Please use a PC Browser to access Register-Tadawul

Assessing Hope Bancorp (HOPE) Valuation After Strong Q4 Earnings And Capital Return Updates

Hope Bancorp, Inc. HOPE | 12.16 | +0.91% |

Hope Bancorp (HOPE) is back in focus after reporting fourth quarter 2025 results, including higher net interest income, higher net income, steady credit costs, a maintained dividend, and an update on its completed share repurchase program.

The earnings, dividend affirmation and update on completed buybacks have come alongside a 30 day share price return of 9.11% and a 90 day share price return of 15.08%. The 1 year total shareholder return is 10.66%, hinting at momentum that has been building rather than fading.

If bank earnings have you rethinking your watchlist, this could be a useful moment to widen your scope with solid balance sheet and fundamentals stocks screener (None results).

With earnings growing, credit costs contained, and the stock still trading about 10% below the average analyst price target, you have to ask: Is Hope Bancorp still cheap, or is the market already pricing in future growth?

Most Popular Narrative: 7% Undervalued

With Hope Bancorp last closing at $11.98 versus a narrative fair value of $12.88, the widely followed view is that the shares trade at a modest discount, with that gap resting on a detailed set of long term earnings and profit assumptions.

The completion of the Territorial Bancorp acquisition expands Hope Bancorp's addressable customer base in Hawaii, enhancing its ability to serve growing Asian-American communities and boosting both deposit and loan growth, supporting future revenue expansion.

Accelerating organic loan production, especially with recently hired, experienced commercial bankers, is expected to drive high single-digit loan growth and increased origination fees, which should positively impact both revenue and non-interest income in the coming quarters.

Want to see what powers that $12.88 fair value? The narrative leans on faster revenue growth, higher margins, and a reset in future earnings multiples. Curious which assumptions really move the needle?

Result: Fair Value of $12.88 (UNDERVALUED)

However, this story can change quickly if commercial real estate credit quality weakens or if integration and technology costs keep pressure on expenses longer than expected.

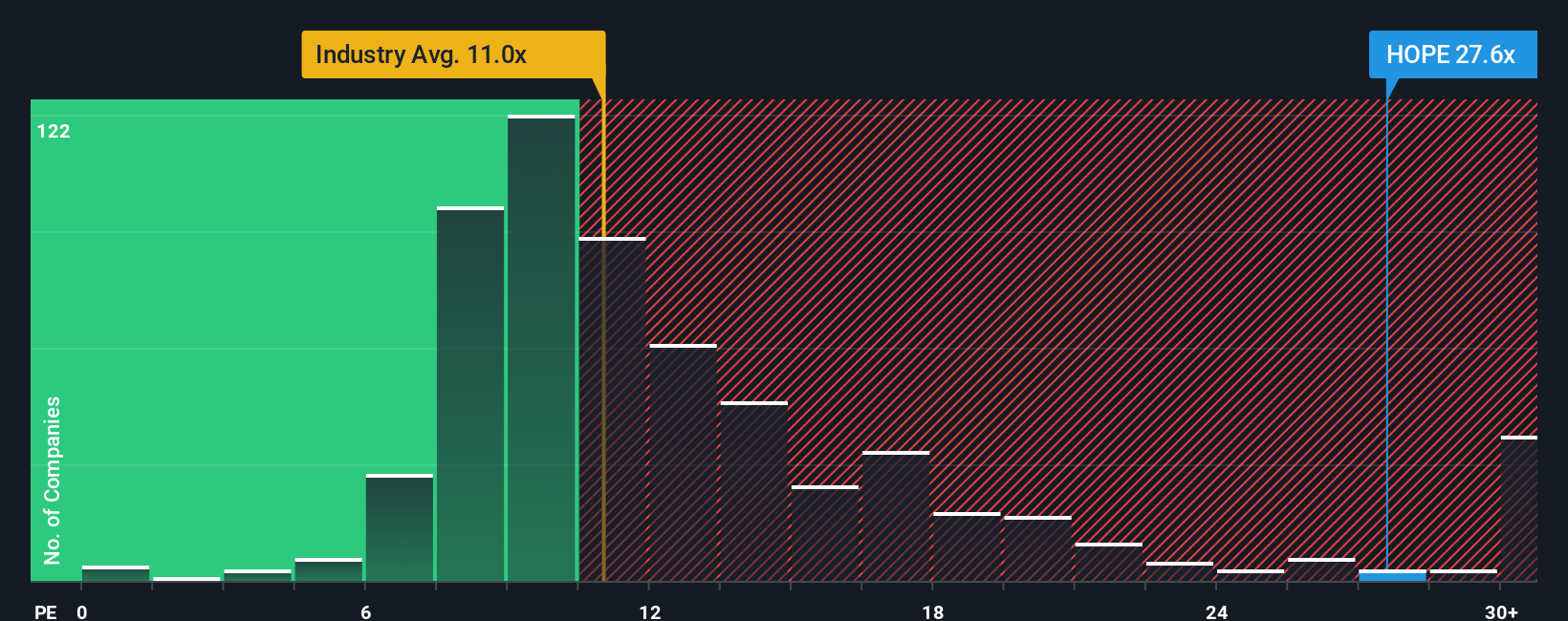

Another View: Earnings Multiple Sends A Different Signal

While the narrative fair value of $12.88 points to modest undervaluation, the current P/E of 24.9x tells a different story. That P/E is above the US Banks industry at 11.7x and above the 20x fair ratio, which suggests less cushion if earnings or credit quality disappoint.

Build Your Own Hope Bancorp Narrative

If you see the numbers differently or prefer to piece together your own view, you can build a custom thesis for Hope Bancorp in just a few minutes with Do it your way.

A great starting point for your Hope Bancorp research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Hope Bancorp is on your radar, do not stop there. The real edge comes from comparing it with other focused ideas picked out by the Simply Wall St Screener.

- Scan for income potential by checking out these 12 dividend stocks with yields > 3% that may appeal if you care about regular cash returns.

- Spot growth stories early by reviewing these 24 AI penny stocks that are tied to the expanding use of artificial intelligence.

- Hunt for value by using these 887 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.