Please use a PC Browser to access Register-Tadawul

Assessing Littelfuse (LFUS) Valuation After Market Optimism Despite Recent Net Loss

Littelfuse, Inc. LFUS | 370.33 | +1.94% |

Littelfuse (LFUS) is back in focus after reporting a quarterly net loss, issuing new 2026 sales guidance of US$625 million to US$645 million, and affirming a US$0.75 per share cash dividend.

The share price is now US$331.88, and a 19.1% 1 month share price return and 36.6% 3 month share price return suggest momentum has picked up ahead of the new 2026 sales guidance. A 43.9% 1 year total shareholder return shows longer term holders have also been rewarded.

If Littelfuse’s recent move has you thinking about where else capital could work hard, this is a good moment to scan 22 power grid technology and infrastructure stocks for more grid focused opportunities.

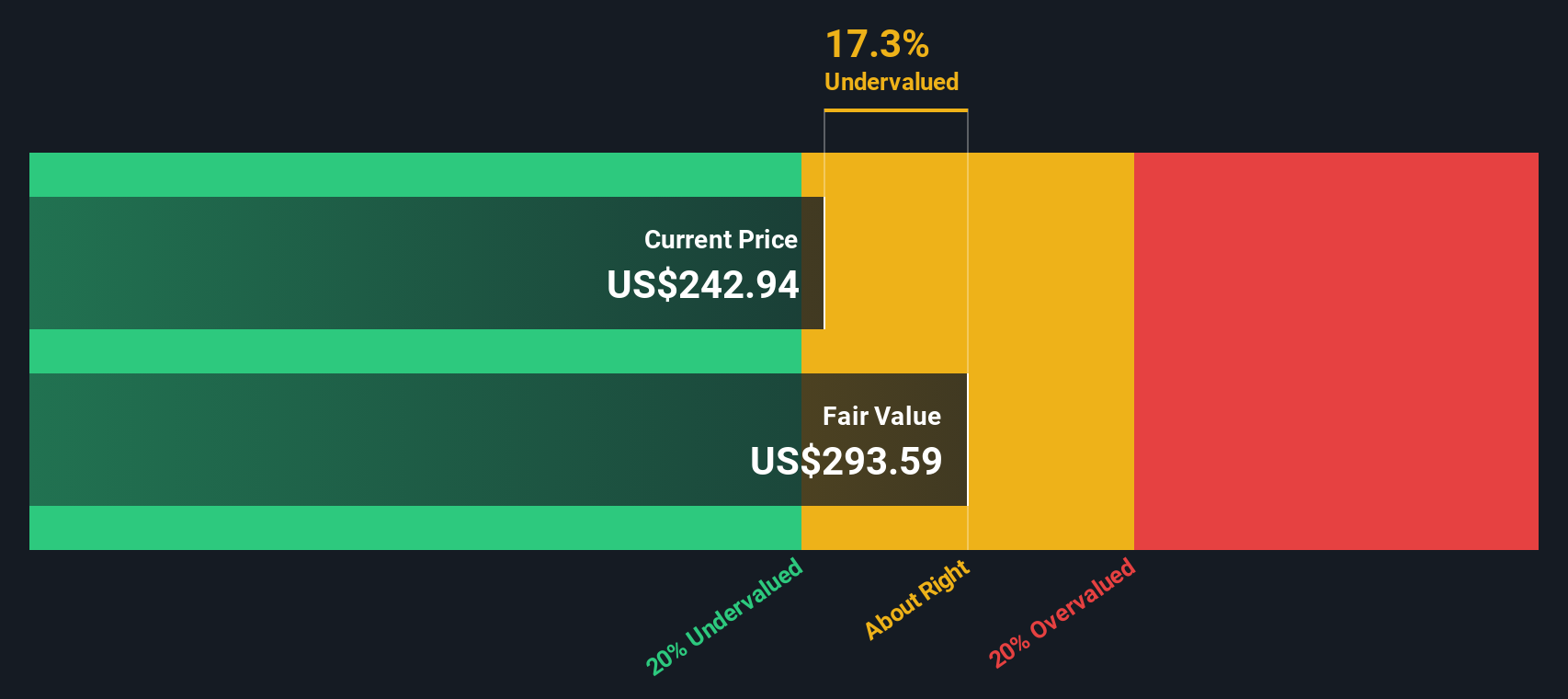

With Littelfuse trading close to analyst targets after a strong run, but still showing an intrinsic discount and a recent net loss, should you view current levels as a fresh entry point, or assume the market is already factoring in future growth?

Most Popular Narrative: 7.9% Overvalued

The most followed narrative puts Littelfuse's fair value at $307.50, below the recent $331.88 share price. This frames the current momentum in a different light.

The rapid buildout of renewable energy infrastructure, grid storage, and sustainable grid ecosystems is resulting in double-digit sales growth and a robust opportunity pipeline for Littelfuse, positioning the company to benefit from continued secular tailwinds and expanding its addressable market, which should positively impact both revenues and margins.

Curious how that growth story translates into the $307.50 fair value? The narrative leans on specific revenue paths, margin expansion, and valuation multiples that you might view very differently.

Result: Fair Value of $307.50 (OVERVALUED)

However, there are clear pressure points, including softness and execution issues in power semiconductors, as well as reliance on cyclical automotive and industrial demand that could easily upset this consensus.

Another Way To Look At Value: Cash Flows Say Something Different

While the popular narrative points to a fair value of $307.50 and calls Littelfuse overvalued at $331.88, our DCF model tells a different story. On that view, fair value sits around $355.62, which would make the current price roughly 6.7% below that estimate. When two methods point in opposite directions like this, which one do you trust more with your capital?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Littelfuse for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 55 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Littelfuse Narrative

If you see the numbers differently, or prefer to lean on your own work, you can pull the data together and shape a custom narrative in just a few minutes, then Do it your way.

A great starting point for your Littelfuse research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Littelfuse is already on your radar, it is worth lining it up against other opportunities so you are not relying on a single story.

- Strengthen your income focus by checking companies in our 15 dividend fortresses that aim to pair higher yields with stability.

- Spot potential mispricing by scanning the 55 high quality undervalued stocks that our models flag as offering quality at a discounted price.

- Protect your downside by comparing Littelfuse with the 80 resilient stocks with low risk scores that score well on resilience and financial risk checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.