Please use a PC Browser to access Register-Tadawul

Assessing Revvity (RVTY) Valuation After New SLAS2026 Lab Automation Launches

Revvity, Inc. RVTY | 100.33 | +0.42% |

What the SLAS2026 product launches mean for Revvity stock

Revvity (RVTY) just used the SLAS2026 conference to roll out several new tools for high throughput drug discovery, including a high content screening system, a multimode plate reader, and an automated liquid handling workstation.

For you as an investor, the focus is not the trade show itself, but what these launches say about how Revvity is trying to compete in automated, data heavy lab workflows that many pharma and biotech customers rely on.

Those product launches land just days after Revvity reported full year 2025 results and issued 2026 revenue guidance. The stock is now at US$99.52 and showing a 9.63% 90 day share price return but a 16.25% 1 year total shareholder return decline, which points to some recent momentum after a weaker longer term experience for shareholders.

If SLAS2026 has you looking more broadly at laboratory automation and related themes, it could be worth scanning our list of 28 robotics and automation stocks as another way to source ideas in this space.

With the stock at US$99.52, recent product news, mixed shareholder returns, and analyst targets that sit higher, you have to ask: is Revvity still undervalued here, or is the market already pricing in future growth?

Most Popular Narrative: 13.2% Undervalued

Revvity’s most followed narrative pegs fair value at about US$114.63 versus the current US$99.52, framing the SLAS2026 launches within a broader profitability and cash return story.

Ongoing shift in product mix toward higher margin, software enabled and consumables driven offerings (e.g., SaaS Signals, reagents, new IDS i20 platform), along with structural cost actions, are expected to materially expand operating and net margins, with 2026 set to start at a higher 28% operating margin baseline.

Curious what kind of revenue pace, margin reset, and share count change sit behind that fair value gap, and how tightly those numbers are connected? The full narrative lays out the earnings bridge and valuation math in a way that a simple P/E snapshot cannot.

Result: Fair Value of $114.63 (UNDERVALUED)

However, there are still pressure points, including China reimbursement changes and weaker academic or government budgets, that could challenge the margin reset and EPS path analysts are using.

Another View on Valuation

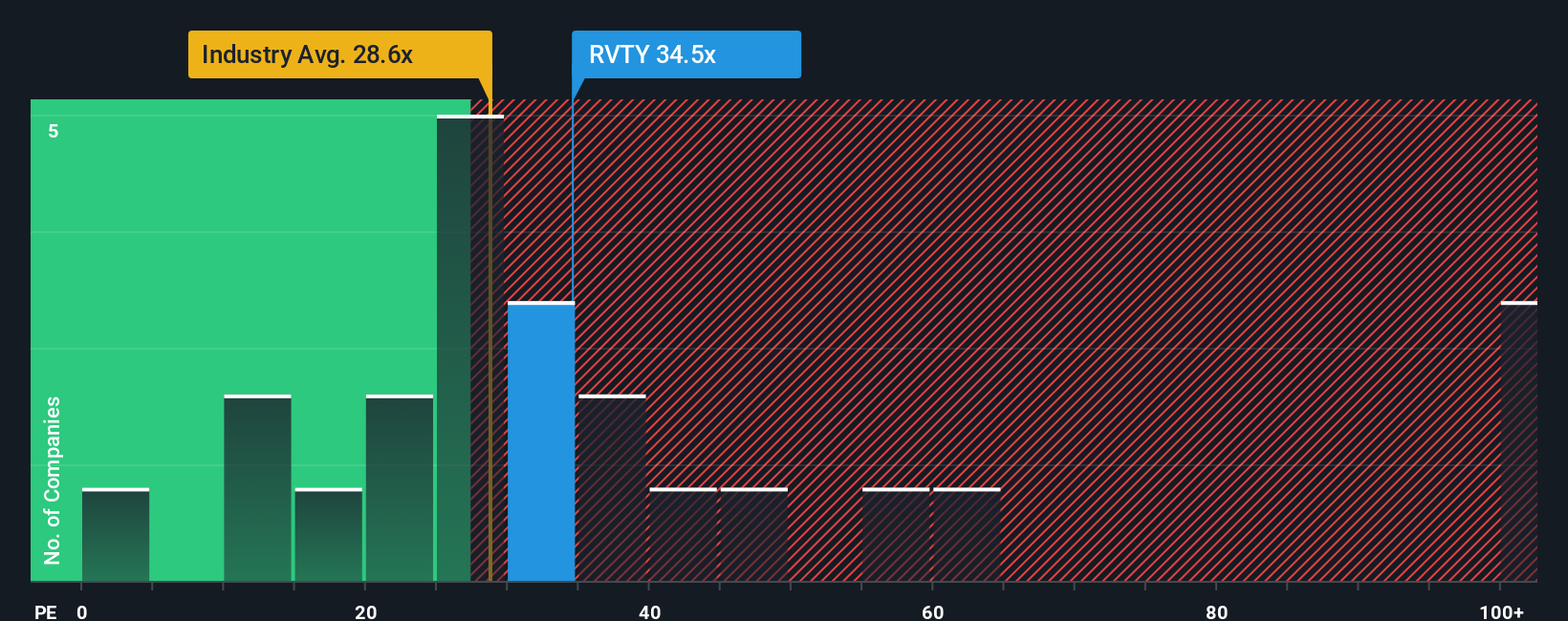

DCF and narrative work suggest Revvity is undervalued. However, the current P/E of 47x is higher than both the North American Life Sciences industry at 36.6x and the fair ratio of 25.1x, even if it screens cheaper than peers at 51.3x. Is the premium a cushion or a risk if sentiment turns?

Build Your Own Revvity Narrative

If you see the story differently or prefer to weigh the data yourself, you can build a custom view of Revvity in just a few minutes and then Do it your way.

A great starting point for your Revvity research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready to hunt for more opportunities?

If Revvity has sharpened your curiosity, do not stop here. Use the Simply Wall St screener to surface other ideas that might suit your style.

- Zero in on quality at a discount by checking our 55 high quality undervalued stocks which pairs solid fundamentals with prices that sit below their fair value estimates.

- Strengthen the income side of your portfolio by reviewing our 15 dividend fortresses which focuses on companies offering higher yielding payouts.

- Sleep a little easier by scanning our 81 resilient stocks with low risk scores which highlights businesses with more resilient risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.