Please use a PC Browser to access Register-Tadawul

Assessing Innospec (IOSP) Valuation After Analyst Upgrades And Insider Buying

Innospec Inc. IOSP | 81.22 | -1.74% |

Zacks Research recently shifted Innospec (IOSP) from a strong sell rating to hold, while Wall Street Zen issued a buy rating, alongside additional share purchases by Director Leslie J. Parrette that increased insider ownership.

The latest analyst upgrades and insider buying come as Innospec’s share price sits at US$80.04, with a 90-day share price return of 7.41% but a 1-year total shareholder return decline of 22.26%. This combination suggests near term momentum alongside weaker longer term outcomes.

If you are reassessing your watchlist after these rating changes and insider moves, it could be a good time to look at fast growing stocks with high insider ownership as potential fresh ideas.

With the stock at US$80.04, a 24% discount to the average analyst price target of US$99.33 but trading close to one estimate of intrinsic value, you have to ask: is there a buying opportunity here, or is future growth already priced in?

Most Popular Narrative: 19.4% Undervalued

At US$80.04, the most followed narrative sees Innospec’s fair value at about US$99.33, putting the current share price at a meaningful discount.

Rising global demand for sustainable chemicals and tightening environmental regulations continue to drive growth in Innospec's Performance Chemicals and specialty additive segments. Recent sales growth signals an opportunity for future revenue and margin expansion as portfolio focus shifts toward higher-value, environmentally friendly products.

Curious what kind of revenue mix shift and margin profile could justify that higher value, even with modest growth assumptions and a disciplined discount rate? The full narrative lays out a very specific roadmap built on detailed earnings, margin and multiple expectations. If you want to see how those moving parts fit together, the underlying projections might surprise you.

Result: Fair Value of $99.33 (UNDERVALUED)

However, there are still pressure points, including margin risks from raw material cost volatility and uncertainty around Oilfield Services revenues and customer credit quality.

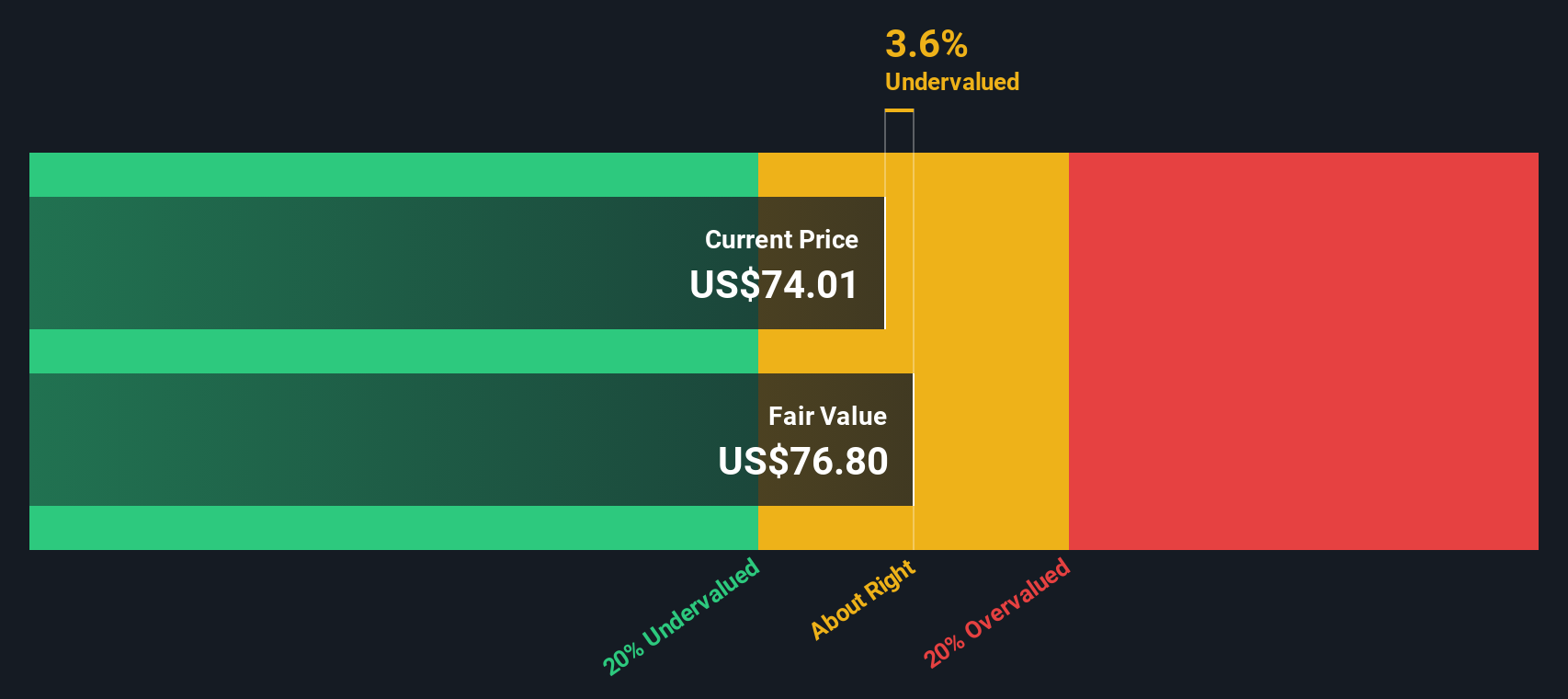

Another View: SWS DCF Says Slightly Overvalued

The narrative fair value of about US$99.33 points to upside, but our DCF model lands lower, at around US$76.32 per share. At the current US$80.04 price, that implies Innospec is trading modestly above this estimate. So which story do you find more convincing: the higher narrative target or the more cautious cash flow view?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innospec for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innospec Narrative

If you see the data differently or prefer to reach your own conclusions, you can build a custom Innospec view in minutes by starting with Do it your way.

A great starting point for your Innospec research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, do not stop with just one company. This is your moment to scan the market for fresh opportunities.

- Target steady income potential by checking out these 12 dividend stocks with yields > 3% that may suit a portfolio focused on regular payouts.

- Spot companies the market might be overlooking with these 882 undervalued stocks based on cash flows that highlight potential value gaps based on cash flows.

- Get ahead of emerging tech themes by reviewing these 28 AI penny stocks that tap into artificial intelligence across different industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.