Please use a PC Browser to access Register-Tadawul

Assessing PDF Solutions (PDFS) Valuation After Fresh Analyst Interest In Semiconductor Analytics

PDF Solutions, Inc. PDFS | 32.43 | -0.03% |

Recent analyst coverage of PDF Solutions (PDFS) has drawn fresh attention to the stock as investors weigh the company’s role in semiconductor manufacturing analytics and its focus on process optimization and yield management across advanced production environments.

The recent analyst attention comes after a choppy few weeks for PDF Solutions, with a 1-day share price return of a 5.12% decline, a 7-day share price return of 6.59%, and a 90-day share price return of 21.16%, while the 1-year total shareholder return of 7.34% points to momentum that has been building more gradually over time.

If this kind of semiconductor data story interests you, it can be useful to widen the lens and see which other chip and AI names stand out through high growth tech and AI stocks.

Analysts see upside to their US$34.75 price target and the business is growing, yet shares still trade around US$30.41 and the company reports a net loss. Is this a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 12.5% Undervalued

With fair value set at US$34.75 against a last close of US$30.41, the most followed narrative frames PDF Solutions as priced below its estimated worth and builds that view around growth, margins, and recurring software economics.

Cross-selling opportunities stemming from recent product integrations (e.g., combining secureWISE and DEX for secure, real-time data collaboration) and partnerships with industry leaders (SAP, Advantest, Intel) are expanding PDF's addressable market and setting a foundation for long-term recurring revenue growth.

Curious what kind of revenue ramp, margin profile, and future earnings multiple are baked into that US$34.75 figure? The narrative leans on fast improving profitability, rising recurring revenue, and a premium P/E assumption that sits above the broader US semiconductor peer group. Want to see exactly how those ingredients are combined to reach that fair value?

Result: Fair Value of $34.75 (UNDERVALUED)

However, this story still faces real pressure points, including heavy R&D and capex that could squeeze margins if demand softens, as well as meaningful customer concentration risk.

Another Angle On Value

So far, the US$34.75 fair value comes from a detailed earnings and cash flow driven view. If you look instead at the price tag investors are paying for each dollar of sales, the picture is a bit more cautious.

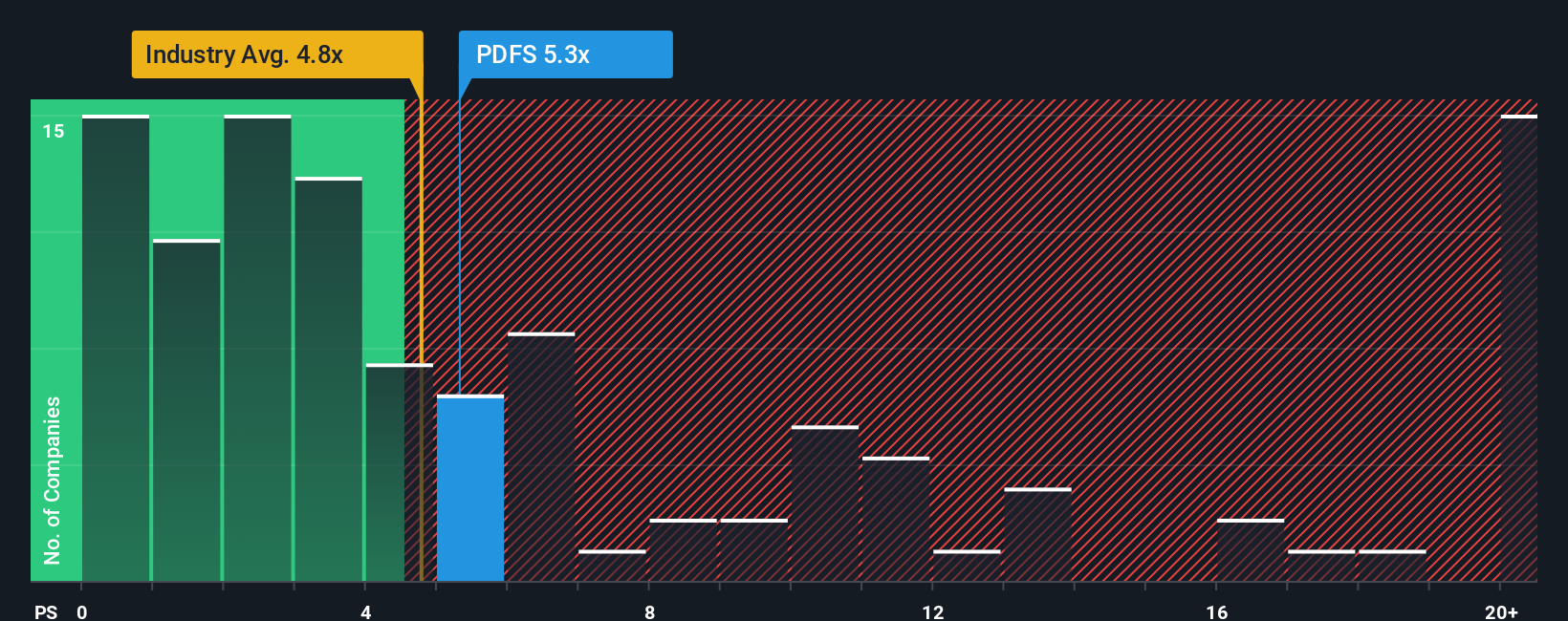

PDF Solutions trades on a P/S of 5.8x, which is richer than both the US semiconductor industry average of 5.2x and its peer average of 5.2x. Yet that same 5.8x sits below the fair ratio estimate of 6.3x, suggesting the market could move either toward peers on the downside or toward the fair ratio on the upside.

In simple terms, you are paying a premium to the group today, but not an extreme one relative to what the fair ratio implies. Does that premium feel like justified quality, or a thinner margin of safety than the cash flow story implies?

Build Your Own PDF Solutions Narrative

If you see the data differently or want to stress test these assumptions yourself, you can build your own view in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding PDF Solutions.

Looking for more investment ideas?

If PDF Solutions caught your eye, do not stop here. The market is full of other opportunities that could fit your goals just as well.

- Hunt for potential high-upside small caps by scanning these 3543 penny stocks with strong financials that pair low share prices with solid financial underpinnings.

- Zero in on companies involved in automation by checking out these 29 healthcare AI stocks leading data driven work in medical diagnostics and treatment support.

- Look for value focused ideas by reviewing these 879 undervalued stocks based on cash flows where prices sit below levels suggested by their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.