Please use a PC Browser to access Register-Tadawul

Assessing Simply Good Foods (SMPL) Valuation After Recent Share Price Rebound

Simply Good Foods Co SMPL | 20.93 | -1.04% |

What recent performance says about Simply Good Foods (SMPL)

Simply Good Foods (SMPL) has attracted attention after a recent 13.4% gain over the past month, even as the stock shows an 11.5% decline over the past 3 months and a 37.9% negative 1 year total return.

With the share price at $21.40, Simply Good Foods has seen strong short term momentum, including a 7 day share price return of 13.6%, in contrast to a 1 year total shareholder return decline of 37.9%, which hints at shifting sentiment around its growth prospects and perceived risks.

If this recent rebound has you looking beyond a single stock, it could be a good time to broaden your search and check out fast growing stocks with high insider ownership.

With Simply Good Foods trading at $21.40, a 61% discount to one intrinsic value estimate and a sizeable gap to analyst targets, you have to ask whether this is a genuine opportunity or if the market already sees limited future growth.

Most Popular Narrative: 27.7% Undervalued

With Simply Good Foods last closing at $21.40 and the most followed narrative pointing to a fair value of $29.60, the gap between price and assumptions is clear and invites a closer look at what is driving that view.

The successful launch and scaling of Quest's salty snacks platform, which has grown to a $300 million business, suggests a long runway for further penetration and growth. This could drive future revenue growth for Simply Good Foods.

Curious what sits behind that fair value? The narrative leans on steady top line expansion, rising margins and a richer future earnings multiple. Want to see how those moving parts add up?

Result: Fair Value of $29.60 (UNDERVALUED)

However, you also need to weigh the risk that ongoing Atkins softness or a bumpier than expected OWYN integration could limit the upside in this story.

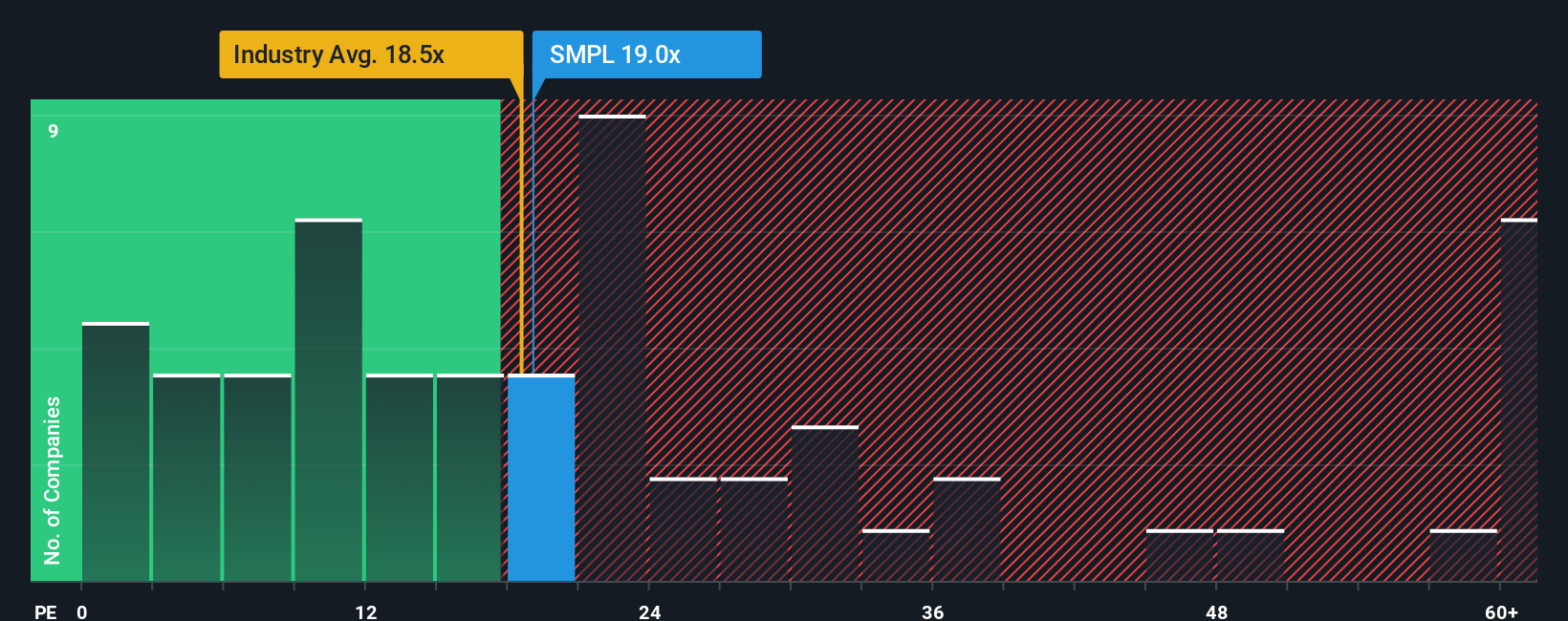

Another View: What Earnings Multiples Are Saying

While one narrative points to a fair value of $29.60, the current P/E of 21.8x paints a different picture. That is slightly above the estimated fair ratio of 21x and well above peers at 14.5x, which suggests less margin for error if revenue and profit growth do not play out as expected.

Build Your Own Simply Good Foods Narrative

If you are not fully on board with these views or prefer to evaluate the numbers yourself, you can build a fresh story in minutes with Do it your way.

A great starting point for your Simply Good Foods research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Simply Good Foods has caught your attention, do not stop here. The real edge often comes from comparing several ideas side by side before you commit.

- Spot potential bargains quickly by scanning these 882 undervalued stocks based on cash flows that may be trading below what their cash flows imply.

- Ride major tech shifts by checking out these 28 AI penny stocks that are building real businesses around artificial intelligence.

- Tap into digital trends by reviewing these 79 cryptocurrency and blockchain stocks tied to cryptocurrency and blockchain themes.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.