Please use a PC Browser to access Register-Tadawul

Assessing Patria Investments (PAX) Valuation As Fundraising Guidance Rises And Long Term Returns Gain Momentum

Patria Investments Ltd. Class A PAX | 14.00 | +1.08% |

Why investor interest in Patria Investments is picking up now

Investor attention around Patria Investments (PAX) has picked up as the firm repeatedly increases its annual fundraising guidance and reports growing capital inflows across private equity, infrastructure, and credit strategies.

This backdrop, paired with stronger long term shareholder returns relative to recent month and past 3 months performance, is prompting some investors to take a closer look at how the current share price lines up with the company’s fundamentals.

Despite a 4.55% 1 day share price decline and a 6.03% 7 day share price pullback to US$16.37, Patria’s 30 day and 90 day share price returns of 1.36% and 9.64%, together with a 1 year total shareholder return of 42.83%, suggest momentum has been building over the longer term.

If Patria’s fundraising story has your attention, this can be a useful moment to broaden your search with fast growing stocks with high insider ownership.

With the shares at US$16.37, roughly 4.7% below the US$17.14 analyst target and trading at what looks like a premium to some intrinsic value estimates, you have to ask: is there still upside here, or is the market already pricing in future growth?

Most Popular Narrative: 4.5% Undervalued

With Patria Investments last closing at $16.37 against a narrative fair value of about $17.14, the widely followed storyline sees modest upside still on the table.

The accelerating global shift of institutional capital towards alternative assets, particularly private equity, infrastructure, and credit, is directly driving robust organic fundraising growth, reflected in Patria's repeated upward revision to annual fundraising guidance and rate of net new fee-earning AUM inflows; this underpins long-term revenue and earnings expansion.

Curious what revenue build, margin profile, and future P/E multiple have to look like for that fair value to add up? The narrative leans on compound growth, rising profitability, and a premium earnings multiple that together have to line up cleanly for $17.14 to make sense.

Result: Fair Value of $17.14 (UNDERVALUED)

However, this hinges on fundraising staying resilient, and any fee compression or bumps from acquisitions and Latin American exposure could quickly challenge that upside case.

Another View: Richer Price Tag on Earnings

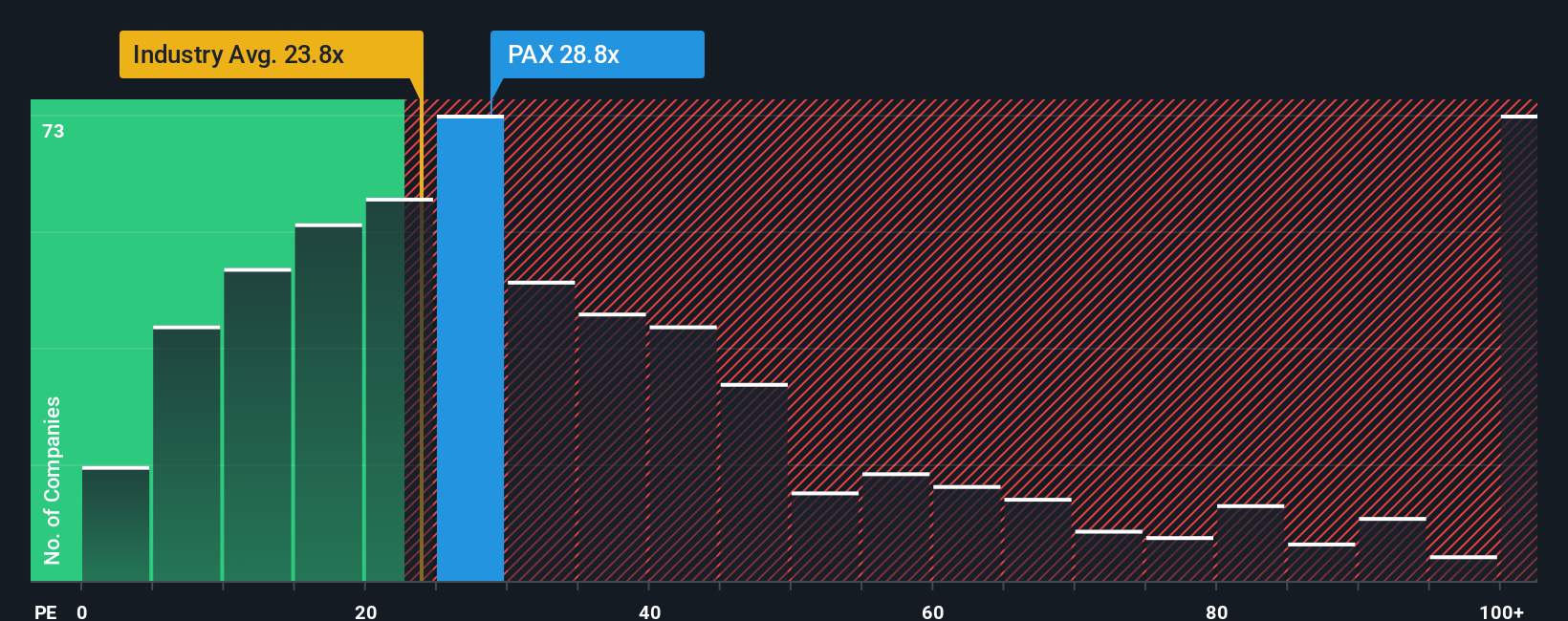

Our DCF model is not the only one flashing caution. On earnings, Patria trades on a P/E of 24.5x, slightly below the US Capital Markets average of 24.8x, yet well above its own fair ratio of 15.9x. That gap points to valuation risk if sentiment or growth expectations cool.

Build Your Own Patria Investments Narrative

If you see the numbers differently or prefer to build your own view from the ground up, you can pull the data together and design a fresh narrative in just a few minutes with Do it your way.

A great starting point for your Patria Investments research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Patria has sparked your interest, do not stop there. Broaden your watchlist with fresh ideas so you are not leaving other potential opportunities on the table.

- Spot early movers in smaller companies by scanning these 3515 penny stocks with strong financials that pair low share prices with stronger balance sheets and improving fundamentals.

- Tap into fast changing technology trends by checking out these 23 AI penny stocks focused on companies using artificial intelligence to reshape their core products and services.

- Hunt for price tags that look more modest relative to cash flows by reviewing these 888 undervalued stocks based on cash flows and seeing which businesses the model currently flags.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.