Please use a PC Browser to access Register-Tadawul

Assessing Royalty Pharma (RPRX) Valuation After Dividend Increase And Raised Full Year Guidance

Royalty pharma plc RPRX | 40.86 40.86 | +1.11% 0.00% Pre |

Royalty Pharma (RPRX) has drawn fresh attention after its board approved a 6.8% increase in the quarterly dividend to US$0.235 per Class A share, along with raised full year guidance following recent results.

The dividend increase and higher full year guidance come after a period of improving momentum, with the share price at US$40.17, a 90 day share price return of 11.55% and a 1 year total shareholder return of 39.65%, suggesting sentiment has strengthened despite the recent slower quarter.

If this kind of income story interests you, it could be a good moment to scan other pharma names with strong payouts, including pharma stocks with solid dividends.

With Royalty Pharma now offering a higher dividend, firmer guidance and a 1 year total return of 39.65%, the key question is whether the current US$40.17 share price leaves upside on the table or already reflects future growth.

Most Popular Narrative: 12.6% Undervalued

Compared to the last close at US$40.17, the most followed narrative sees fair value closer to US$45.98, framing Royalty Pharma as undervalued and hinging on how its cash flows and deal pipeline evolve over time.

The company's internalization, resulting in lower operating and professional costs relative to receipts (guiding toward a 4 to 5% run rate), and aggressive share buybacks signal a structurally higher future net margin and EPS growth, as excess cash is more efficiently deployed to both accretive deals and shareholder returns.

Curious how buybacks, margin compression and future deal flow all still point to upside in this narrative? The valuation hinges on a specific growth path, shifting profitability, and a richer earnings multiple. The key is how these moving parts are expected to line up a few years from now, not where they sit today.

Result: Fair Value of $45.98 (UNDERVALUED)

However, the thesis can quickly change if the Vertex royalty dispute drags on or if rising competition in drug royalties pressures returns on new deals.

Another Angle on Valuation

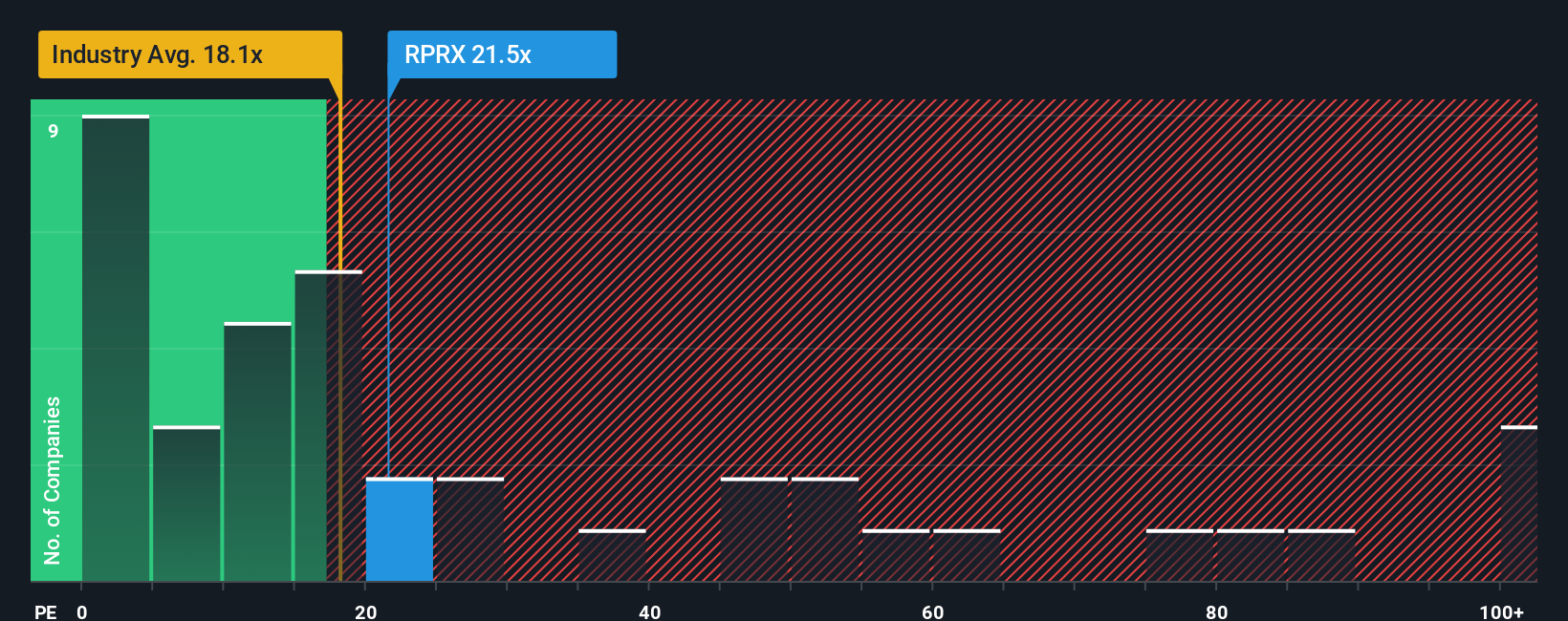

Those narrative fair values around US$45.98 point to upside, but the current P/E of 22.4x tells a slightly different story. It sits above both the US Pharmaceuticals average of 19.7x and the fair ratio of 20.2x, which hints at some valuation risk if expectations cool.

Build Your Own Royalty Pharma Narrative

If you see the numbers differently or want to stress test your own assumptions, you can build a personalized Royalty Pharma thesis in just a few minutes, starting with Do it your way.

A great starting point for your Royalty Pharma research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you are serious about building a stronger portfolio, it makes sense to keep hunting for fresh ideas that others might be missing right now.

- Spot potential value early by checking out these 3538 penny stocks with strong financials that combine lower share prices with solid underlying fundamentals.

- Tap into long term growth themes by scanning these 28 AI penny stocks shaping the future of artificial intelligence in real businesses.

- Focus on price versus cash generation by reviewing these 879 undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.