Please use a PC Browser to access Register-Tadawul

Assessing Portland General Electric (POR) Valuation After Fresh Analyst Target Upgrades

Portland General Electric Company POR | 52.44 | +0.67% |

Recent analyst actions have put Portland General Electric (POR) in focus, as BTIG reiterated its buy rating alongside a higher price target, while Wells Fargo also lifted its target ahead of the company’s FY 2025 results and growth update.

At a share price of $50.25, Portland General Electric has seen a 10.0% 90 day share price return and a 28.09% 1 year total shareholder return, suggesting that recent analyst updates and upcoming FY 2025 results may be contributing to growing momentum.

If this kind of steady move in utilities has your attention, it could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Portland General Electric trading near recent analyst targets and showing an 8.17% intrinsic discount, the key question for you is whether that gap hints at a buying opportunity or whether the market is already pricing in future growth.

Most Popular Narrative: 1% Overvalued

The most followed narrative pegs Portland General Electric’s fair value at about $49.67, slightly below the $50.25 last close, which keeps expectations finely balanced.

The analysts have a consensus price target of $46.364 for Portland General Electric based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $58.0, and the most bearish reporting a price target of just $40.0.

Curious what has to happen in revenues, margins and future earnings multiples for that fair value to hold up? The narrative leans on detailed forecasts, tight discounting assumptions and a specific path for profitability that you might want to pressure test for yourself.

Result: Fair Value of $49.67 (OVERVALUED)

However, that fair value story can unravel quickly if Oregon regulatory decisions limit cost recovery or if the groundwater lawsuit leads to higher expenses and reputational pressure.

Another View: Market Ratios Tell a Different Story

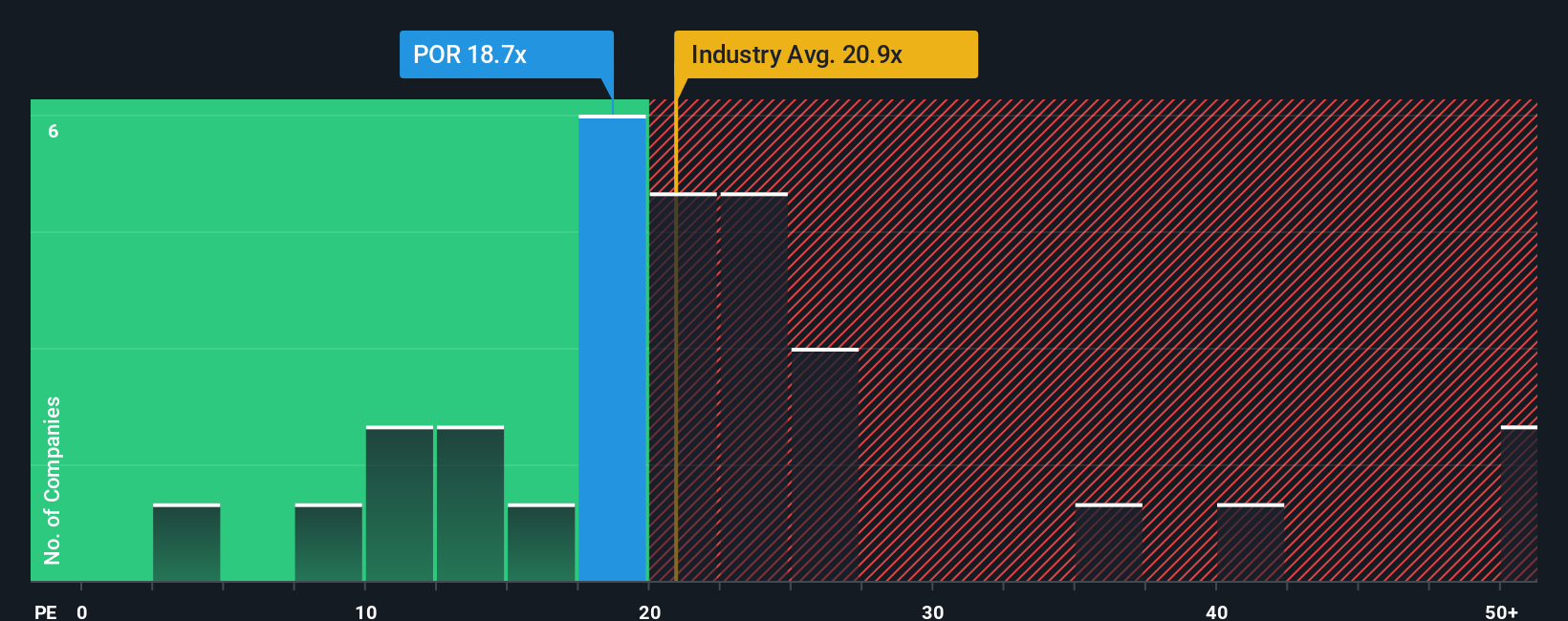

While our fair value model flags Portland General Electric as 1% overvalued at $49.67 versus the $50.25 share price, the current P/E of 18.7x looks cheaper than both the peer average of 23.9x and a fair ratio of 20.3x, which points to good value. Which signal do you trust more right now?

Build Your Own Portland General Electric Narrative

If you are not fully on board with this view or you prefer to weigh the numbers yourself, you can build your own story in just a few minutes, starting with Do it your way.

A great starting point for your Portland General Electric research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

If Portland General Electric has sharpened your thinking, do not stop here. Use the Simply Wall St Screener to spot other opportunities that match your style.

- Target income potential and shortlist companies offering steady cash returns through these 14 dividend stocks with yields > 3% that might fit a yield focused portfolio.

- Tap into long term growth themes by scanning these 25 AI penny stocks that are tied to the rise of artificial intelligence across sectors.

- Hunt for value by filtering these 868 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.