Please use a PC Browser to access Register-Tadawul

Assessing Innospec (IOSP) Valuation After Analyst Upgrade And Insider Share Purchase

Innospec Inc. IOSP | 81.22 | -1.74% |

Innospec (IOSP) has come into focus after a research firm shifted its recommendation to buy and a company director added to their holdings, developments that may be shaping recent trading and investor interest.

Recent trading reflects a mixed picture, with the share price at US$86.58 after a 30 day share price return of 7.09% and a 90 day share price return of 16.86%. However, the 1 year total shareholder return is an 18.23% loss, suggesting that shorter term momentum contrasts with weaker longer term results as sentiment responds to the new rating and insider buying.

If this update has you thinking about where else performance and sentiment may be lining up, take a look at our screener of 23 top founder-led companies as another source of ideas.

With Innospec trading at US$86.58 and sitting about 15% below one research firm’s price target, yet carrying an intrinsic value estimate that implies a premium, the real question is whether today’s price reflects a mispricing or if the market is already factoring in the company’s next chapter.

Most Popular Narrative: 12.8% Undervalued

With Innospec last closing at $86.58 against a narrative fair value of $99.33, the current price sits below what this widely followed framework implies, setting up a valuation built on specific growth and margin expectations rather than sentiment alone.

The company's ongoing margin improvement initiatives, disciplined pricing strategies, and product mix optimization, particularly in Fuel Specialties and Performance Chemicals, are expected to boost gross margin and earnings as operational execution improves through the second half and into 2026.

Curious what kind of revenue glide path and margin profile justify that fair value gap, and how future earnings power is being framed relative to today, the full narrative lays out those financial assumptions in detail.

Result: Fair Value of $99.33 (UNDERVALUED)

However, this depends on profits actually improving, because prolonged margin pressure or weaker demand in key segments could quickly challenge the idea that IOSP is undervalued.

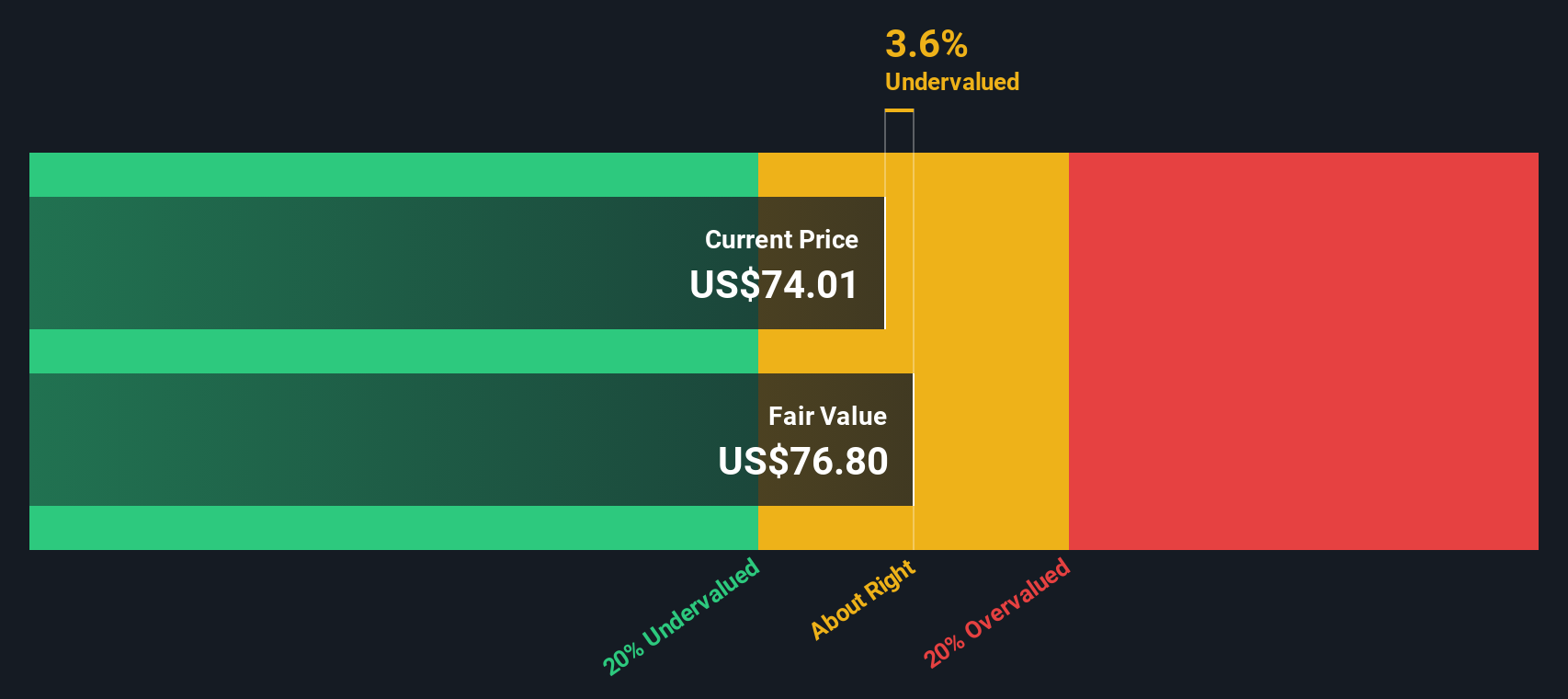

Another View: DCF Points The Other Way

While the popular narrative sees Innospec as 12.8% undervalued with a fair value of $99.33, our DCF model tells a different story. On that measure, the shares trade above an estimated future cash flow value of $78.12, which frames IOSP as overvalued instead.

That split between story driven fair value and cash flow based fair value leaves you with a simple question: which lens do you trust more when the numbers do not line up neatly?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innospec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innospec Narrative

If you see the data pointing in a different direction, or simply prefer your own homework, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Innospec research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about leveling up your watchlist, do not stop with a single stock. Let the data help you surface ideas you might otherwise miss.

- Target potential value with 53 high quality undervalued stocks that pair supportive fundamentals with prices that may not fully reflect their underlying strength.

- Prioritize resilience by scanning 85 resilient stocks with low risk scores that score well on financial and risk checks so you are not flying blind.

- Get ahead of the crowd by reviewing our screener containing 23 high quality undiscovered gems where quality metrics highlight companies that many investors may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.