Please use a PC Browser to access Register-Tadawul

Assessing Patria Investments (PAX) Valuation After Recent Share Price Weakness

Patria Investments Ltd. Class A PAX | 14.00 | +1.08% |

Event context and recent return profile

Patria Investments (PAX) has been drawing attention after a period of mixed share performance, with the stock showing a 1 day return of about a 2% decline and a 7 day move of roughly a 9% decline.

Over the past month the stock has returned about a 16% decline, while the past 3 months show roughly a 7% decline, set against a 1 year total return of about 25% and a 3 year total return near 8%.

At a share price of $13.99, Patria Investments has seen short term share price pressure with its 1 month share price return of about a 16% decline, even as the 1 year total shareholder return of roughly 25% points to a stronger longer term picture. This suggests recent moves may reflect shifting expectations around growth prospects or risk rather than a simple reversal of the broader trend.

If Patria’s recent volatility has you reassessing your options, it could be a good moment to broaden your search and uncover fast growing stocks with high insider ownership.

So with Patria trading at $13.99 and carrying a value score of 1, the real question is whether the recent weakness leaves shares undervalued or if the market is already accounting for future growth.

Most Popular Narrative: 18.4% Undervalued

At a last close of $13.99, the most followed narrative sees fair value at about $17.14, framing the recent share price weakness in a different light.

The company's ongoing expansion into new strategies, products, and geographies (including recent acquisitive moves in Brazilian and Mexican real estate and GPMS European platforms) further diversifies fee revenues and enhances operating leverage, thus supporting higher sustainable margins and earnings compounding as scale advantages take hold.

Curious how a higher growth path, fatter margins, and a lower future P/E still produce that premium fair value? The narrative spells out the math behind it. Short forecasts, long horizon, tight assumptions. If you want to see which numbers really carry this story, the full narrative lays them out in black and white.

Result: Fair Value of $17.14 (UNDERVALUED)

However, this hinges on key assumptions, and fee compression or setbacks in higher risk Latin American markets could quickly challenge the current fair value narrative.

Another view on valuation

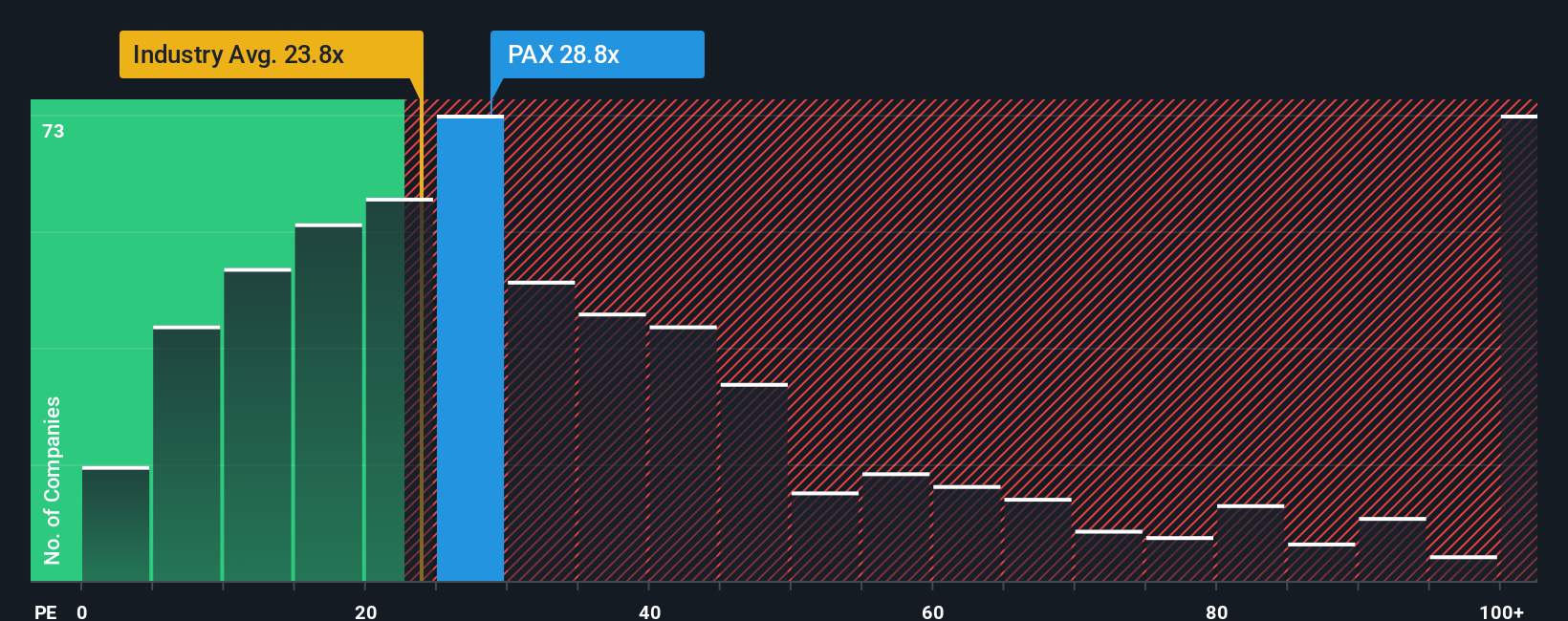

The most popular narrative sees Patria as about 18% undervalued, yet the current P/E of 26.1x is higher than the US Capital Markets industry at 22.5x, the peer average at 14.4x, and the fair ratio of 16.6x. This points to a valuation that already bakes in a lot of optimism. Where do you land on that trade off between growth potential and valuation risk?

Build Your Own Patria Investments Narrative

If this perspective does not match your view of Patria, you can test the assumptions yourself and shape your own story in minutes, Do it your way.

A great starting point for your Patria Investments research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If Patria has your attention, do not stop there. A few focused screeners can quickly surface other opportunities that match the kind of profile you care about.

- Target long term compounding potential by checking out these 868 undervalued stocks based on cash flows that align with your preferred balance of quality, price, and future cash flow expectations.

- Spot the next wave of automation and productivity gains by scanning these 27 AI penny stocks that could benefit from wider adoption of artificial intelligence across multiple sectors.

- Position yourself for income-focused returns by reviewing these 11 dividend stocks with yields > 3% that may suit a portfolio built around regular cash payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.