Please use a PC Browser to access Register-Tadawul

Assessing Kinetik Holdings (KNTK) Valuation After Analyst Upgrade And Kings Landing Project Progress

Kinetik Holdings Inc. Class A KNTK | 45.56 | +1.90% |

Conference appearance and recent rating change put Kinetik in focus

Kinetik Holdings (KNTK) is drawing fresh attention after presenting at the UBS Global Energy & Utilities Winter Conference in Park City, Utah, shortly after a Raymond James upgrade to Outperform.

Despite the recent conference appearance and upgrade, Kinetik’s 1 year total shareholder return decline of 35.4% contrasts with a 43.0% gain over three years, suggesting longer term investors have seen stronger momentum than those focused on the recent past.

If this kind of midstream story has your attention, it can be a good moment to scan other energy infrastructure names through fast growing stocks with high insider ownership and see what else stands out.

With the share price down 35.4% on a 1 year total return but still up 43.0% over three years, and trading below both analyst and intrinsic value estimates, is Kinetik a mispriced midstream name, or is the market already banking on future growth?

Most Popular Narrative: 18.3% Undervalued

With Kinetik’s fair value in the mid US$40s against a last close of US$36.56, the leading narrative sees clear upside grounded in long term cash flows.

The combination of basin-level consolidation among large oil & gas producers and increasing regulatory barriers to new-build midstream infrastructure enhances the competitive moat for incumbent operators like Kinetik, ensuring high asset utilization and pricing power, translating to resilient or growing earnings and improved return on invested capital.

Curious what has to happen for that mid US$40s fair value to hold up? Revenue growth, margin expansion, and a punchy future earnings multiple all sit at the core of this story.

Result: Fair Value of $44.77 (UNDERVALUED)

However, this hinges on Permian volumes and cost control. Weaker drilling activity or sustained gas price and Waha basis pressure could quickly challenge that upside story.

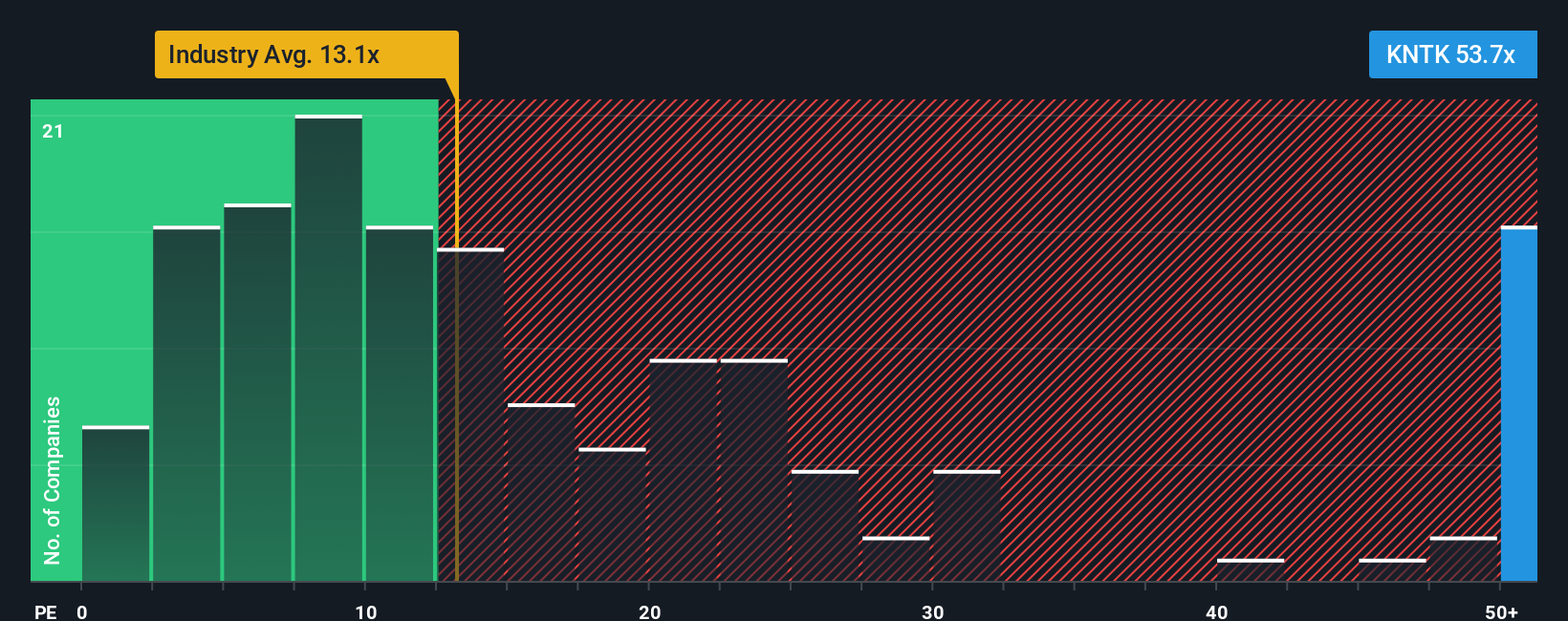

Another View: High P/E Puts Pressure On The Story

While the narrative points to Kinetik as undervalued on cash flow, the current P/E of 91.7x versus a US Oil and Gas average of 13.3x and a fair ratio of 22x suggests the shares trade at a heavy premium that could compress if expectations cool.

That kind of gap can work in your favor if earnings grow as forecast, but it can also magnify disappointment if profit growth or margins fall short. Which side of that equation do you feel more comfortable underwriting right now?

Build Your Own Kinetik Holdings Narrative

If you see the numbers differently or prefer to stress test your own assumptions, you can build a complete Kinetik view in minutes by starting with Do it your way.

A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Kinetik has sharpened your thinking, do not stop here. Broaden your watchlist with focused screens that surface different types of opportunities across the market.

- Target potential value gaps by scanning these 880 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Explore the evolution of artificial intelligence by checking out these 26 AI penny stocks leading real world adoption across sectors.

- Boost your income focus by reviewing these 12 dividend stocks with yields > 3% that combine yields above 3% with equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.