 per share, which is far above both the current $119.38 price and the $127.31 narrative fair value. That gap points to a very different risk reward trade off, so which set of assumptions do you trust more?

Build Your Own Glaukos Narrative

If you view the numbers differently or prefer to test your own assumptions, you can build a fresh Glaukos story in just a few minutes: Do it your way.

A great starting point for your Glaukos research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Glaukos is already on your radar, do not stop there. A few minutes with the right screeners can surface opportunities you might regret overlooking later.

- Spot potential value early by checking out these 3535 penny stocks with strong financials that pair low share prices with stronger balance sheets and fundamentals than you might expect at this end of the market.

- Ride the AI trend more deliberately by scanning these 24 AI penny stocks that connect artificial intelligence themes with smaller names you may not see in headline indexes yet.

- Focus on price versus cash flows by reviewing these 886 undervalued stocks based on cash flows that flag companies trading below what their projected cash generation might justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.