Please use a PC Browser to access Register-Tadawul

Assessing MannKind (MNKD) Valuation After Recent Revenue And Profit Results

MannKind Corporation MNKD | 5.54 | +0.18% |

Why MannKind (MNKD) is on investors’ radar

MannKind (MNKD) has attracted attention after posting annual revenue of US$313.787 million and net income of US$29.233 million, putting fresh focus on how its inhaled and pulmonary therapies are translating into financial results.

At a share price of US$5.49, MannKind’s 1 day share price return of 5.37% contrasts with weaker 30 day and 1 year total shareholder returns of 5.99% decline and 9.11% decline, hinting at early but tentative momentum after recent financial results.

If MannKind’s latest numbers have you reassessing healthcare exposure, this could be a good moment to scan other US-listed healthcare stocks that might fit your watchlist.

With MannKind posting value metrics that score just 4 out of 10 and trading at a steep discount to analyst price targets, you have to ask: is this a mispriced healthcare player, or is the market already baking in its future growth?

Most Popular Narrative: 42.9% Undervalued

With MannKind last closing at US$5.49 against a narrative fair value of US$9.61, the current share price sits well below that modelled estimate. This puts the focus squarely on what assumptions are doing the heavy lifting.

Analysts are assuming MannKind's revenue will grow by 13.2% annually over the next 3 years. Analysts assume that profit margins will increase from 10.9% today to 16.1% in 3 years time.

Curious what kind of earnings path could support that higher value, and why it implies a richer future P/E than many US biotechs? The full narrative lays out the specific revenue ramp, margin shift and profit multiple that need to line up before that fair value starts to look realistic.

Result: Fair Value of $9.61 (UNDERVALUED)

However, the story can change quickly if Afrezza uptake stays niche or if setbacks in key programs like MNKD-101 signal tougher hurdles for the broader pipeline.

Another Way To Look At MannKind’s Valuation

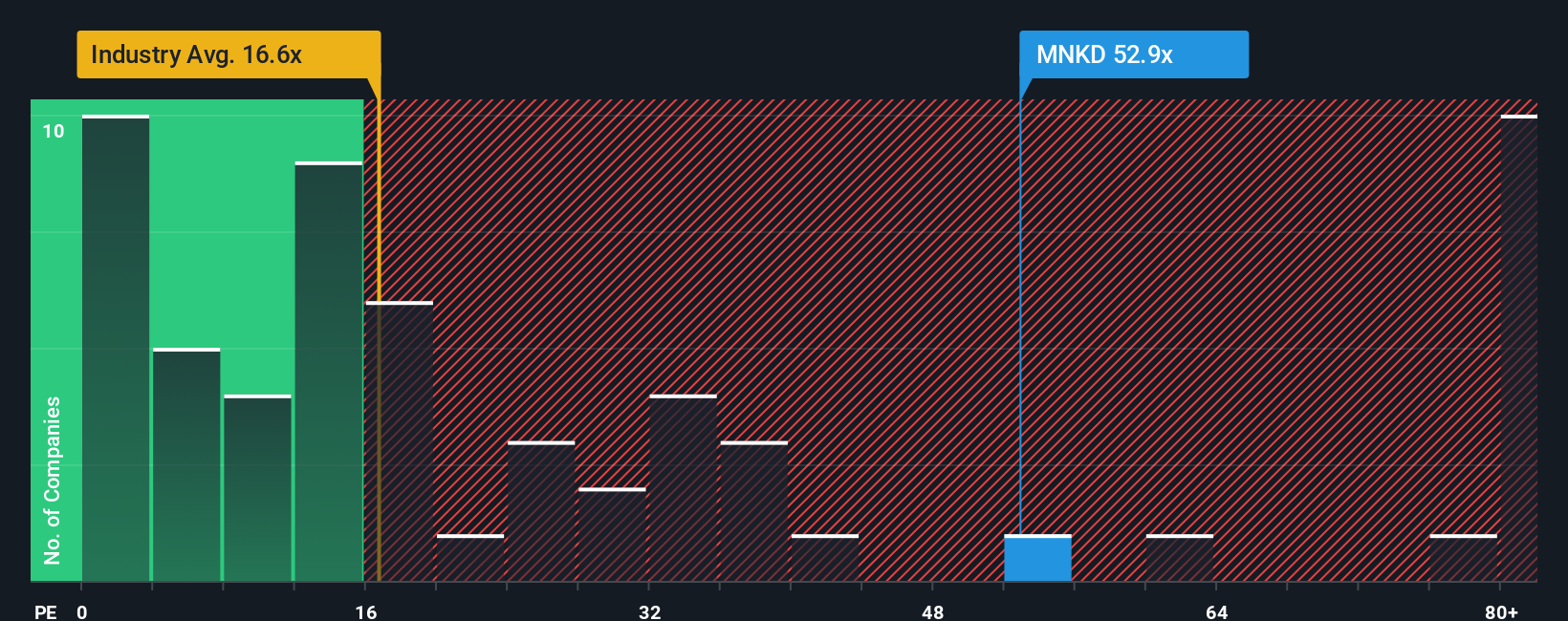

If the narrative fair value of US$9.61 paints MannKind as undervalued, its current P/E of 57.7x tells a tougher story. That is far above the US Biotechs average of 19.7x and more than double the fair ratio of 24.7x, while still sitting below peers at 66.3x.

Put simply, the market is already pricing in a lot of future earnings progress. The gap to that lower fair ratio hints at real downside risk if the growth case stalls, even if some peers trade richer. Which story you trust more, the model fair value or the earnings multiple, is the key question.

Build Your Own MannKind Narrative

If this view does not quite fit how you see MannKind, you can always review the same data points yourself, shape a fresh narrative in just a few minutes, then Do it your way.

A great starting point for your MannKind research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If MannKind has sparked fresh questions about your portfolio, do not stop here, use the Simply Wall St Screener to spot other opportunities that might suit your style.

- Target potential mispricings by scanning these 872 undervalued stocks based on cash flows that may offer more value based on their current cash flow profiles.

- Ride powerful themes by checking out these 24 AI penny stocks that are tied to advances in artificial intelligence across different parts of the market.

- Boost your income focus by reviewing these 13 dividend stocks with yields > 3% that currently offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.