Please use a PC Browser to access Register-Tadawul

Assessing Keysight Technologies (KEYS) Valuation Following Recent Share Price Volatility

Keysight Technologies Inc KEYS | 208.81 | -2.49% |

Keysight Technologies (KEYS) shares have been drawing investor attention following recent trading activity, with some shifts in performance over the past month. This movement raises questions about what may be driving sentiment for the company right now.

Keysight’s latest share price move comes after a period of choppy trading, which underscores a broader trend: short-term volatility has weighed on returns, yet its 1-year total shareholder return still edges into positive territory at 0.3%, and the 5-year figure stands out at 52.0%. While recent momentum looks subdued, the long-term picture highlights the value of patience for investors who stick around through the cycles.

If you’re looking for what else could offer a strong growth story, this is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With shares trading below analyst price targets, but long-term gains showing the value of patience, investors are now left to consider whether Keysight Technologies is trading at a bargain or if the market is already factoring in its growth potential.

Most Popular Narrative: 15% Undervalued

Compared to the last close price of $159.49, the narrative’s fair value of $187.60 suggests meaningful upside if assumptions hold true. This narrative draws on future technology catalysts to back a valuation premium.

Early engagement and leadership in next-generation wireless technologies, such as ongoing 5G-Advanced deployments, direct-to-cell, non-terrestrial networks, and active participation in 6G research, position Keysight to capture significant share as new wireless standards roll out globally. This supports future revenue growth and a stable order outlook.

What exactly powers this upbeat view? It is not just about today’s numbers. There is a bold forecast for margin expansion and earnings acceleration built into the narrative, hinging on emerging trends and strategic bets. Want to see the financial blueprint that could put Keysight in the driver’s seat for tech’s next wave?

Result: Fair Value of $187.60 (UNDERVALUED)

However, ongoing tariffs and unexpectedly weak demand from key verticals could quickly undercut the margin improvements and growth that bulls are hoping for.

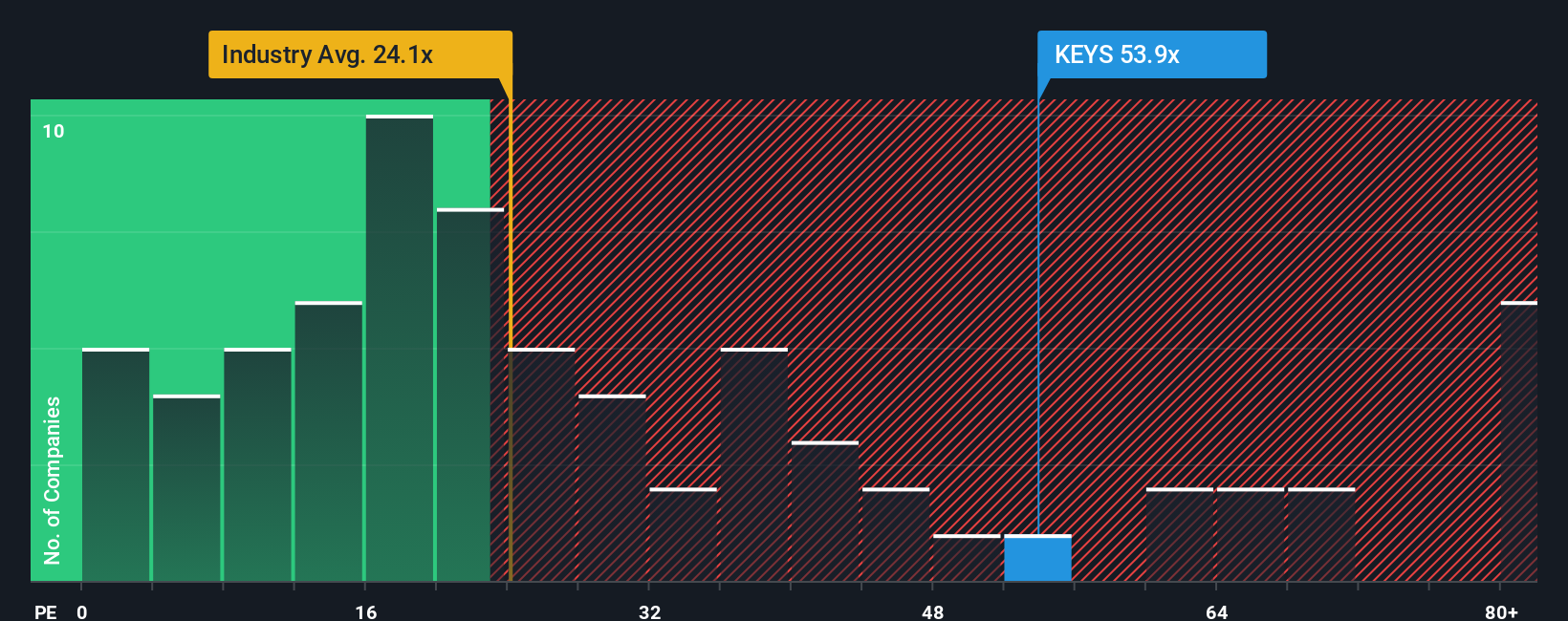

Another View: Comparing with Peers and Industry

While the analyst consensus suggests meaningful upside, a closer look at valuation using the price-to-earnings ratio tells a different story. Keysight trades at 50.4 times earnings, which is above the US Electronic industry average of 25.5x and the fair ratio of 32.5x, as well as its peer group at 43.9x. This higher premium may signal greater risk if future results fall short, or it could reflect confidence in long-term growth. Could the market be pricing in too much optimism, or is this a sign of smart money moving ahead of the curve?

Build Your Own Keysight Technologies Narrative

If you see things differently or want to dig into the numbers yourself, you can use our platform to craft your own Keysight Technologies story in just a few minutes. Do it your way

A great starting point for your Keysight Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for a narrow view when you can spot tomorrow’s standout performers today. The right tools can reveal early winners and undervalued gems, so don’t miss your chance to act before the crowd.

- Capture high growth potential and outpace the pack when you back tomorrow’s tech leaders with these 24 AI penny stocks.

- Benefit from stable income streams by targeting solid yields through these 19 dividend stocks with yields > 3%, delivering 3% or more.

- Position yourself at the forefront of innovation by following these 26 quantum computing stocks, where the next breakthroughs in computing are taking shape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.