Please use a PC Browser to access Register-Tadawul

Assessing LegalZoom (LZ) Valuation After Strong Recent Returns And High Earnings Multiple

LegalZoom.com, Inc. LZ | 8.88 | -1.33% |

Framing LegalZoom.com after recent performance

LegalZoom.com (LZ) has attracted fresh attention after a period in which its shares showed positive total returns over the past year and past 3 months, prompting investors to reassess how its fundamentals line up.

The company reports annual revenue of US$727.483m and net income of US$22.224m, with revenue growth at 6.61% and net income growth at 47.37%. These figures give investors more concrete data to work with.

LegalZoom.com’s recent 7 day share price return of 8.24% and 1 year total shareholder return of 38.03% suggest momentum has been building around the stock, with the latest share price at US$10.38.

If LegalZoom.com’s move has you reassessing the space, this could be a good moment to see what else is setting the pace among high growth tech and AI stocks.

So with LegalZoom.com trading at US$10.38, showing a strong 1 year total return and sitting at a reported intrinsic discount of 64.08%, are you looking at a genuine value opportunity, or has the market already priced in future growth?

Most Popular Narrative: 16% Undervalued

LegalZoom.com’s most followed valuation narrative puts fair value at US$12.36 per share, compared with the recent close at US$10.38. This frames the current debate around upside potential.

Robust free cash flow generation and a strengthened balance sheet provide LegalZoom with flexibility to strategically invest in growth initiatives and pursue further M&A, supporting long-term earnings growth.

Want to see what is baked into that cash flow story? The narrative leans heavily on revenue expansion, rising margins, and a richer earnings multiple. Curious which assumptions really carry the fair value math? Read on and test whether those numbers line up with your own view.

Result: Fair Value of $12.36 (UNDERVALUED)

However, the story can change quickly if AI makes basic legal services cheaper and easier to copy, or if lower retention on bundled subscriptions keeps recurring revenue under pressure.

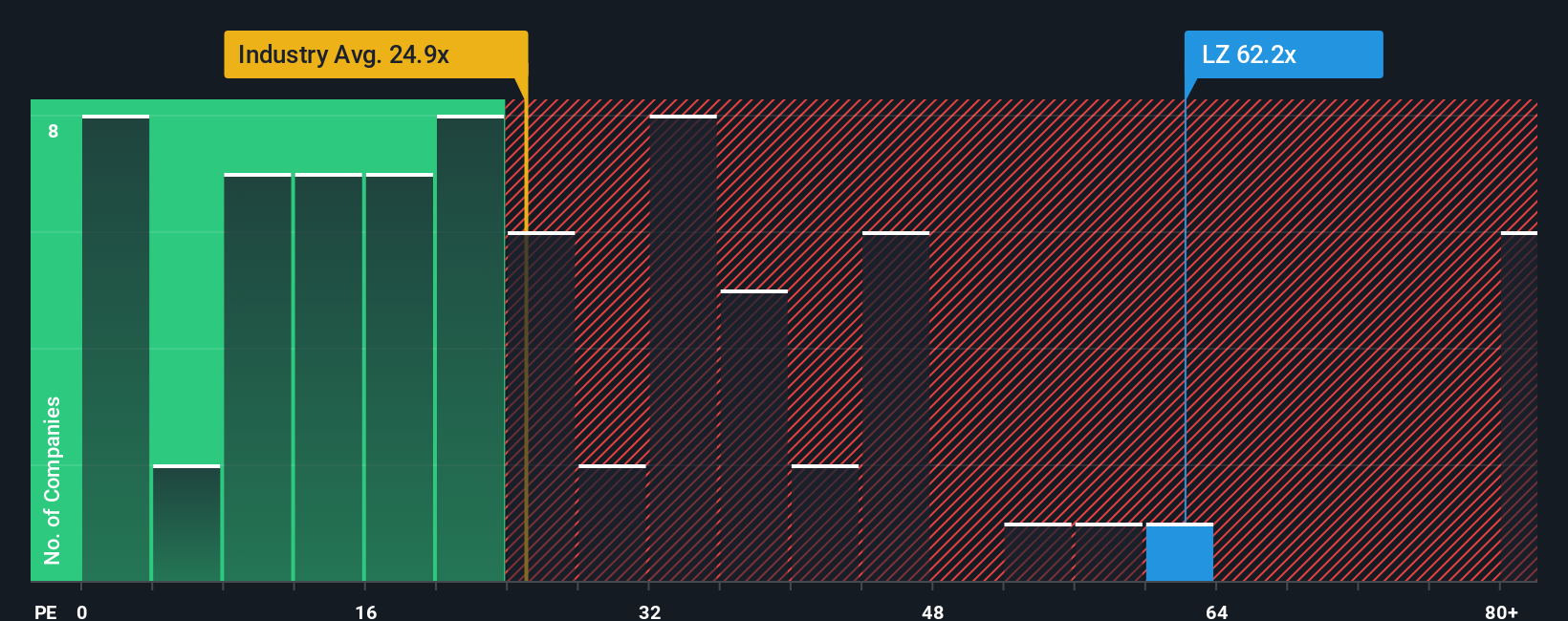

Another View: Earnings Multiple Sends A Different Signal

So far, the story leans on fair value estimates that point to LegalZoom.com looking undervalued. Yet its current P/E of 82.8x is far higher than the US Professional Services industry at 25.1x, the peer average of 25.5x, and even the fair ratio of 41.7x.

That gap suggests the market is already paying a premium price for each dollar of earnings, which could leave less room for error if expectations change. Does that premium feel justified to you at today’s US$10.38 share price, or does it tilt the balance of risk and reward?

Build Your Own LegalZoom.com Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a custom view in just a few minutes, starting with Do it your way.

A great starting point for your LegalZoom.com research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If LegalZoom.com has sharpened your thinking, do not stop here. Use the Simply Wall St screener to uncover other opportunities that might better fit your approach.

- Spot potential turnaround stories by scanning these 3539 penny stocks with strong financials that pair lower share prices with stronger fundamentals than you might expect.

- Zero in on future facing themes by checking out these 28 AI penny stocks that tie artificial intelligence to real business models and financials.

- Focus your research on price conscious opportunities by filtering for these 882 undervalued stocks based on cash flows that look cheap based on their cash flow profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.