Please use a PC Browser to access Register-Tadawul

Assessing Invesco (IVZ) Valuation After Recent Share Price Momentum

Invesco Ltd. IVZ | 26.48 | +0.84% |

Invesco (IVZ) has been moving quietly higher, and that likely has some investors wondering what is behind the recent gains. While there has been no headline event to spark this, watching a well-known asset manager like Invesco rise without a clear trigger always raises questions. Is this market optimism about the business itself, or could investors be reacting to something overlooked in the fundamentals?

Looking at the bigger picture, Invesco has delivered a 45% total return over the past year and is up nearly 25% so far in 2024. The past three months in particular saw a surge of nearly 49%, showing momentum has picked up in a big way. This is despite annual revenue tracking down slightly, with net income climbing almost 19%. Shares have now more than doubled investors’ money over the past five years, making recent moves hard to ignore for anyone tracking sector trends.

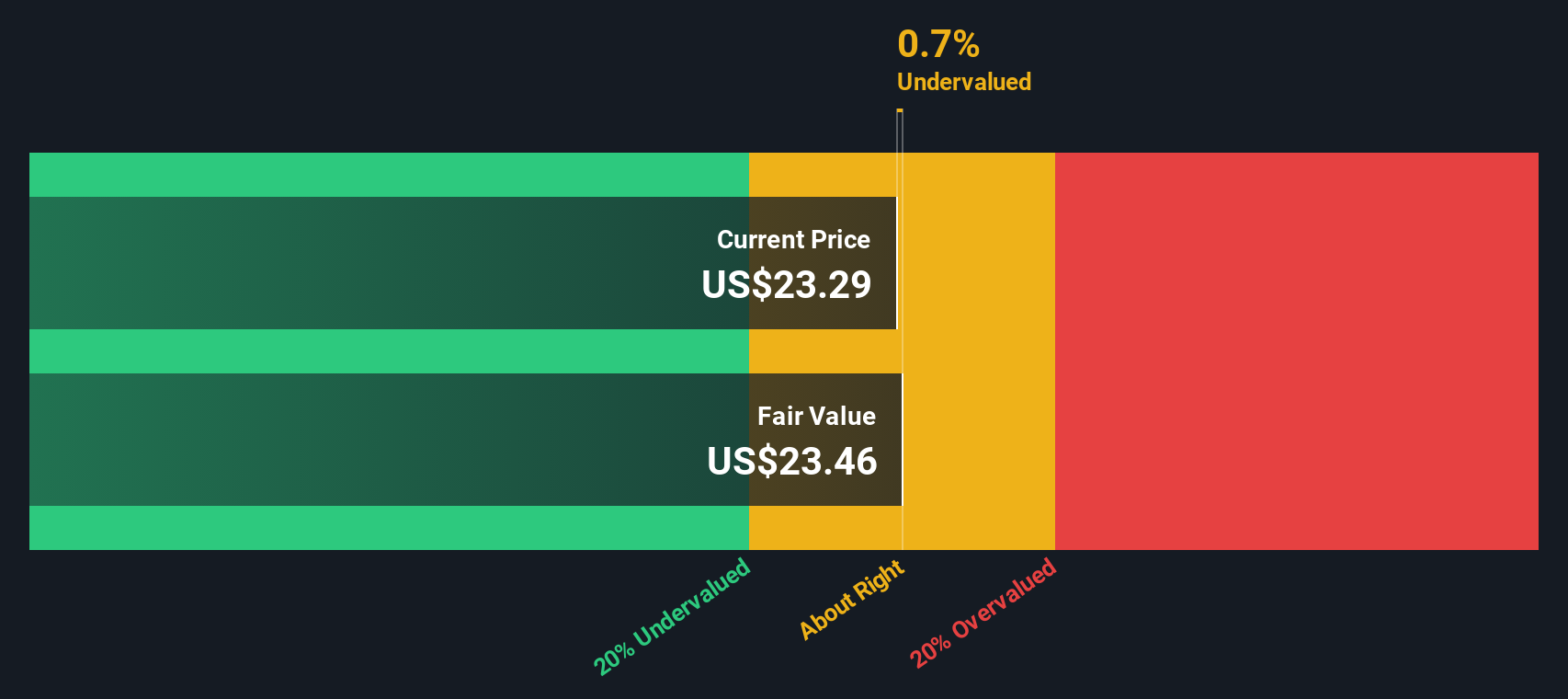

After such a strong run, is Invesco trading at a bargain, or has the market already priced in any future growth the company might deliver?

Most Popular Narrative: 2.6% Undervalued

According to the most widely followed narrative, Invesco is viewed as slightly undervalued at its current levels, with analysts believing there is modest upside potential from here.

"Effective cost discipline, scale-driven margin expansion, and balance sheet optimization (deleveraging, regular share repurchases, and planned capital return) suggest sustained improvements in operating leverage and net profit. These factors may further enhance future EPS and shareholder value."

Can Invesco’s disciplined transformation really drive shareholder value in the coming years? This narrative is anchored by bold forecasts for profitability, margins, and a valuation multiple below the industry average. Curious about the numbers and financial leaps that support this seemingly conservative fair value? The blueprint behind the valuation might surprise you.

Result: Fair Value of $22.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing pressure on net revenue yield from passive investing trends and increasing competition in ETFs could undermine Invesco’s earnings outlook.

Find out about the key risks to this Invesco narrative.Another View

The SWS DCF model arrives at a different conclusion, suggesting that Invesco might actually be trading slightly above its intrinsic value. This alternative approach challenges the previous “undervalued” assumption. Which side do you think is closer to the truth?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Invesco Narrative

If you want a different angle or want to dig into the numbers yourself, you can easily build your own Invesco narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Invesco.

Looking for more investment ideas?

The market is full of compelling stocks beyond Invesco, and missing out on the next big opportunity can happen fast. Use the Simply Wall Street Screener to spot untapped gems and advance your investing strategy today.

- Accelerate your portfolio’s growth by checking out undervalued stocks based on cash flows. These may offer potential bargains based on strong cash flows and attractive fundamentals.

- Spot income stability and safeguard returns when you seek out dividend stocks with yields > 3%. These options feature robust yields that consistently reward shareholders.

- Ride the innovation wave and see which AI penny stocks are reshaping industries with artificial intelligence breakthroughs and disruptive technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.