Please use a PC Browser to access Register-Tadawul

Assessing Himax Technologies (HIMX) Valuation After New AR Glasses Partnerships Spotlighted At CES 2026

Himax Technologies, Inc. Sponsored ADR HIMX | 8.59 | +2.02% |

Vuzix Corporation’s new optical component reference design for AR glasses, built around Himax Technologies (HIMX) HX7319FL Front lit LCoS microdisplay and Vuzix waveguide optics, is in the spotlight at CES 2026.

For Himax Technologies, the CES 2026 AR glasses work with Vuzix comes after a steady run of product and partnership news. The latest US$8.31 share price sits against a 1-year total shareholder return of 19.99%. This suggests the recent negative 3-month share price return of 12.53% has cooled short-term momentum, even as longer-term holders have still seen gains.

If you are looking beyond Himax to see where similar themes are playing out in semiconductors and AR, this could be a good moment to scan high growth tech and AI stocks for other ideas riding the same tech and AI wave.

With a 1 year return near 20% and the share price sitting close to analyst targets, plus recent AR wins at CES, the key question is whether Himax is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 2.7% Undervalued

With Himax Technologies last closing at US$8.31 and a narrative fair value of about US$8.54, the gap is small but still meaningful for valuation watchers.

The company's deepening engagement and design wins in emerging smart glasses/AR markets, underpinned by unique proprietary technologies in ultra-low power sensing (WiseEye), microdisplay, and nano-optics, create opportunities to capitalize on the rising demand for next-generation wearables, providing a new long-term revenue stream that will positively impact both top-line growth and margins.

Curious what kind of revenue path and margin profile need to line up for that fair value to hold? The most followed narrative leans heavily on compounding earnings, firmer profitability and a future earnings multiple that does not stretch today’s sector averages. The exact mix of those ingredients might surprise you.

Result: Fair Value of $8.54 (UNDERVALUED)

However, there are clear pressure points here. Trade tensions and tariff uncertainty, customer demand swings, and rising operating costs could undermine the current fair value story.

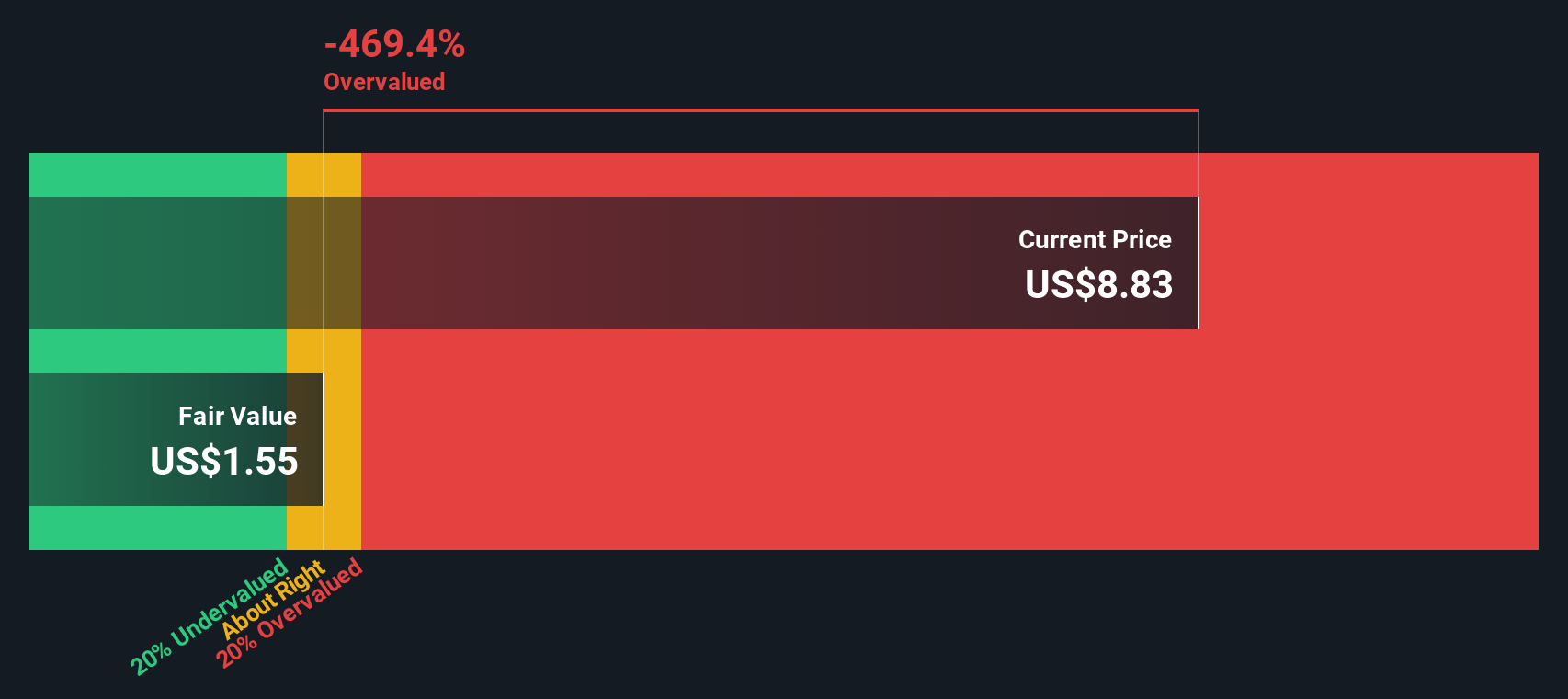

Another View: DCF Sends a Very Different Signal

If you step away from the narrative fair value and look at our DCF model, the picture changes sharply. On this view, Himax at US$8.31 is far above an estimated fair value of about US$1.87, which points to a stock that could be overvalued rather than modestly undervalued. Which story do you find more convincing?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Himax Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 878 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Himax Technologies Narrative

If this version of the story does not quite fit your view, you can put the data to work yourself and build a custom thesis in minutes: Do it your way.

A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Himax has caught your attention, do not stop here. The next move might sit in a corner of the market you have not checked yet.

- Spot early-stage growth stories by scanning these 3535 penny stocks with strong financials that pair small market caps with balance sheets and earnings profiles you can actually analyze.

- Target AI-led opportunities by filtering for these 26 AI penny stocks where real business models sit behind the hype and revenue potential is front and center.

- Hunt for potential mispricing by focusing on these 878 undervalued stocks based on cash flows that screen for businesses trading below what their cash flows may justify.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.