Please use a PC Browser to access Register-Tadawul

Assessing Kaiser Aluminum (KALU) Valuation After Wells Fargo Downgrade And New Dividend Announcement

Kaiser Aluminum Corporation KALU | 133.16 133.16 | +4.37% 0.00% Post |

Dividend and downgrade put Kaiser Aluminum in focus

Kaiser Aluminum (KALU) is drawing attention after a Wells Fargo downgrade on substitution and valuation concerns, along with a declared quarterly dividend of US$0.77 per share payable on February 13, 2026.

Despite the downgrade, investor interest has stayed strong, with Kaiser Aluminum’s share price at US$131.22 and a 90 day share price return of 68.08%, while the 1 year total shareholder return sits at 83.65%, suggesting momentum has been building.

If this kind of sharp move has caught your attention, it could be a good moment to look beyond metals and scan aerospace and defense stocks for other aerospace and defense names on your radar.

With KALU now trading above both its analyst price target and an estimated intrinsic value, the big question is whether recent gains leave limited upside or if the market is still catching up to future growth potential.

Price-to-Earnings of 24.7x: Is it justified?

With Kaiser Aluminum trading at US$131.22, the current P/E of 24.7x places the stock at a higher earnings multiple than the company’s own fair P/E estimate, yet still below both industry and peer averages.

The P/E ratio tells you how much investors are paying today for each dollar of current earnings, which is a common yardstick for metals and mining names that already generate profits. At 24.7x earnings, Kaiser Aluminum is described as expensive relative to its estimated fair P/E of 21.1x. This implies the market is paying a premium compared to what that model suggests might be a more typical level.

By contrast, the same 24.7x multiple is framed as good value versus the broader US Metals and Mining industry average of 27.8x, and even more so versus a peer group average P/E of 55.2x, which is more than double Kaiser Aluminum’s level. That comparison suggests the earnings multiple could move closer to the fair ratio over time if sentiment changes, while still sitting at a discount to some sector peers.

Result: Price-to-Earnings of 24.7x (ABOUT RIGHT)

However, the recent downgrade on substitution and valuation concerns, plus KALU trading above its US$112.50 analyst target, could leave the story vulnerable to changes in sentiment.

Another angle on valuation

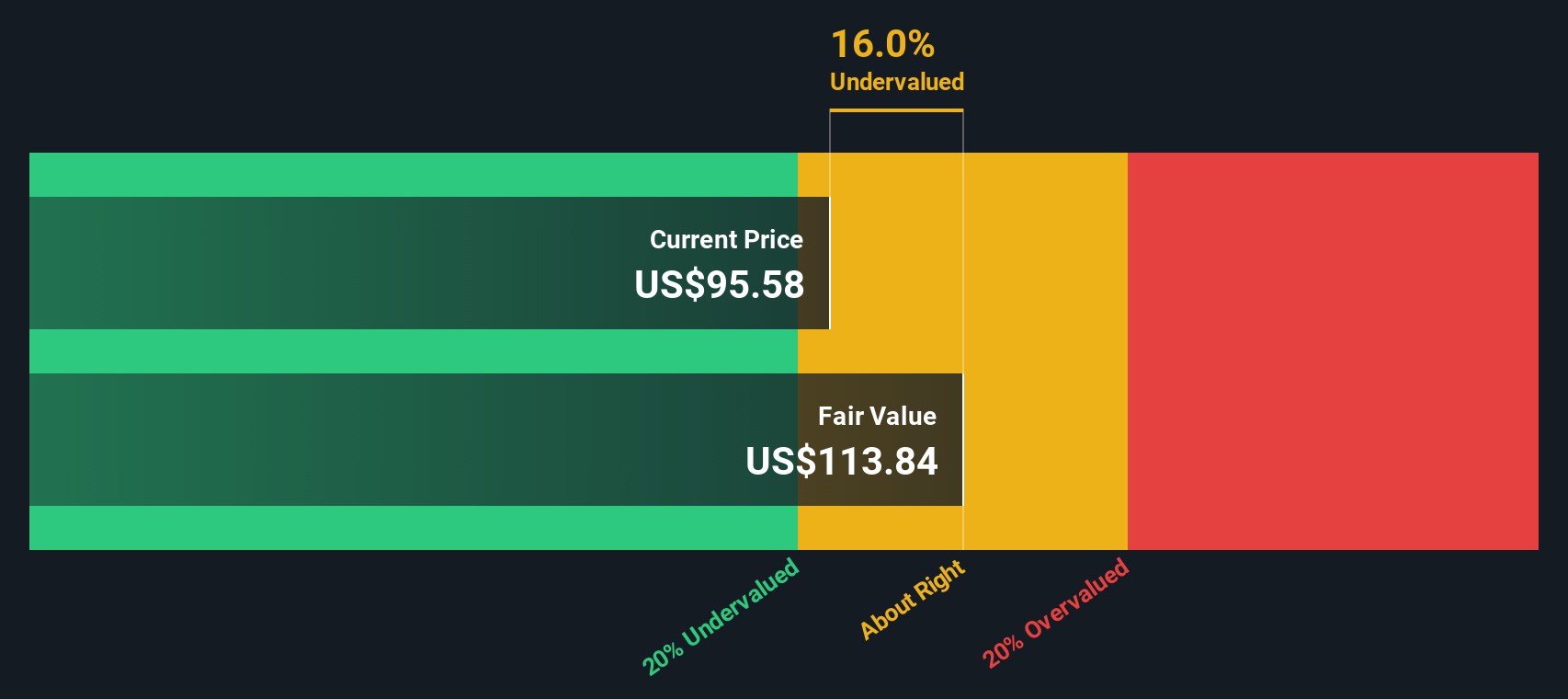

Our DCF model presents a slightly different picture compared to the P/E discussion. With KALU at US$131.22 versus an estimated fair value of US$128.04, the stock appears slightly overvalued rather than clearly cheap. This raises a practical question: are you comfortable paying a premium for the current momentum?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kaiser Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 868 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kaiser Aluminum Narrative

If you see the numbers differently or prefer to test your own assumptions directly, you can build a personalised Kaiser Aluminum view in just a few minutes: Do it your way

A great starting point for your Kaiser Aluminum research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Kaiser Aluminum has sparked your interest, do not stop here. Broaden your watchlist with other focused ideas that match how you like to invest.

- Target income potential with these 12 dividend stocks with yields > 3% that put regular cash returns front and centre for your portfolio planning.

- Spot future focused themes early by scanning these 24 AI penny stocks that are tied to artificial intelligence trends shaping many sectors.

- Hunt for mispriced opportunities using these 868 undervalued stocks based on cash flows that some investors may be overlooking right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.