Please use a PC Browser to access Register-Tadawul

Assessing SPS Commerce (SPSC) Valuation: Is There Untapped Upside for Patient Investors?

SPS Commerce, Inc. SPSC | 86.23 86.23 | +0.31% 0.00% Pre |

SPS Commerce (SPSC) has been in the spotlight as investors take stock of its recent performance. Shares have seen modest gains over the past week, while still trailing over the past three months. This trend highlights shifting sentiment around the company as market conditions evolve.

SPS Commerce’s 1-year total shareholder return of -41.1% shows the company is still working to win back market confidence after this year’s sharp pullback. At the same time, the recent 7-day share price return of nearly 5% suggests some positive momentum might be building. Longer-term holders have seen a modest gain over five years, but short-term swings highlight persistent questions around valuation and growth expectations.

If you’re rethinking your portfolio strategy, now’s a great time to broaden your search and discover fast growing stocks with high insider ownership.

With shares still trading at a significant discount to analyst price targets, and annual revenue and profit both growing, is SPS Commerce an overlooked bargain for patient investors, or is the market already factoring in future gains?

Most Popular Narrative: 21% Undervalued

With a fair value set at $142.27, substantially above the latest close of $112.45, there is a notable gap between analyst consensus and recent market pricing. This opens the door for investors to explore what is driving analysts’ conviction in the company’s long-term prospects.

The accelerating digitalization of retail supply chains and rising compliance requirements are driving robust demand for SPS Commerce's cloud-based EDI and supply chain solutions, supporting sustained growth in new customer adds and recurring revenue. As the complexity of omni-channel retail and need for real-time, integrated supply chain analytics increases, SPS Commerce is well positioned to expand its average revenue per user (ARPU) through expanded network connections and the cross-selling of high-value products like analytics and revenue recovery solutions.

Want to know why analysts see so much hidden potential in SPS Commerce? The narrative’s projected future growth, profit margins, and valuation multiples could unlock major upside. The key drivers behind this valuation might surprise you. Click through to discover the bold assumptions fueling these targets.

Result: Fair Value of $142.27 (UNDERVALUED)

However, ongoing macroeconomic caution and increased customer efforts to lower spending may put pressure on SPS Commerce’s growth and profit expectations in the future.

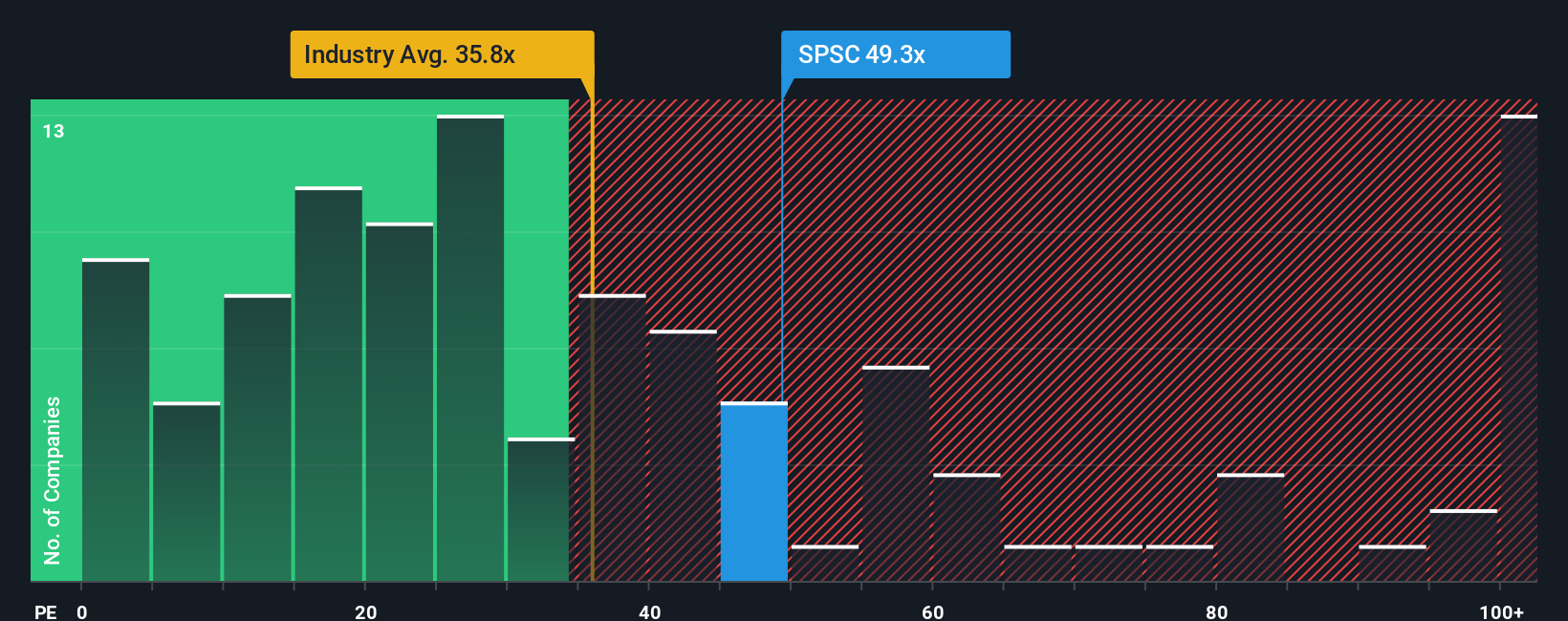

Another View: High Price Relative to Peers

Looking at valuation through one key metric, SPS Commerce trades at a price-to-earnings ratio of 51.4x, which is well above both its industry average (34.3x) and close peers (18.3x). The fair ratio estimate is just 33.9x, highlighting a real risk if the market retunes its view. Is this a sign of a premium worth paying, or could expectations be running ahead of future results?

Build Your Own SPS Commerce Narrative

If this perspective doesn’t quite fit what you see in the data, there’s no need to settle for someone else’s view when you can quickly build your own angle. You can analyze the numbers and assemble a narrative in under three minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding SPS Commerce.

Looking for More Investment Ideas?

Great opportunities don't wait. Stay a step ahead and target growth or income by tapping into hand-picked stocks in sectors that are capturing global attention right now.

- Uncover potential multi-baggers backed by strong fundamentals with these 3569 penny stocks with strong financials offering robust financials and growth momentum.

- Start building a forward-thinking portfolio by evaluating these 27 quantum computing stocks driving advances in tomorrow’s computing breakthroughs.

- Boost your income strategy by pinpointing reliable yield opportunities among these 17 dividend stocks with yields > 3% paying over 3% annual returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.