Please use a PC Browser to access Register-Tadawul

Assessing GoodRx (GDRX) Valuation After Recent Share Price Momentum

GoodRx Holdings GDRX | 2.82 | +1.08% |

GoodRx Holdings (GDRX) shares have climbed steadily over the past week, gaining more than 12% even as longer-term returns remain mixed. Investors are watching to see if renewed momentum signals improvement in the company’s growth narrative.

GoodRx shares have started to turn a corner after recent softness, with momentum picking up over the past week. While the 1-year total shareholder return is still down more than 36%, this fresh uptick hints that sentiment around growth prospects could be shifting.

If you’re also curious about dynamic shifts in healthcare stocks, now is a perfect time to explore what’s moving in the market with our curated screener: See the full list for free.

With shares still trading at a sizable discount to analyst targets, and recent financials showing returning growth, investors must decide if GoodRx is undervalued and ready to rebound or if the market has already factored in its future potential.

Most Popular Narrative: 15.6% Undervalued

GoodRx's most widely followed narrative estimates a fair value above the recent close of $4.53, hinting at notable upside if growth drivers materialize. The story behind this valuation draws heavily on the evolving digital health landscape and the company's push into higher-margin services.

Substantial momentum in the company's pharma manufacturer solutions (32% YoY revenue growth, with management projecting 30%+ in 2025) reflects strong demand for direct-to-patient engagement. This unlocks higher-margin revenue streams and provides meaningful upside to consolidated revenue and net margins.

Curious what assumptions push GoodRx's potential even higher? The narrative hinges on future profit margins, rapid earnings acceleration, and lower trading multiples by 2028. Wonder which levers drive this fair value? Unlock the full story for the key targets behind this estimate.

Result: Fair Value of $5.37 (UNDERVALUED)

However, risks such as pharmacy partner instability and competitive pricing pressures could quickly dampen GoodRx’s rebound and potentially limit future upside for investors.

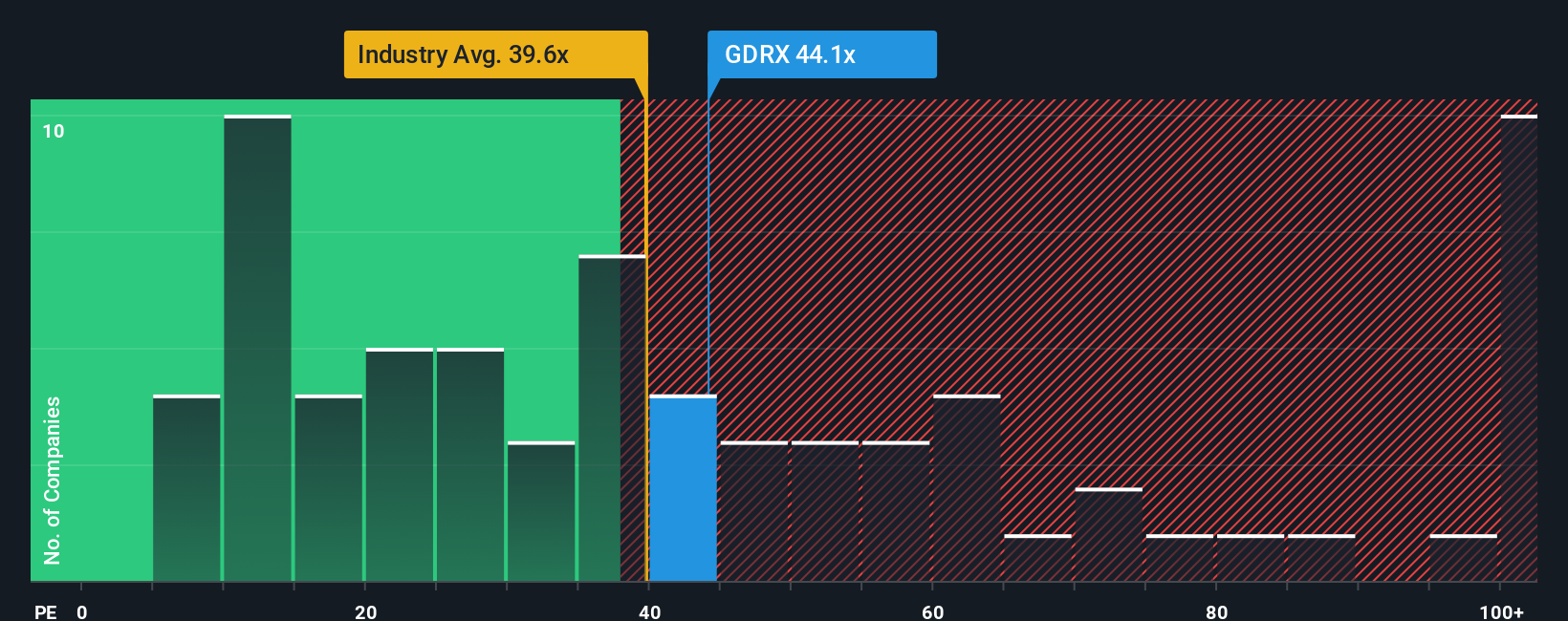

Another View: Valuing GoodRx by Earnings Multiples

Looking through a different lens, GoodRx trades at a price-to-earnings ratio of 45.5x. This is more expensive than its fair ratio of 37.4x and the Global Healthcare Services industry average of 38.4x, but it remains below many peers at 61x. This premium suggests higher valuation risk if growth stumbles. Are investors overpaying for future potential, or is the market betting on sustained momentum?

Build Your Own GoodRx Holdings Narrative

If you have your own perspective on GoodRx’s valuation or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes. Do it your way

A great starting point for your GoodRx Holdings research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock a world of fresh opportunities. Don’t just stop at GoodRx. These hand-picked stock screens offer unique angles and could uncover your next big win.

- Tap into future tech by scanning these 26 quantum computing stocks for companies advancing quantum computing and redefining what’s possible in information science.

- Boost your portfolio income by checking out these 19 dividend stocks with yields > 3% featuring high-yield businesses with the potential for steady cash flow and stable returns.

- Spot bargains before the crowd by browsing these 901 undervalued stocks based on cash flows packed with stocks trading below their intrinsic value and primed for potential growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.