Please use a PC Browser to access Register-Tadawul

Assessing LTC Properties (LTC) Valuation As Recent Momentum Meets Premium Earnings Multiple

LTC Properties, Inc. LTC | 36.47 | +0.80% |

Why LTC Properties Is On Investor Radar Today

LTC Properties (LTC), a real estate investment trust focused on seniors housing and health care properties, has drawn attention after recent share price moves and its current valuation metrics in the income focused real estate space.

At a share price of US$36.52, LTC’s recent 30 day share price return of 6.88% and 90 day return of 3.78% sit alongside a 1 year total shareholder return of 11.56%, suggesting momentum has been building rather than fading.

If LTC has caught your eye in the health care real estate space, you might also want to see how other income oriented names stack up in healthcare stocks.

With LTC trading at US$36.52 and sitting close to analyst targets yet flagged with a sizeable intrinsic discount, the key question is simple: is the market missing something here or already pricing in future growth?

Most Popular Narrative: 3.5% Undervalued

With LTC Properties closing at $36.52 against a widely followed fair value estimate of about $37.83, the narrative currently points to a modest discount that hinges on specific growth and profitability assumptions.

The company's ability to recycle capital out of older skilled nursing assets (via portfolio sales and potential loan prepayments) and redeploy proceeds into higher-yielding, modern properties enhances rent growth potential and operating efficiency, which supports higher net margins and long-term NAV growth.

Curious what sits behind that projected uplift in value, rent growth, and margins? The narrative leans heavily on ambitious revenue expansion and a future earnings profile that assumes LTC can steadily scale its modern senior housing footprint while keeping returns attractive. Want to see exactly how those expectations translate into today’s fair value and where the pressure points might be?

Result: Fair Value of $37.83 (UNDERVALUED)

However, there is still a real chance that higher debt costs or pressure on key tenants could cap LTC’s earnings ambitions and weaken the current growth story.

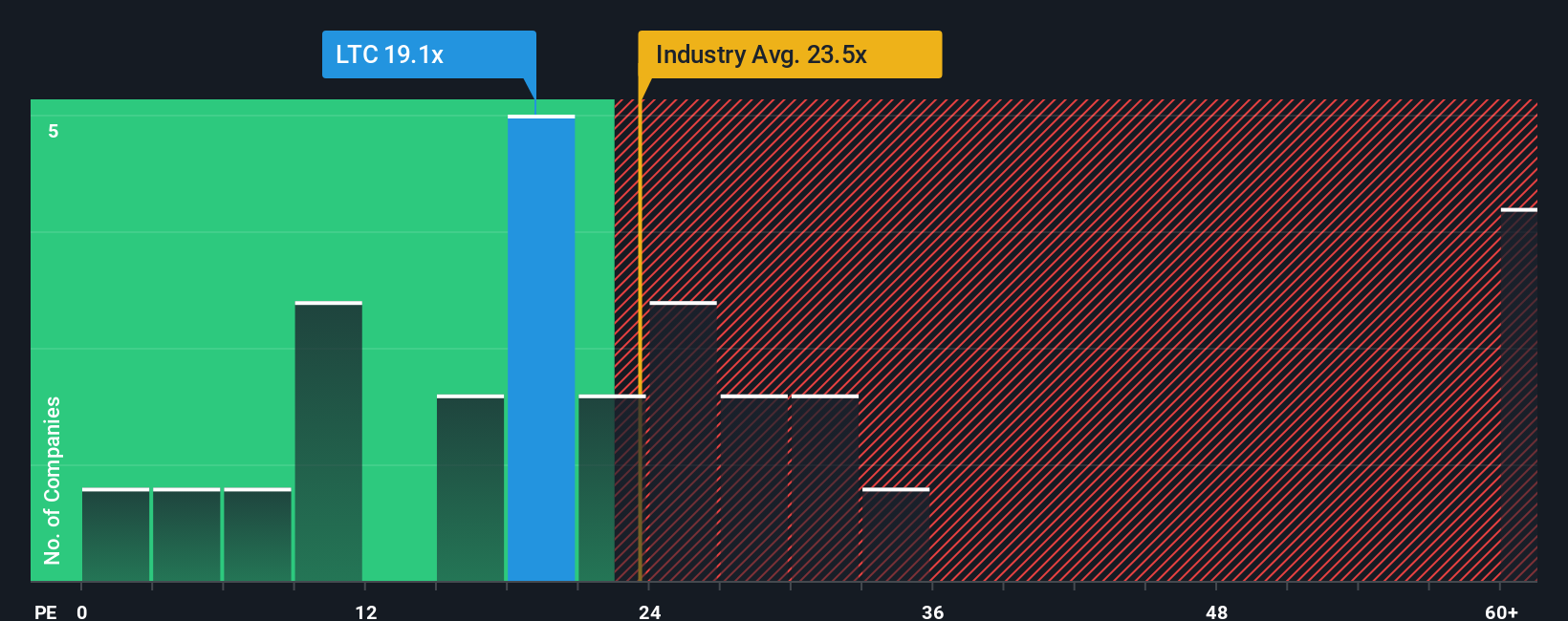

Another Take On Valuation: Multiples Look Less Generous

That 3.5% discount to a US$37.83 fair value and a large gap to our cash flow estimate hint at upside, but the current P/E of 52.3x tells a different story. It sits above the estimated fair ratio of 44.6x and well ahead of both peer average 27.7x and global Health Care REITs at 27x. Is the market already paying up for a lot of that future growth?

Build Your Own LTC Properties Narrative

If you see the numbers differently or prefer to test your own assumptions against the data, you can build a complete view in minutes, starting with Do it your way.

A great starting point for your LTC Properties research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop your research with a single stock, you might miss other opportunities that fit your style even better, so keep broadening your watchlist thoughtfully.

- Spot potential high return upstarts early by scanning these 3519 penny stocks with strong financials that already show stronger financial underpinnings than many expect from this corner of the market.

- Position yourself at the intersection of medicine and machine learning by checking out these 109 healthcare AI stocks, where data driven tools meet real world health needs.

- Strengthen your income focus by reviewing these 14 dividend stocks with yields > 3%, a filtered set of companies offering dividend yields above 3% that may complement your cash flow goals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.