Please use a PC Browser to access Register-Tadawul

Assessing Syndax Pharmaceuticals (SNDX) Valuation After Revuforj And Niktimvo Commercial Launch

Syndax Pharmaceuticals Inc SNDX | 19.69 | -4.56% |

Why the launch of Revuforj and Niktimvo matters for Syndax Pharmaceuticals (SNDX)

Syndax Pharmaceuticals (SNDX) has shifted into a commercial-stage biotech after launching Revuforj and Niktimvo for cancer and chronic graft-versus-host disease, a change that puts revenue execution and label expansion plans in sharper focus for investors.

The recent launches of Revuforj and Niktimvo come after a sharp 49.67% 90 day share price return and a 42.11% 1 year total shareholder return, even though the year to date share price return is slightly negative. This suggests earlier optimism has cooled a bit as investors weigh commercial execution risks against long term potential.

If this kind of biotech story has your attention, it could be a good moment to broaden your search across healthcare stocks and see what else fits your watchlist.

With SNDX trading at US$20.25 and sitting at a large discount to both analyst targets and some intrinsic value estimates, you have to ask: is this an overlooked commercial pivot, or is the market already pricing in potential future developments?

Most Popular Narrative: 48.5% Undervalued

At $20.25, the most followed narrative pegs Syndax Pharmaceuticals’ fair value at $39.31, which puts a big spotlight on the growth assumptions behind that gap.

Late-stage pipeline advancements (including frontline trials, lifecycle management, and expansion into new indications like IPF for Niktimvo), coupled with strong clinical data and market-leading positions in precision oncology, provide robust long-term growth avenues aligned with surging demand for targeted therapies, supporting sustained multi-year earnings momentum.

Curious what kind of revenue ramp and margin shift would need to line up with that story? The narrative leans on aggressive earnings progress and a rich future multiple that usually only shows up in higher growth sectors. If you want to see exactly which assumptions are carrying that $39.31 fair value, the full narrative lays them out in black and white.

Result: Fair Value of $39.31 (UNDERVALUED)

However, the whole story can change quickly if Revuforj or Niktimvo hit regulatory or safety setbacks, or if intense competition squeezes pricing and slows uptake.

Another View: Multiples Point To A Very Different Story

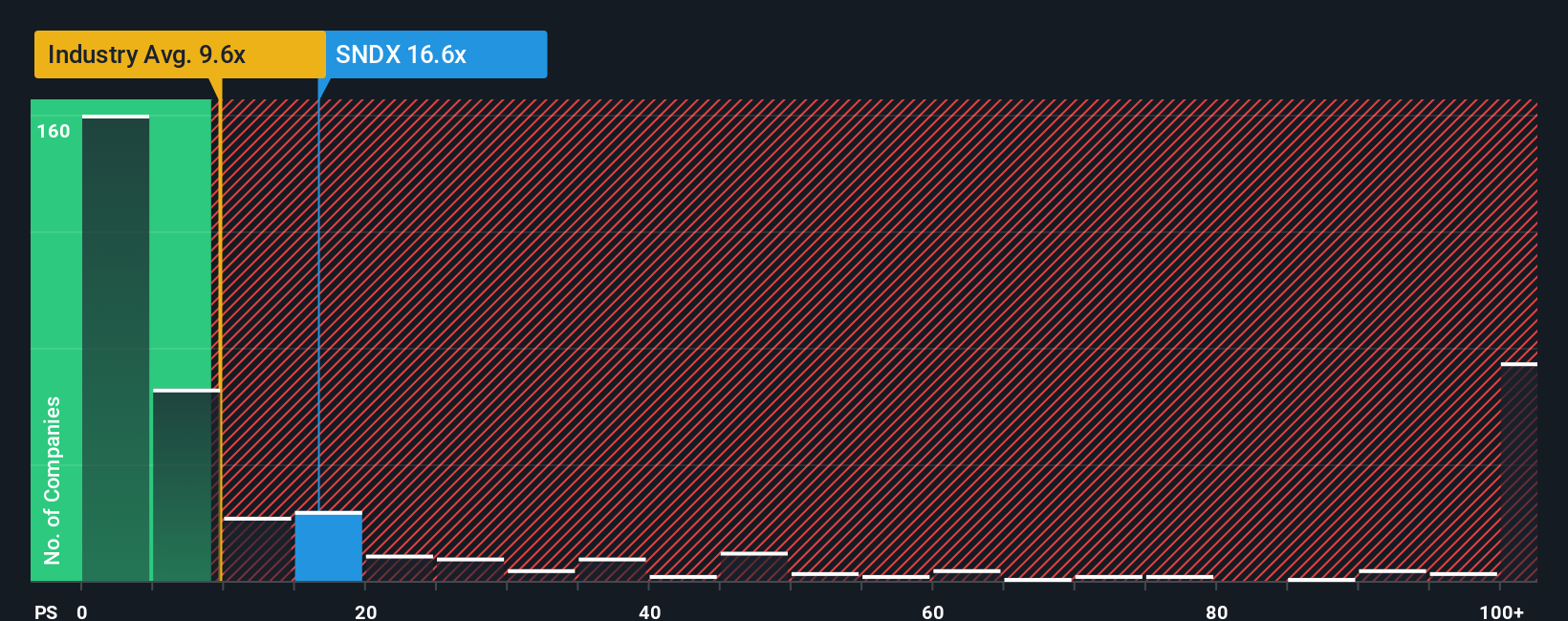

The community narrative leans on a fair value of $39.31, but the market is sending a different signal. At a P/S of 15.8x, Syndax trades richer than both the US Biotechs average of 12x and its own fair ratio of 0.9x. This points to meaningful valuation risk if expectations reset.

Build Your Own Syndax Pharmaceuticals Narrative

If you are not on board with these views or simply prefer to test the numbers yourself, you can build your own Syndax story in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Syndax Pharmaceuticals.

Looking for more investment ideas?

If Syndax has sharpened your interest, do not stop here. The right watchlist often starts with a few well chosen themes that fit how you like to invest.

- Spot potential early movers by scanning these 3523 penny stocks with strong financials that already back their share price with stronger financial foundations.

- Ride the AI shift by focusing on these 24 AI penny stocks that are tying artificial intelligence to real business models rather than just headlines.

- Hunt for price dislocations using these 864 undervalued stocks based on cash flows where current share prices sit below what cash flow estimates suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.