Please use a PC Browser to access Register-Tadawul

Assessing Moelis (MC) Valuation: Is the Current Share Price an Opportunity for Investors?

Moelis & Co. Class A MC | 69.37 | -0.06% |

Moelis’s share price has mostly drifted sideways after a strong start to the year. Momentum is now fading as investor sentiment cools. Despite this, the company’s 1-year total shareholder return of 7.76% shows its long-term track record remains intact.

If you’re looking for fresh investment ideas beyond the usual names, now is a great time to broaden your search and discover fast growing stocks with high insider ownership.

With mixed recent returns but solid revenue and net income growth, the question remains: is Moelis currently trading at an attractive discount, or is the market already anticipating stronger results ahead?

Most Popular Narrative: 14% Undervalued

With Moelis’s fair value pegged at $80 according to the most popular narrative, and a last close price of $68.83, the shares appear attractively priced as optimistic growth forecasts shape analyst expectations.

*The accelerated expansion and investment into the private capital advisory (PCA) business, including aggressive hiring of industry-leading talent and focus on secondary and primary capital solutions for sponsors, positions Moelis to capture significant incremental deal flow as global private markets and sponsor-driven transactions proliferate. This may drive higher revenues and improved earnings visibility.*

Curious what blockbuster forecasts could justify that gap? The narrative hints at an ambitious earnings surge, standout margin improvements, and an industry-defying profit multiple. Want to see the bold assumptions propelling this price target? Dive in now to discover the growth math behind the story.

Result: Fair Value of $80 (UNDERVALUED)

However, persistent competition and the high cost of attracting top talent could squeeze margins and challenge the optimistic outlook for Moelis’s future growth.

Another View: The Multiples Approach

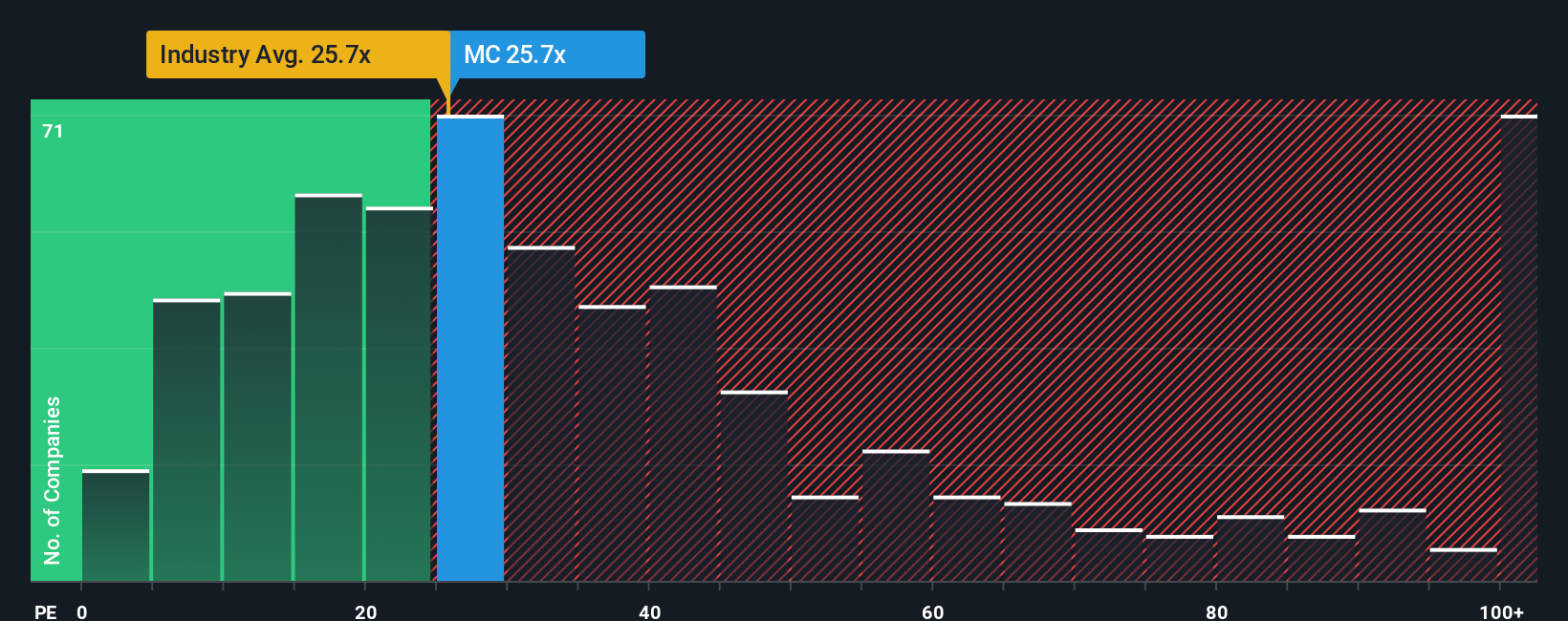

Looking at Moelis through the lens of its price-to-earnings ratio, the picture changes. The company trades at 25.8x earnings, which is higher than its peer average of 23.2x and well above a fair ratio of 18.6x. This suggests an element of valuation risk, as the market may be pricing in quite a bit of optimism already. But does this premium truly reflect Moelis’s longer-term earnings power, or is it a red flag for value seekers?

Build Your Own Moelis Narrative

If you see things differently or want to dig into the numbers yourself, crafting your own narrative takes just a few minutes. Do it your way.

A great starting point for your Moelis research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the potential for smarter investing now. Expand your horizons beyond Moelis and set yourself up for the next big opportunity with these expert-curated ideas.

- Tap into long-term growth by checking out these 909 undervalued stocks based on cash flows and spot companies trading below intrinsic value before the rest of the market catches on.

- Fuel your portfolio with innovation by seeing which pioneers are reshaping medicine in these 31 healthcare AI stocks and get ahead in the healthcare AI revolution.

- Supercharge your income strategy with these 19 dividend stocks with yields > 3% and find businesses offering consistently high dividend yields for steady cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.