Please use a PC Browser to access Register-Tadawul

Assessing MannKind (MNKD) Valuation As Regulatory Catalysts And Pipeline Updates Draw Investor Attention

MannKind Corporation MNKD | 5.54 | +0.18% |

Regulatory catalysts and pipeline progress put MannKind (MNKD) in focus

MannKind (MNKD) recently outlined a series of 2026 growth drivers, centering on upcoming FDA decisions for Afrezza and FUROSCIX ReadyFlow, as well as updates across several clinical and preclinical respiratory programs.

The recent update on Afrezza, FUROSCIX ReadyFlow and the broader respiratory pipeline comes as MannKind’s share price sits at US$6.01, with a 90 day share price return of 23.16% but a 1 year total shareholder return decline of 2.59%, suggesting near term momentum has picked up even as longer term results have been more muted.

If this kind of pipeline driven story interests you, it could be a good time to scan other healthcare stocks that are adding new treatments and indications to their portfolios.

With MannKind trading at US$6.01 and indicators such as analyst targets and intrinsic value models suggesting a possible discount, investors now face a key question: is there still a buying opportunity here, or has the market already priced in future growth?

Most Popular Narrative: 37.5% Undervalued

The most followed narrative sees MannKind’s fair value at US$9.61 per share versus the last close of US$6.01, framing a sizeable gap that hinges on execution in diabetes and lung disease franchises.

Afrezza's continued double-digit prescription growth, international expansion efforts, upcoming pediatric indication launch, and a broadened salesforce footprint are set to accelerate market penetration amid a rising global diabetes burden and an aging population, directly supporting revenue and earnings growth.

Curious how this thesis gets to that higher value? The narrative leans heavily on faster revenue growth, wider margins, and a rich future earnings multiple. The full breakdown shows exactly how those moving parts are stitched together into today’s fair value number.

Result: Fair Value of $9.61 (UNDERVALUED)

However, this thesis still hinges on broader Afrezza adoption and a relatively concentrated portfolio, where any clinical or regulatory setback could quickly challenge that upside case.

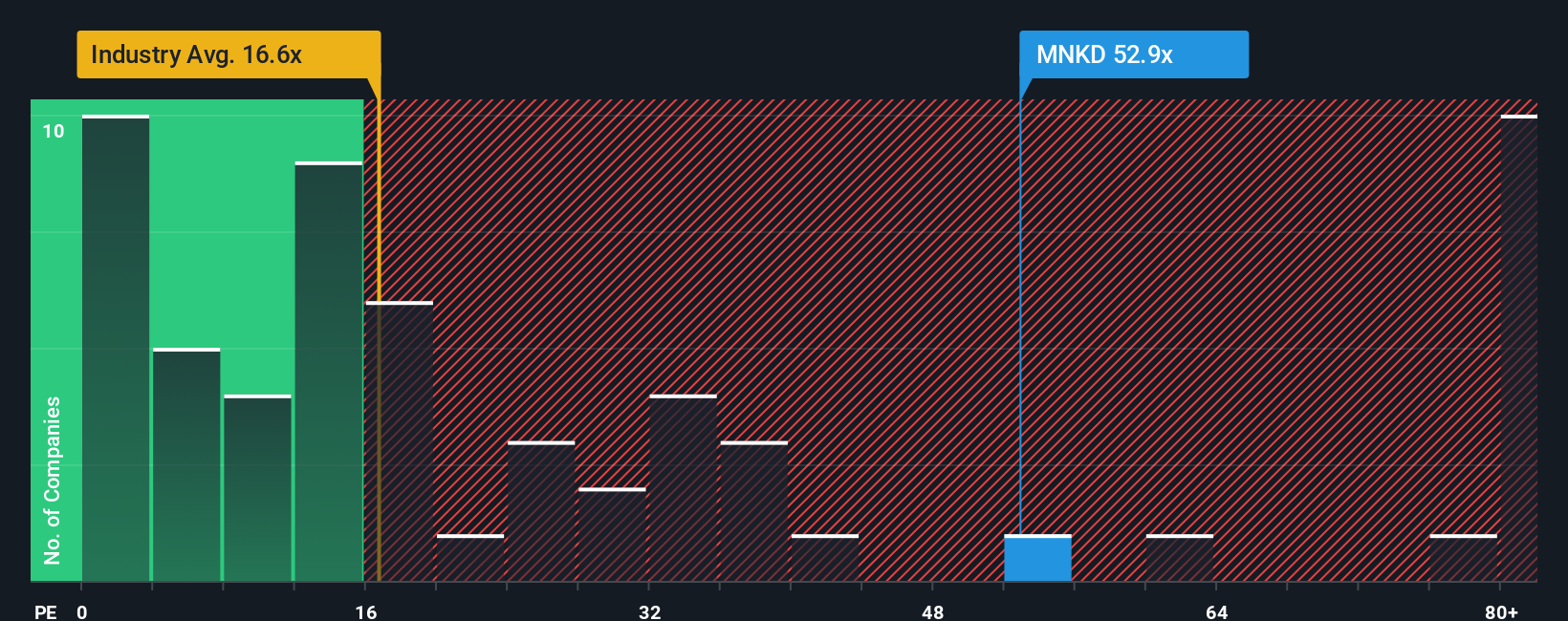

Another View: High P/E Puts The Market’s Caution On Display

Our model-based fair value of US$23.02 suggests MannKind looks very cheap at US$6.01. However, the current P/E of 63.1x is high versus the US Biotechs industry at 22x and a fair ratio of 25x. This points to real valuation risk if sentiment cools.

Build Your Own MannKind Narrative

If you see the numbers differently or prefer to stress test the assumptions yourself, you can use the same data to build a custom view in minutes: Do it your way.

A great starting point for your MannKind research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If MannKind has caught your attention, do not stop here. Use the same tools to uncover other opportunities that could suit your style and watchlist.

- Spot potential value opportunities early by scanning these 881 undervalued stocks based on cash flows, which may be trading below what their cash flows imply.

- Tap into long term themes by checking out these 28 AI penny stocks positioned around artificial intelligence demand.

- Strengthen your income focus by reviewing these 11 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.