Please use a PC Browser to access Register-Tadawul

Assessing Iridium Communications (IRDM) Valuation as Shares Rebound and Analyst Targets Signal Upside

Iridium Communications Inc. IRDM | 17.74 | +1.14% |

Iridium Communications has bounced back from a tough quarter with a 1-month share price return of nearly 6%, hinting at renewed investor optimism following recent revenue and net income growth. Still, with a year-to-date share price return of -35% and a three-year total shareholder return down over 57%, momentum is only just starting to rebuild as the market weighs the company’s long-term trajectory in a challenging environment.

If you’re keeping an eye out for what’s really moving, now is a prime moment to broaden your perspective and explore fast growing stocks with high insider ownership

With shares trading at about 70% of consensus analyst targets and solid fundamentals, does Iridium still offer untapped value for investors, or is the market already factoring in its future growth prospects?

Most Popular Narrative: 42% Undervalued

Iridium Communications' most widely followed narrative estimates its fair value much higher than the last close price. This highlights a significant gap in how the market values the company today. The narrative projects a positive outlook based on analyst expectations related to long-term revenue and high-margin growth drivers.

Rising demand for secure, resilient communications due to increased geopolitical instability, disaster response needs, and critical infrastructure vulnerabilities, for example, GPS spoofing mitigation via Iridium's PNT offering, is expected to drive both commercial and government uptake. This would support above-trend service revenue and margin expansion.

What is fueling the optimism? The narrative emphasizes future technology adoption, expanding margins, and notable improvements in profitability to support this valuation. The assumptions behind this price target are only revealed in the full narrative—find out which factors shape the valuation and why they are important for the future of Iridium Communications.

Result: Fair Value of $33.38 (UNDERVALUED)

However, accelerating customer migration to lower-value plans and slower than expected IoT revenue growth could quickly challenge analyst optimism and reshape Iridium’s outlook.

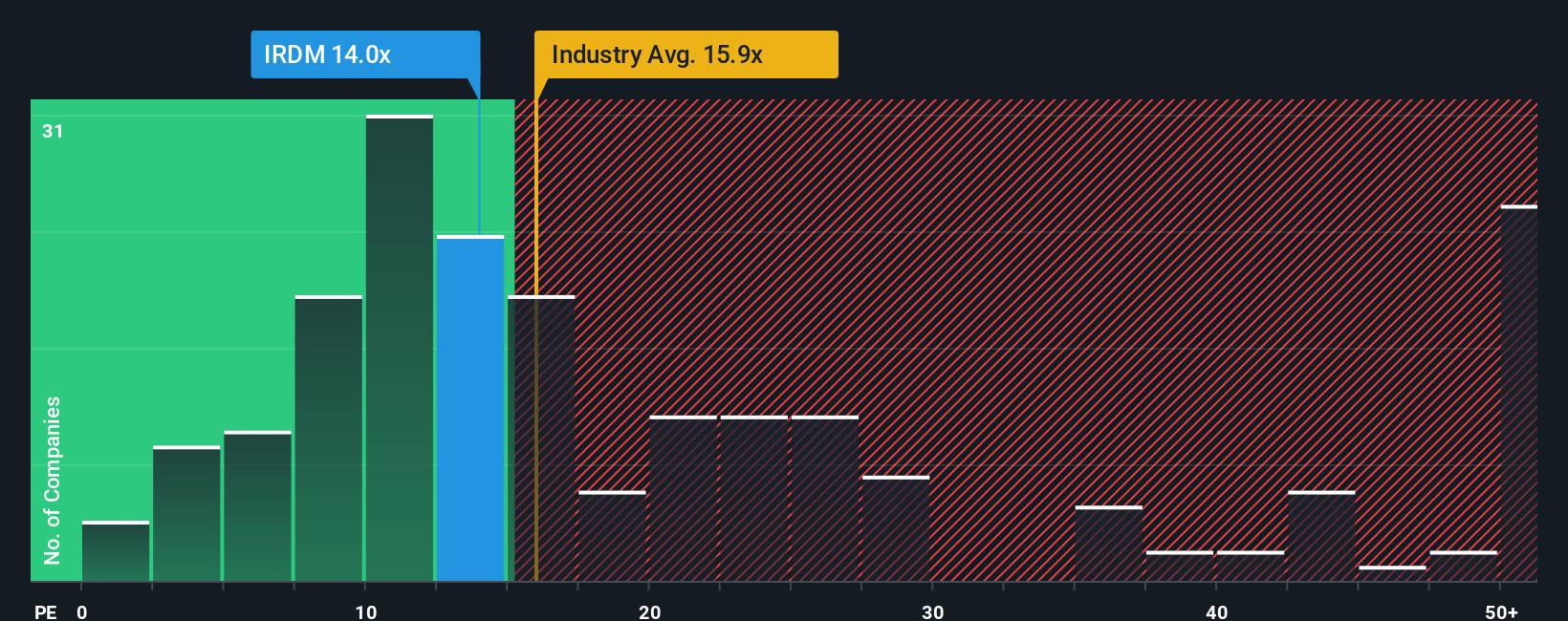

Another View: Multiples Comparison Challenges the Narrative

Switching gears, if we look at Iridium Communications through the lens of price-to-earnings, things appear less optimistic. Shares are trading at 18 times earnings, which is higher than both the Telecom industry average of 17x and its peers at 17.2x. This premium could mean investors are pricing in more future growth or overlooking some downside risk if expectations are not met. Could the market re-rate Iridium if sentiment swings?

Build Your Own Iridium Communications Narrative

If you see Iridium Communications differently or want to base your outlook on your own research, you can easily craft your own perspective in a matter of minutes. Do it your way

A great starting point for your Iridium Communications research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Ready to put your research to work? Don't let fresh, high-potential opportunities slip by while the market evolves. Take charge and find your next great investment with tools built for smart investors.

- Capture untapped potential in emerging industries when you seize these 24 AI penny stocks that power the future of automation and intelligent tech.

- Target steady income streams by selecting these 18 dividend stocks with yields > 3% with strong yields above 3% and robust fundamentals.

- Ride the wave of blockchain innovation as you evaluate these 79 cryptocurrency and blockchain stocks positioned to benefit from growth in digital finance and decentralization.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.