Please use a PC Browser to access Register-Tadawul

Assessing Live Oak Bancshares (LOB) Valuation After Quarterly Beat And Analyst Target Upgrade

Live Oak Bancshares, Inc. LOB | 40.88 | +1.74% |

Live Oak Bancshares (LOB) is back in focus after quarterly results significantly beat market expectations, followed by an analyst firm lifting its valuation outlook while keeping a positive rating on the stock.

The latest quarterly beat and valuation upgrade come on top of strong momentum, with a 30-day share price return of 13.98% and a 90-day share price return of 30.10%. The 1-year total shareholder return of 15.73% and 3-year total shareholder return of 19.65% point to gains that have built over time, despite a weaker 5-year total shareholder return of 11.30%.

If strong bank results have caught your attention, it could be a good moment to widen your watchlist and check out our 22 top founder-led companies as another source of potential ideas.

With shares up sharply and the stock trading at a reported 26% intrinsic discount and a modest 7% gap to the latest analyst target, investors may now need to ask whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative: 60% Undervalued

Against the latest close of $41.75, the most followed narrative puts Live Oak Bancshares’ fair value at $42, suggesting only a small absolute gap but a sizable percentage discount to that narrative benchmark.

The rapid scaling of new digital products, such as Live Oak Express and checking account offerings (both essentially at zero in 2023 and now meaningfully contributing to loan and deposit growth), positions the company to capture increased demand from the ongoing shift toward tech-enabled banking and digital-native small business owners, supporting sustained revenue and margin growth.

Want the full story behind that fair value? The narrative leans on robust revenue compounding, rising profit margins and a future earnings multiple that is materially lower than what many banks trade on today. Curious which specific growth and profitability assumptions have been baked into that $42 figure, and how they stack up against today’s price action? The detailed narrative lays out those building blocks step by step.

Result: Fair Value of $42 (UNDERVALUED)

However, the story could change if regulatory rules around government backed lending tighten, or if tech investments keep expenses high without the expected payoff.

Another Angle On Valuation

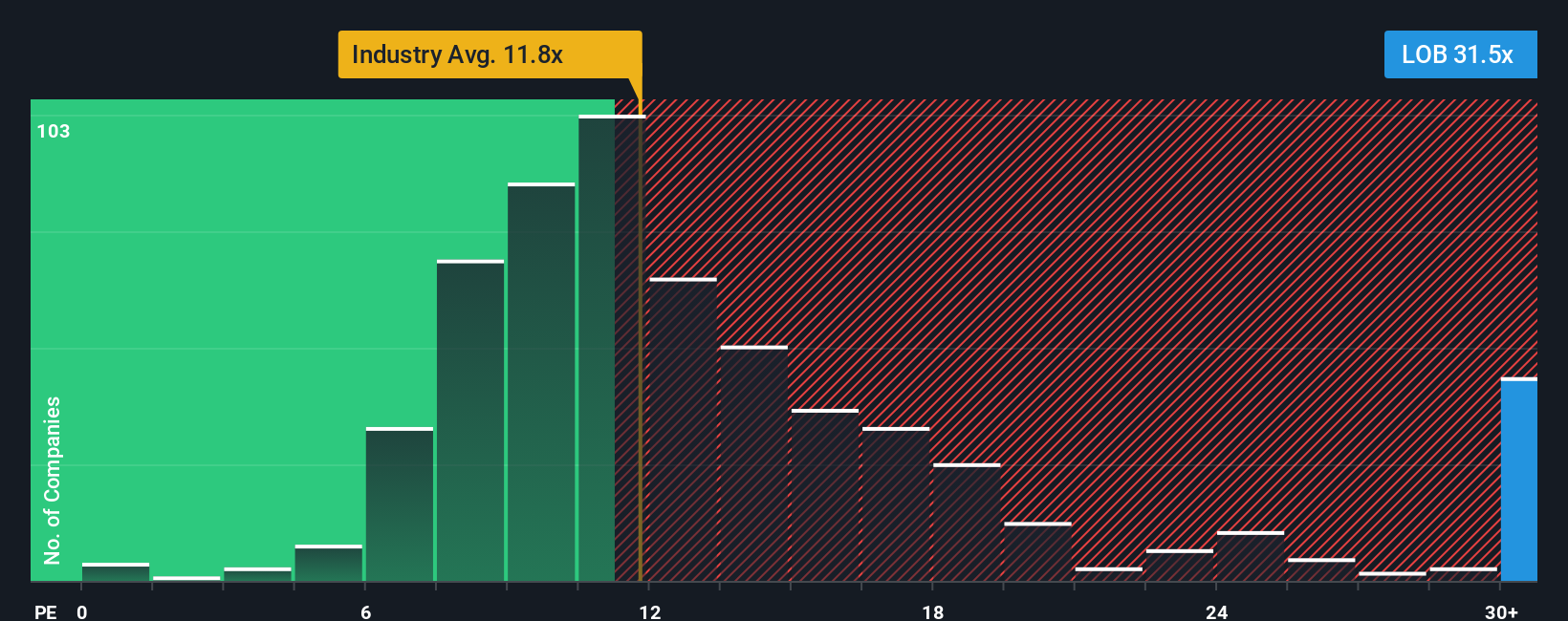

Our fair value estimate points to a discount, but the current P/E of 18.7x tells a different story. It sits above the US Banks industry average of 12x, the peer average of 13.9x, and even our fair ratio of 17.3x. This suggests there may be less room for error if growth expectations fall short.

That premium raises a simple question for you as an investor: is the market already paying up for Live Oak Bancshares’ growth story, or is this just the starting point if the bullish narrative plays out?

Build Your Own Live Oak Bancshares Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a custom thesis in minutes: Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

If this story has sharpened your thinking, do not stop here. Use the Simply Wall St screener to quickly surface other opportunities that might fit your style.

- Target value by running your eye over 52 high quality undervalued stocks that pair quality fundamentals with prices that may not fully reflect them yet.

- Prioritise resilience with 82 resilient stocks with low risk scores that aim to keep volatility and risk scores in check while you focus on the long term.

- Spot under the radar potential through our screener containing 24 high quality undiscovered gems that many investors may not be watching closely yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.