Please use a PC Browser to access Register-Tadawul

Assessing Krystal Biotech (KRYS) Valuation As Analyst Upgrades And Earnings Optimism Gain Traction

Krystal Biotech, Inc. KRYS | 261.80 | -0.33% |

Recent analyst attention on Krystal Biotech (KRYS), including a top ranking and higher earnings estimates, has pushed the stock into focus as investors respond to this shift in sentiment and its recent market outperformance.

That analyst enthusiasm comes on top of strong recent price action, with a 30 day share price return of 12.03%, a 90 day share price return of 51.25%, and a 1 year total shareholder return of 81.86%. This suggests that momentum has been building even if the latest 1 day move was softer.

If Krystal Biotech has caught your eye, it could be a moment to see what else is moving in healthcare, starting with healthcare stocks.

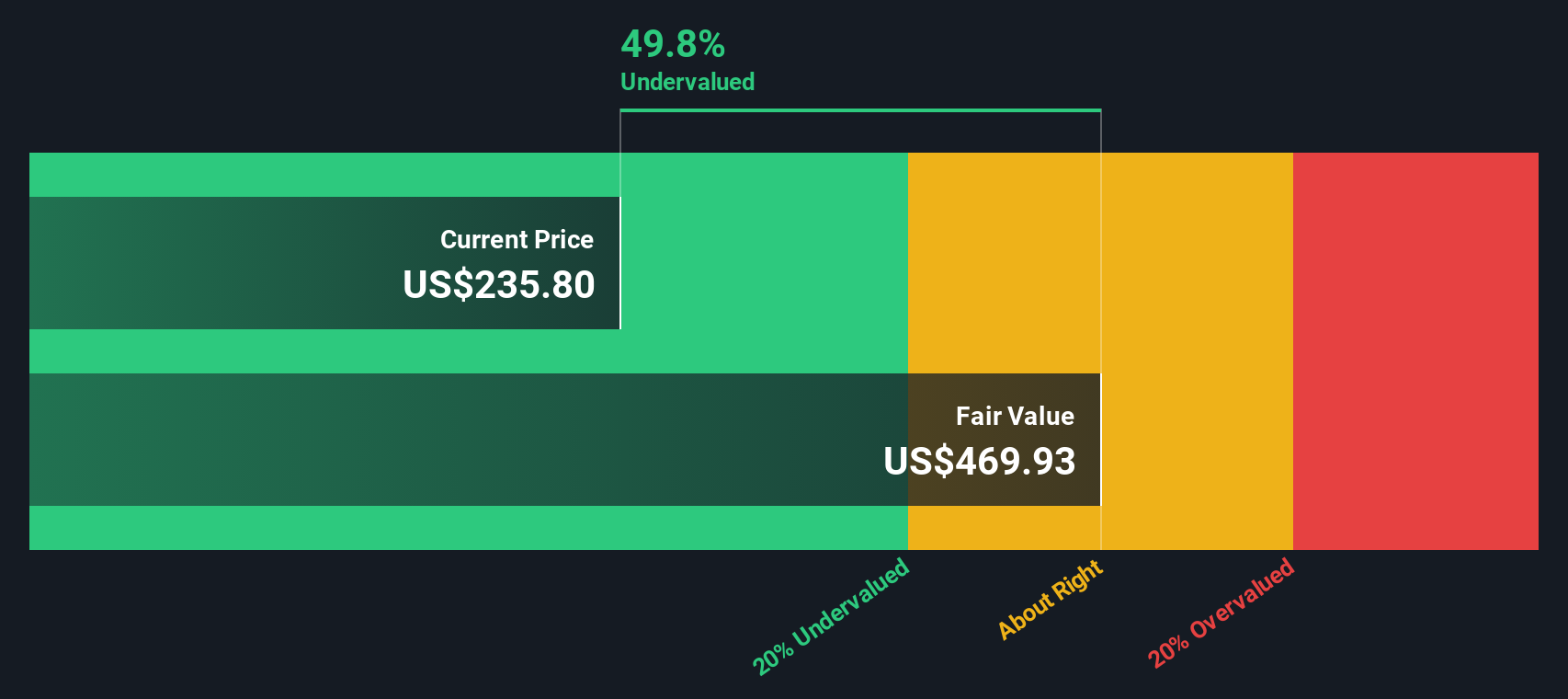

With Krystal Biotech trading at $281.53, slightly above the average analyst price target yet showing an estimated 49% intrinsic discount, it raises a key question for you: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3% Overvalued

The most followed narrative puts Krystal Biotech’s fair value at $273.60, which sits just below the recent close of $281.53 and frames the current enthusiasm.

The analysts have a consensus price target of $205.2 for Krystal Biotech based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $252.0, and the most bearish reporting a price target of just $166.0.

Consider how a higher fair value sits alongside a lower consensus target, rising margin assumptions, and faster projected revenue growth. The full narrative lays out the numbers step by step so you can evaluate those trade offs for yourself.

Result: Fair Value of $273.60 (OVERVALUED)

However, you still need to weigh the concentration on VYJUVEK and the early stage of key programs like KB407, where clinical or reimbursement setbacks could quickly challenge this optimism.

Another View: Cash Flows Tell a Different Story

The narrative fair value of $273.60 suggests Krystal Biotech is slightly overvalued at $281.53. Yet our DCF model, which focuses on projected cash flows, arrives at $555.65, implying the shares trade at roughly a 49% discount. Which set of assumptions do you trust more: sentiment driven targets or cash flow math?

Build Your Own Krystal Biotech Narrative

If you look at these numbers and reach a different conclusion, or simply prefer to rely on your own work, you can build a fresh view in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Krystal Biotech.

Looking for more investment ideas?

If Krystal Biotech is just one piece of your watchlist, broaden your view with a few focused stock ideas that could sharpen your next investing move.

- Spot potential value plays by scanning these 862 undervalued stocks based on cash flows, where cash flow based opportunities might stand out before they hit everyone else’s radar.

- Get ahead of the next big tech story by checking out these 24 AI penny stocks, focusing on companies tied to artificial intelligence themes.

- Strengthen your income watchlist by reviewing these 13 dividend stocks with yields > 3%, highlighting businesses with yields above 3% that may suit a dividend focused approach.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.