Please use a PC Browser to access Register-Tadawul

Assessing Halozyme Therapeutics (HALO) Valuation After Raised 2025 And 2026 Revenue Guidance

Halozyme Therapeutics, Inc. HALO | 70.98 | -1.47% |

Why Halozyme Therapeutics (HALO) raised guidance matters now

Halozyme Therapeutics (HALO) has lifted its 2026 revenue outlook to a range of US$1.71b to US$1.81b, up from US$1.43b to US$1.53b, while also updating its 2025 expectations.

For 2025, the company now guides to total revenue of US$1.385b to US$1.40b. Management indicates year on year growth of 36% to 38%, a data point many investors will likely use as a reference when reassessing the stock.

The raised guidance arrives after a strong run in the share price, with a 7 day share price return of 13.3% and a 90 day share price return of 19%. The 1 year total shareholder return of 42.3% suggests momentum has been building over a longer stretch.

If this kind of earnings guidance update has your attention, it might be a good moment to see what else is setting up for growth in the healthcare space through our 26 healthcare AI stocks.

With the share price already up strongly and 2026 revenue now guided as high as US$1.81b, the key question is whether HALO still trades at a discount or if the market is already pricing in that growth.

Most Popular Narrative: 5.3% Overvalued

Halozyme Therapeutics last closed at $81.23, while the most followed narrative pegs fair value closer to $77.13, so the latest guidance sits against a slightly richer valuation backdrop.

The analysts have a consensus price target of $70.556 for Halozyme Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $91.0, and the most bearish reporting a price target of just $51.0.

Want to see what kind of earnings curve and margin profile underpin that fair value gap, and how it ties into ENHANZE royalty assumptions and future multiples? The full narrative spells out the growth path and the valuation logic behind it.

Result: Fair Value of $77.13 (OVERVALUED)

However, you still need to weigh the ENHANZE patent challenges and Halozyme’s reliance on a handful of large partners, either of which could meaningfully reshape the story.

Another angle on valuation

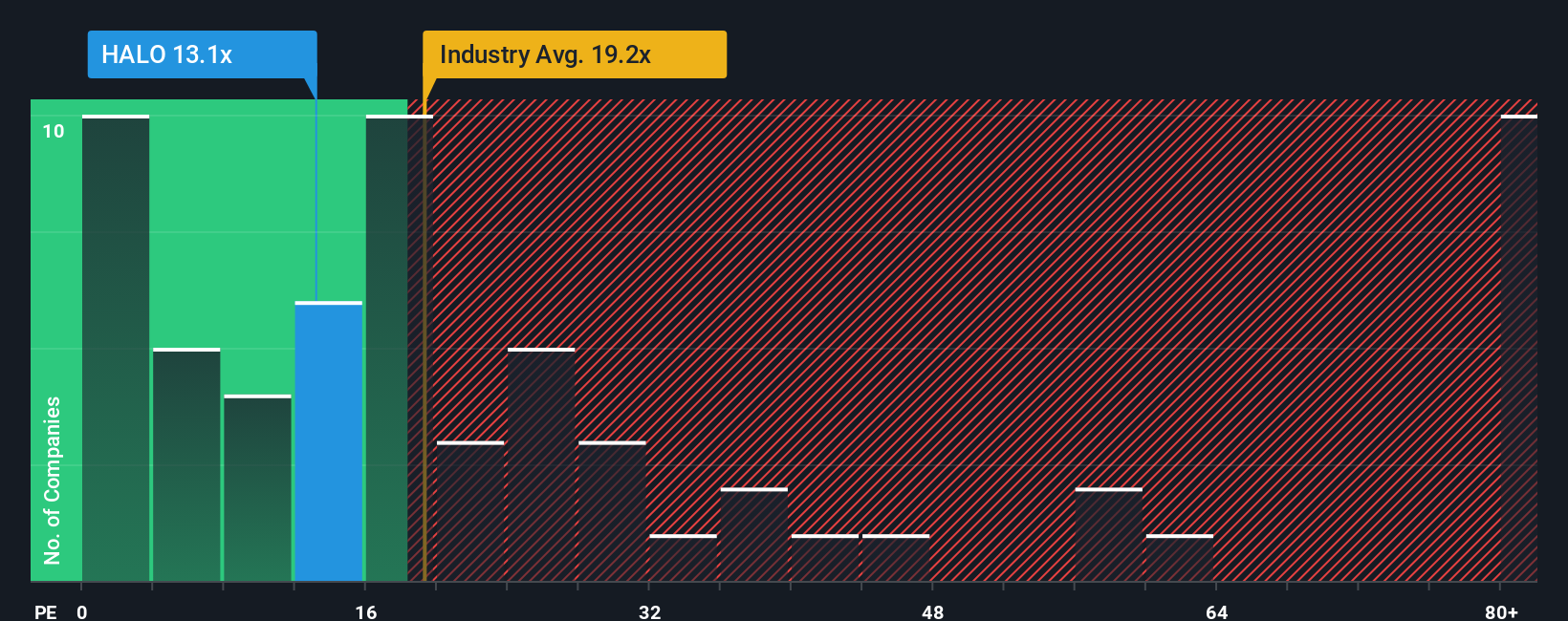

While the narrative model pegs Halozyme Therapeutics at a fair value of $77.13 and labels the shares as overvalued at $81.23, the P/E picture tells a different story. At 16x earnings, HALO trades below both peers at 19.9x and the US Biotechs industry at 22.8x, and also below its own fair ratio of 20.8x. That gap suggests the market may be assigning some extra risk, so the real question is whether you agree with that caution or see it as an opening.

Build Your Own Halozyme Therapeutics Narrative

If you look at the numbers and come to a different conclusion, or simply want to test your own view against the market, you can build a personalized Halozyme thesis in just a few minutes with Do it your way.

A great starting point for your Halozyme Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you only stop at Halozyme, you risk missing other opportunities that might fit your style even better, so broaden your watchlist while this is top of mind.

- Target potential mispricings by scanning companies that pass our quality checks with the 53 high quality undervalued stocks.

- Strengthen your focus on capital preservation by reviewing companies highlighted in our 86 resilient stocks with low risk scores.

- Get ahead of the crowd by spotting smaller names our screener containing 25 high quality undiscovered gems has flagged with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.