Please use a PC Browser to access Register-Tadawul

Assessing NiSource (NI) Valuation After Analyst Downgrade Cites Indiana Regulatory Risks

NiSource Inc. NI | 41.41 41.41 | -0.67% 0.00% Pre |

Most Popular Narrative: 7% Undervalued

According to the most widely followed valuation narrative, NiSource is trading at a discount to its estimated fair value. Based on analysts' models, the current share price offers roughly 7% upside from today's levels.

Major gas and electric infrastructure modernization initiatives, including AI-driven operational efficiency programs and digital asset management, are reducing operating costs and leak risk. These measures could expand net margins over time.

Craving the real story behind NiSource’s potential? The narrative’s fair value relies on bold growth forecasts, margin gains, and an earnings multiple that would turn heads in any utility market. Want to know the blueprint fueling that bullish target? Explore the details and see which financial levers could reshape how investors view NiSource’s upside.

Result: Fair Value of $43.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower-than-expected regulatory approvals and a long-term shift away from natural gas could present challenges to the bullish outlook for NiSource’s growth prospects.

Find out about the key risks to this NiSource narrative.Another View: What Do Different Models Say?

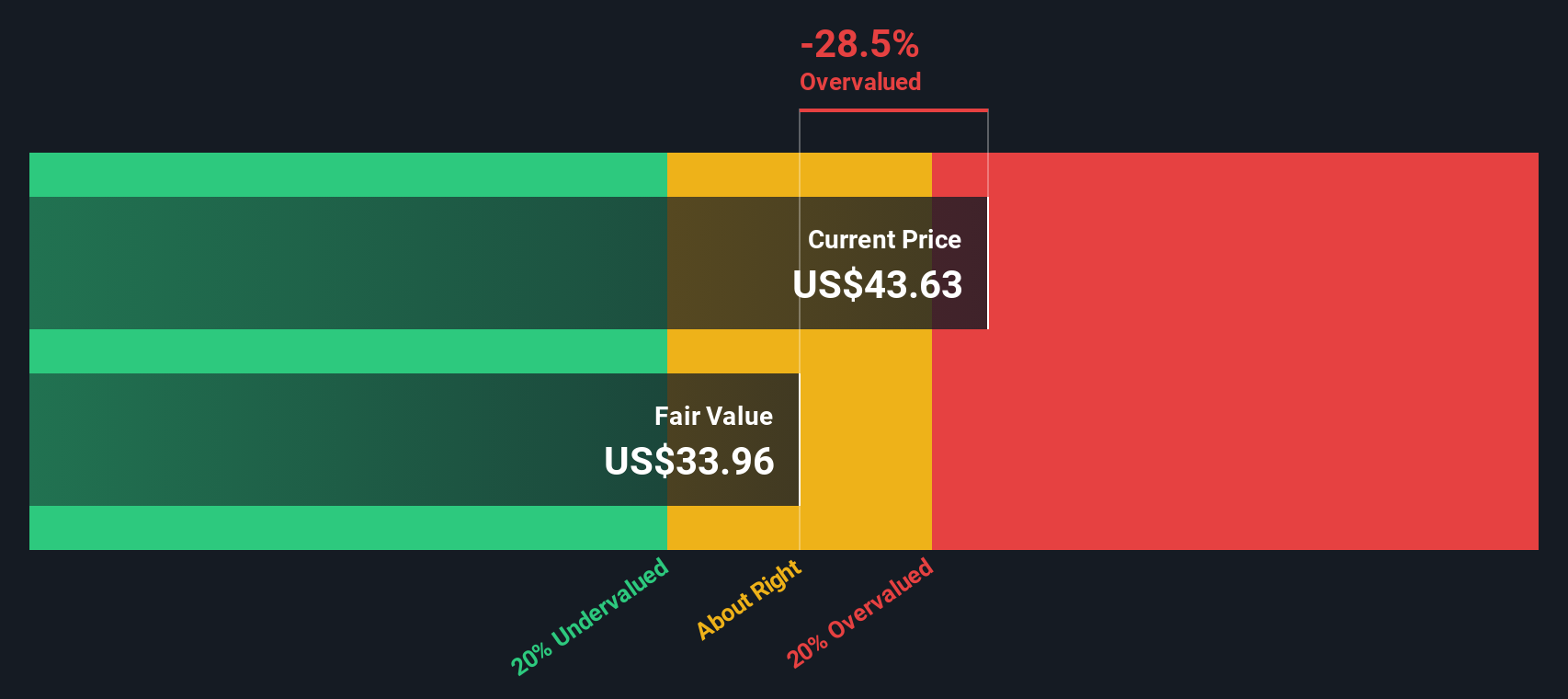

While the analyst consensus sees upside, our DCF model tells a different story. It suggests NiSource is trading above its estimated fair value based on projected future cash flows. Does the market see something the models do not?

Build Your Own NiSource Narrative

Investors who want to challenge these assumptions or carve their own path can dive into the data and craft a personal NiSource story in just minutes. Do it your way

A great starting point for your NiSource research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Investment Ideas?

Level up your investing game by seizing fresh opportunities others might miss. The Simply Wall Street Screener highlights stocks across dynamic themes, waiting for focused investors like you.

- Boost your income with reliable yields and see which companies offer dividend stocks with yields > 3% that outperform the market average.

- Catch the next disruption in technology by tracking businesses at the forefront of artificial intelligence, using our smart picks for AI penny stocks.

- Spot undervalued gems trading below their potential, and get ahead of the crowd in our exclusive list of undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.