Please use a PC Browser to access Register-Tadawul

Assessing Medical Properties Trust (MPT) Valuation As Mixed Returns Follow Recent Share Price Moves

Medical Properties Trust, Inc. MPT | 5.66 | -5.98% |

Medical Properties Trust (MPT) continues to attract attention as investors weigh its recent share performance against underlying fundamentals, including US$1,009.16m in revenue and a net loss of US$707.946m, alongside mixed total return figures across different timeframes.

Recent trading reflects this mixed picture, with a 1 day share price return of 2.16% decline contrasted with a 30 day share price return of 4.62% and a 1 year total shareholder return of 17.34%. However, longer term total shareholder returns over 3 and 5 years remain deeply negative, suggesting any positive momentum is still rebuilding from a low base.

If this has you thinking about where else capital could work harder, it may be worth broadening your search and checking out our list of 23 top founder-led companies.

With Medical Properties Trust trading around US$5.44, an intrinsic discount of about 27%, mixed returns, and a US$707.946m net loss, investors may need to consider whether this is a potential recovery opportunity or if the market has already priced in future growth.

Most Popular Narrative: 5.3% Overvalued

The most followed narrative puts Medical Properties Trust's fair value at $5.17, slightly below the last close of $5.44, suggesting only a small gap between price and model.

The analysts have a consensus price target of $4.857 for Medical Properties Trust based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $4.0.

Want to see what is baked into that fair value? Revenue climbing steadily, margins flipping from deep red to solidly positive, and a future earnings multiple that assumes real progress. Curious how all of that fits together in one story?

Result: Fair Value of $5.17 (OVERVALUED)

However, there are still meaningful risks, including tenant concentration around previously distressed operators and higher refinancing costs that could pressure cash flows if conditions do not improve.

Another View: Multiples Tell a Different Story

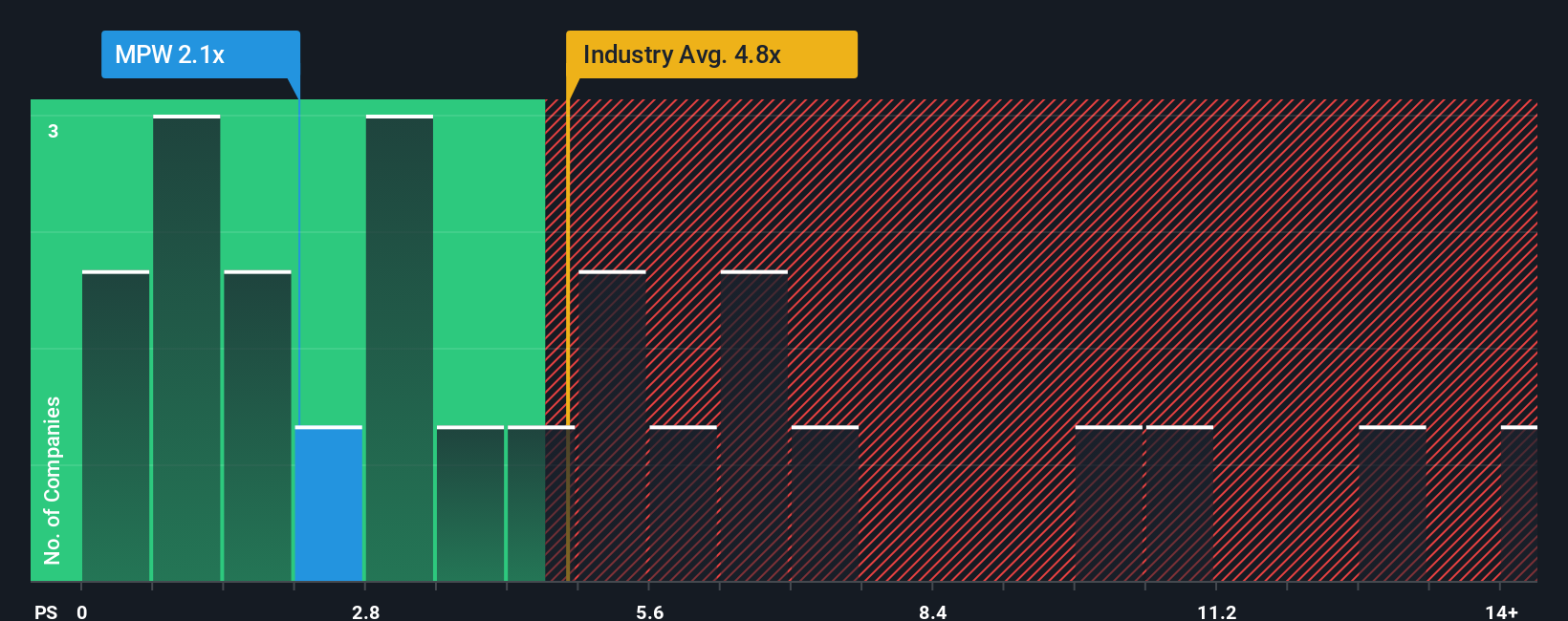

While the narrative model suggests Medical Properties Trust looks 5.3% overvalued around $5.17 per share, the current P/S ratio of 3.2x looks cheaper than both peers at 8x and a fair ratio of 5.8x. If the market ever moves closer to that fair ratio, what would that mean for today’s price?

Build Your Own Medical Properties Trust Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to test your own view against the data, you can build a tailored thesis for Medical Properties Trust in just a few minutes, starting with Do it your way.

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about shaping a stronger portfolio, do not stop at one stock. Use the screener to spot new ideas before everyone else catches on.

- Target potential value by scanning companies our tool flags as 54 high quality undervalued stocks with solid fundamentals already laid out for you.

- Strengthen your portfolio core by focusing on businesses in the solid balance sheet and fundamentals stocks screener (44 results) that can better support their operations through different conditions.

- Hunt for future standouts using our screener containing 24 high quality undiscovered gems that highlight smaller names with quality metrics many investors may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.