Please use a PC Browser to access Register-Tadawul

Assessing Knife River (KNF) Valuation Following Infrastructure Act Momentum and Expanding Project Backlog

Knife River Corp Ordinary Shares KNF | 77.29 | -1.54% |

Most Popular Narrative: 29.6% Undervalued

The leading narrative sees Knife River as significantly undervalued, with its current price trading well below fair value, based on forward-looking earnings and margin expansion potential.

Knife River's record $1.3 billion backlog and exposure to public infrastructure projects, supported by robust, multiyear federal and state Department of Transportation funding (including 60% of IIJA funds still to be spent), positions the company for strong, sustained revenue growth well into 2026 and beyond.

Curious how analysts justify such a big upside? Their formula hinges on a blend of long-term backlog, government funding, and bold profit forecasts. The path to this valuation is based on aggressive growth and margin assumptions that might surprise you. What is fueling all this future optimism? Keep reading to dig into the details behind the numbers.

Result: Fair Value of $110.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent funding delays in key markets and rising input costs could stall Knife River’s momentum and challenge even the most bullish outlooks.

Find out about the key risks to this Knife River narrative.Another View: Multiples Tell a Different Story

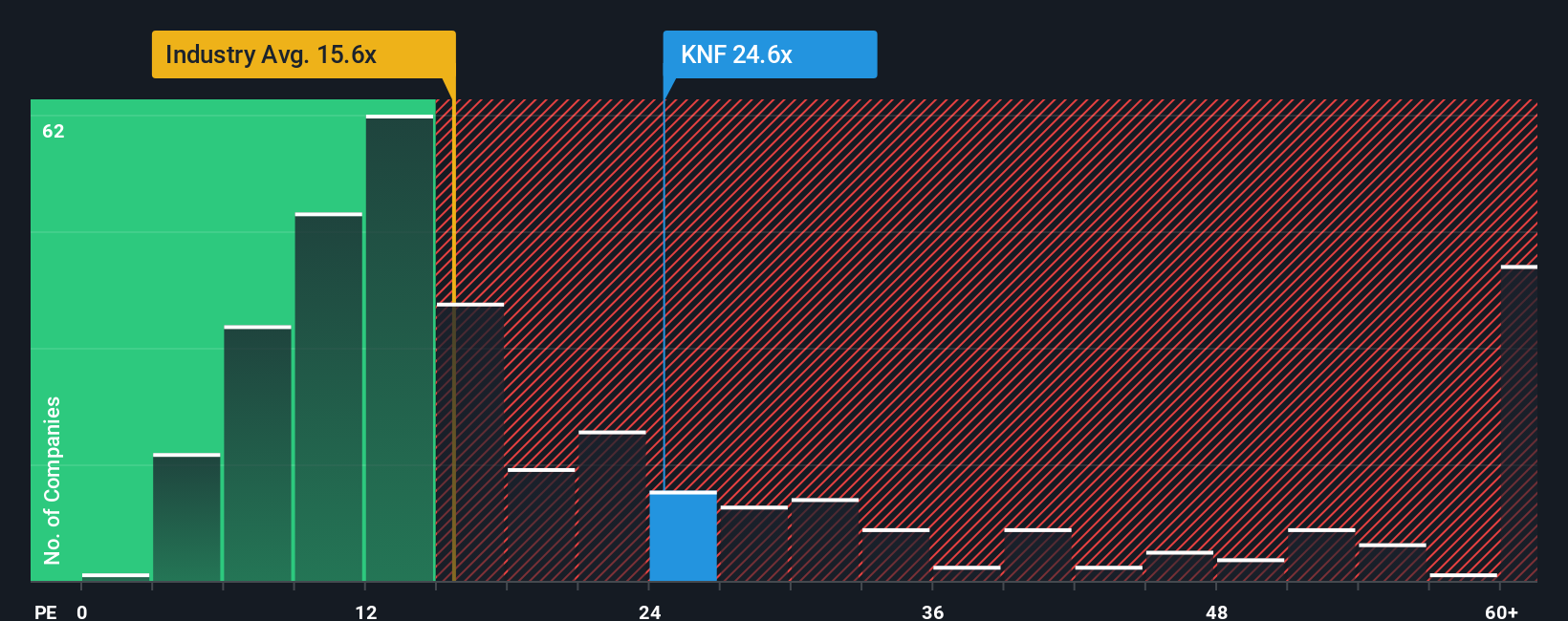

Looking at Knife River through a different lens, its current market valuation appears steep when compared to the broader industry, based on a common earnings metric. Is the optimism around growth already included in the price, or is the market playing it safe?

Build Your Own Knife River Narrative

If you see things differently or want to dive deeper into the numbers yourself, you can build your own perspective in just a few minutes. Do it your way.

A great starting point for your Knife River research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investing Opportunities?

Do not limit your portfolio to just one angle. Explore these fast-moving themes and unlock stocks with the attributes investors everywhere are chasing right now.

- Uncover top-yielding companies with lasting cash returns by checking out dividend stocks with yields > 3%.

- Target businesses harnessing artificial intelligence to lead healthcare innovation through healthcare AI stocks.

- Tap into game-changing tech breakthroughs with our handpicked list of quantum computing stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.