Please use a PC Browser to access Register-Tadawul

Assessing Medical Properties Trust’s Valuation After Major California Expansion and Seismic Investment Commitments

Medical Properties Trust, Inc. MPW | 4.92 | -2.48% |

Most Popular Narrative: 5.6% Overvalued

According to the most widely followed narrative, Medical Properties Trust is currently trading at a premium to its estimated fair value. The consensus among analysts now sees the stock as around 5.6% overvalued based on long-term earnings and margin prospects, discounted at a rate of 12.32%.

Strategic international expansion, including increased investments in the UK, Germany, and Switzerland, is enhancing portfolio diversification. This reduces geographic concentration risk and provides exposure to higher-growth healthcare markets, which may positively impact long-term net margins and earnings consistency.

A major global pivot with big ambitions is underway. But what kind of future revenue growth and margin improvement do analysts expect to justify their estimates? The story features bold assumptions and controversial profit forecasts. Want to see the projections that underpin this attention-grabbing valuation? Find out what is driving the debate over the next move for Medical Properties Trust.

Result: Fair Value of $4.86 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering tenant concentration and unresolved asset impairments could challenge the bullish case and create renewed uncertainty in Medical Properties Trust’s outlook.

Find out about the key risks to this Medical Properties Trust narrative.Another View: SWS DCF Model Suggests Undervalued

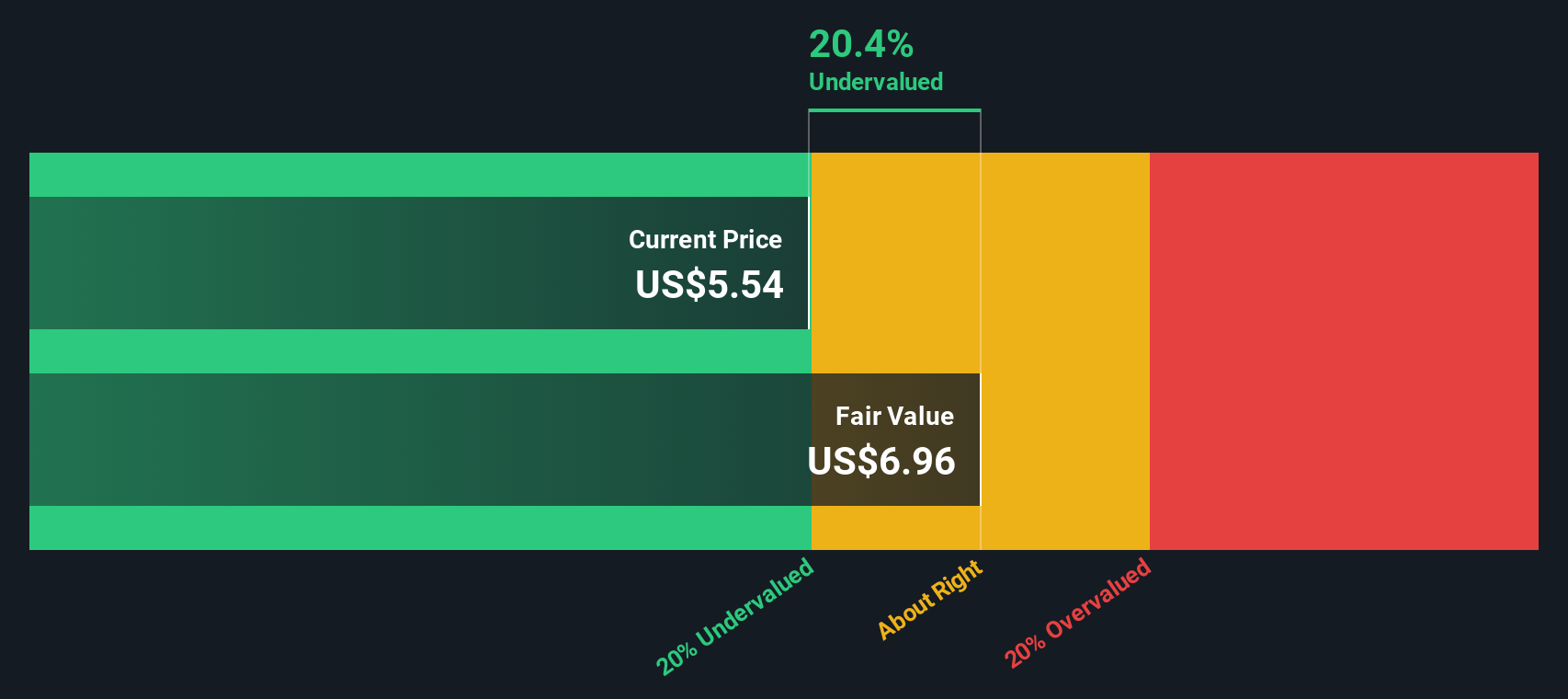

While analyst estimates based on future earnings and margins see Medical Properties Trust as overvalued, our DCF model tells a very different story. It indicates the stock actually trades below its intrinsic value. Which perspective will the market ultimately trust?

Build Your Own Medical Properties Trust Narrative

If you see things differently or want to draw your own conclusions, you can personalize the analysis and build your version of the story in just a few minutes. Do it your way

A great starting point for your Medical Properties Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing toolkit and spark your next strategy by using our powerful screeners. You’ll uncover opportunities you might miss if you stick to the usual stocks.

- Tap into promising tech by checking out quantum computing stocks. Get ahead of breakthroughs in futuristic computing.

- Strengthen your portfolio with steady income streams through dividend stocks with yields > 3%. This screener focuses on companies that prioritize rewarding shareholders.

- Unlock hidden bargains and spot potential winners with undervalued stocks based on cash flows. It is designed to zero in on attractive valuations that may be overlooked by the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.