Please use a PC Browser to access Register-Tadawul

Assessing SiteOne Landscape Supply (SITE) Valuation After Recent Share Price Momentum

SiteOne Landscape Supply, Inc. SITE | 151.40 | +0.65% |

Why SiteOne Landscape Supply Is Back on Investors’ Radar

SiteOne Landscape Supply (SITE) has caught attention after recent share price moves, with the stock showing gains over the past month and past 3 months that stand out against its longer term total return record.

The recent 19.8% 3 month share price return, alongside a 19.9% year to date share price gain and 11.9% 1 year total shareholder return, points to momentum rebuilding after weaker multi year total returns.

If this move in SITE has you thinking about where else growth stories might emerge, it could be a good moment to scan our list of 22 top founder-led companies as potential next ideas.

With revenue of US$4.7b, net income of US$139.9m and mixed multi year returns, SiteOne now trades only slightly below one analyst price target. This raises the question of whether there is real value left or if the market is already banking on future growth.

Most Popular Narrative: 4.1% Undervalued

At a last close of $150.01 versus a narrative fair value of $156.40, SiteOne Landscape Supply is framed as modestly undervalued, with the story leaning heavily on earnings and margin expansion assumptions rather than near term price action.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.8x on those 2028 earnings, down from 50.8x today. This future PE is greater than the current PE for the US Trade Distributors industry at 22.0x.

Curious why this narrative still sees upside even with a richer future earnings multiple than peers, and relies on rising margins plus steady revenue compounding to get there, without assuming rapid top line acceleration or outsized acquisitions to close the gap.

Result: Fair Value of $156.40 (UNDERVALUED)

However, risks around acquisition integration and exposure to softer construction and renovation markets could easily disrupt this margin expansion story.

Another View: Multiples Paint a Tougher Picture

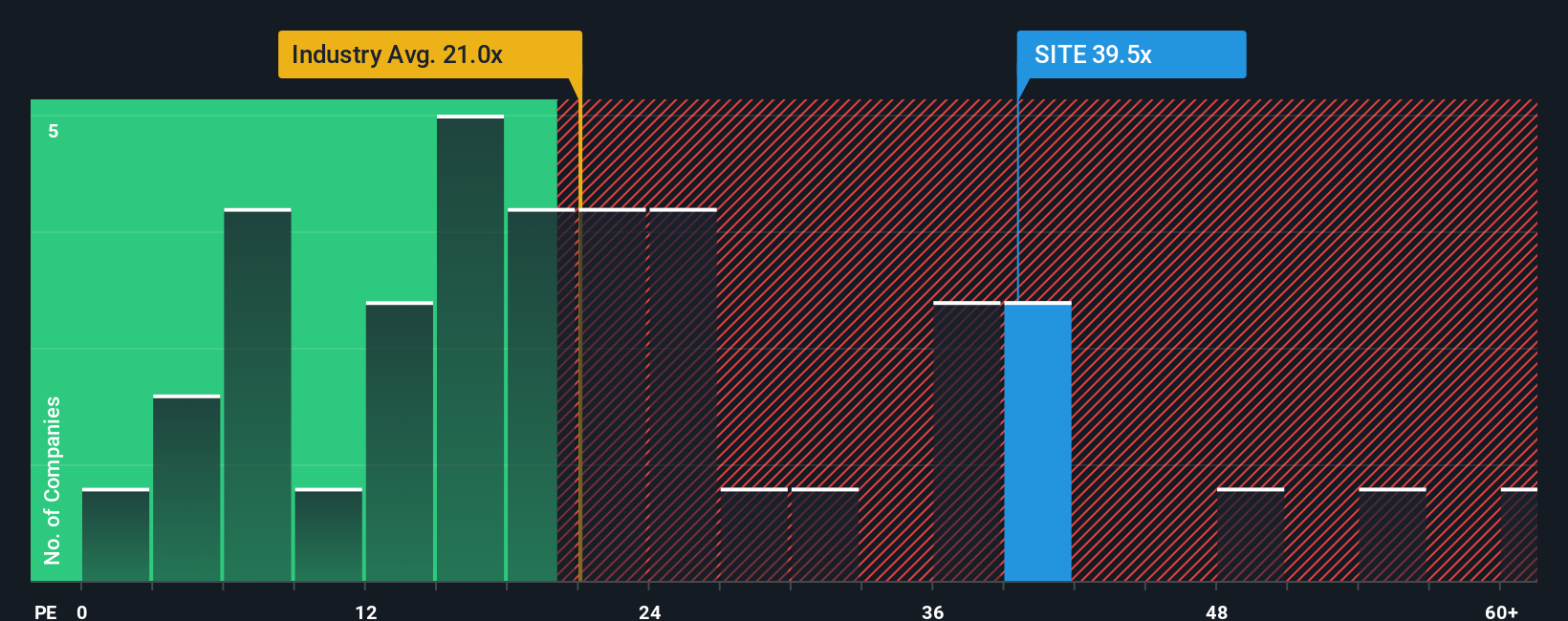

That 4.1% narrative undervaluation sits awkwardly next to how the market is actually pricing SiteOne today. The stock trades on a P/E of 47.8x, compared with 24.7x for the US Trade Distributors industry and a fair ratio of 31.2x, which points to valuation risk rather than a clear bargain. This raises the question of whether the story is really about upside or about how much optimism is already in the price.

Build Your Own SiteOne Landscape Supply Narrative

If this framework does not fully line up with your own view, or you would rather work from the raw numbers yourself, you can build a tailored narrative in just a few minutes using our tools. Start with Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding SiteOne Landscape Supply.

Looking for more investment ideas?

If you like what you have seen with SiteOne but want a broader watchlist, it makes sense to line up a few more candidates now.

- Target potential value opportunities by scanning our 52 high quality undervalued stocks that combine quality fundamentals with room for a more appealing price.

- Prioritise resilience first and shortlist companies using the 84 resilient stocks with low risk scores designed to highlight businesses with lower overall risk profiles.

- Chase future standouts early by checking our screener containing 24 high quality undiscovered gems that focuses on companies with strong fundamentals yet limited market attention.

Skip waiting for the next idea to land in your feed, and line up options today with these focused screeners so you are ready when opportunity appears.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.