Please use a PC Browser to access Register-Tadawul

Assessing Okta (OKTA) Valuation After Analyst Endorsement Highlights AI Security Growth Potential

Okta, Inc. Class A OKTA | 90.76 | -0.77% |

Okta (OKTA) is back in focus after an analyst described the identity security provider as a contrarian value play, citing its valuation discount, expanding product set, and role in AI-driven security.

The recent buyback authorization and upcoming conference appearance add extra context to Okta’s recent 7 day share price return of 4.11% and year to date share price return of 12.47%. The 1 year total shareholder return of 13.24% contrasts with a 5 year total shareholder return decline of 63.94%, which indicates that shorter term momentum has picked up even as longer term holders are still facing losses.

If identity security and AI have your attention, it could be a useful moment to broaden your watchlist with high growth tech and AI stocks.

With the stock trading at a discount to analyst targets and an authorized US$1b buyback in place, the key question now is whether Okta is genuinely undervalued or whether the market is already pricing in future growth.

Most Popular Narrative: 16.8% Undervalued

Compared to Okta’s last close at US$94.07, the most followed narrative sees fair value at US$113.02, which frames the recent share price move in a different light.

The proliferation of AI agents and nonhuman identities is creating new, urgent security use cases that require sophisticated identity governance, privileged access management, and policy controls in areas where Okta is innovating (Cross App Access, Auth0 for AI Agents, Axiom acquisition), opening incremental growth avenues and potential margin expansion through higher value and differentiated products.

Curious how a mid single digit revenue growth view, a higher profit margin profile, and a rich future earnings multiple combine to support that valuation? The full narrative lays out the exact growth, profitability, and discount rate assumptions that need to line up for Okta to reach that implied fair value.

Result: Fair Value of $113.02 (UNDERVALUED)

However, this upbeat story can crack if larger suite vendors squeeze Okta’s pricing power or if RPO growth undershoots expectations and investors reassess its earnings path.

Another View: Earnings Multiple Sends A Different Signal

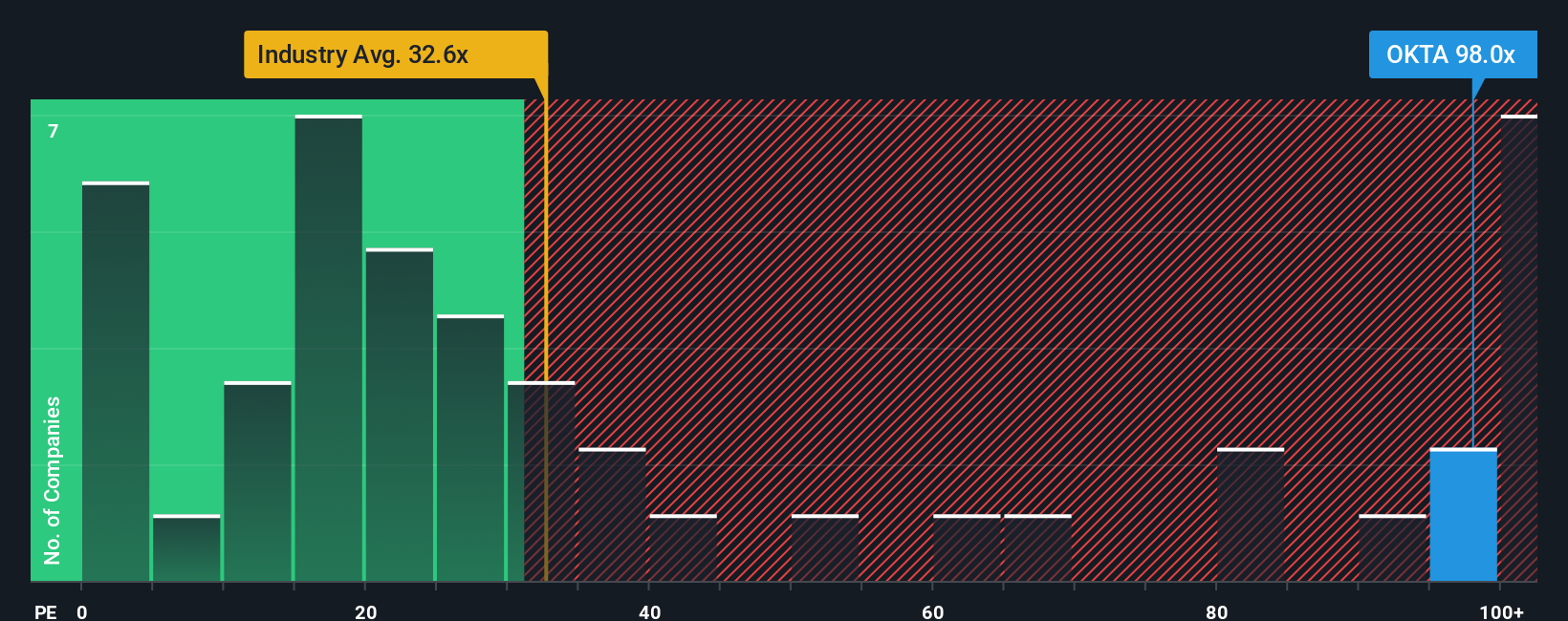

While our DCF model points to Okta trading about 22.5% below an estimated fair value of US$121.42, the P/E ratio tells a tougher story. At 85.5x compared with 28.8x for the US IT industry and 30.5x for peers, and a fair ratio of 35.9x, the current pricing leaves less room for disappointment if growth or margins fall short. Which signal do you trust more right now?

Build Your Own Okta Narrative

If you look at the numbers and reach a different conclusion, or just prefer to test your own assumptions, you can build a custom narrative in a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Okta.

Looking for more investment ideas?

If Okta is on your radar, do not stop there. The market is full of other potential opportunities worth your attention right now.

- Spot early movers by checking out these 3533 penny stocks with strong financials that already show stronger balance sheets and fundamentals than many expect at this size.

- Target the next wave of automation by tracking these 25 AI penny stocks that are building businesses around AI driven products and services.

- Focus on price and cash flow discipline with these 886 undervalued stocks based on cash flows that line up with discounted cash flow signals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.