Please use a PC Browser to access Register-Tadawul

Assessing the Valuation of Gemini Space Station (NasdaqGS:GEMI) After Renewed Investor Interest

Gemini Space Station, Inc. GEMI | 12.11 | +4.26% |

Price-to-Sales of 27.5x: Is it justified?

Based on the preferred price-to-sales ratio, Gemini Space Station currently trades at 27.5 times its sales. This is significantly higher than the US Capital Markets industry average of 4.1 times sales and the peer group average of 3.2 times sales. This suggests that the stock is considered expensive compared to its peers and industry based on this commonly used valuation metric.

The price-to-sales ratio considers the company’s market value relative to its annual revenue. It is a helpful tool for evaluating companies that are not yet profitable or are in early growth phases. In capital markets, a lower price-to-sales ratio typically reflects a more attractive valuation, while a higher ratio can indicate that the market expects rapid revenue growth or improved profitability in the future.

Given the lack of sustained profitability and the absence of clear analyst forecasts or strong financial history, this high multiple signals that investors are willing to pay a premium for anticipated future prospects rather than proven results. Whether this optimism will be justified remains to be seen as more financial data becomes available.

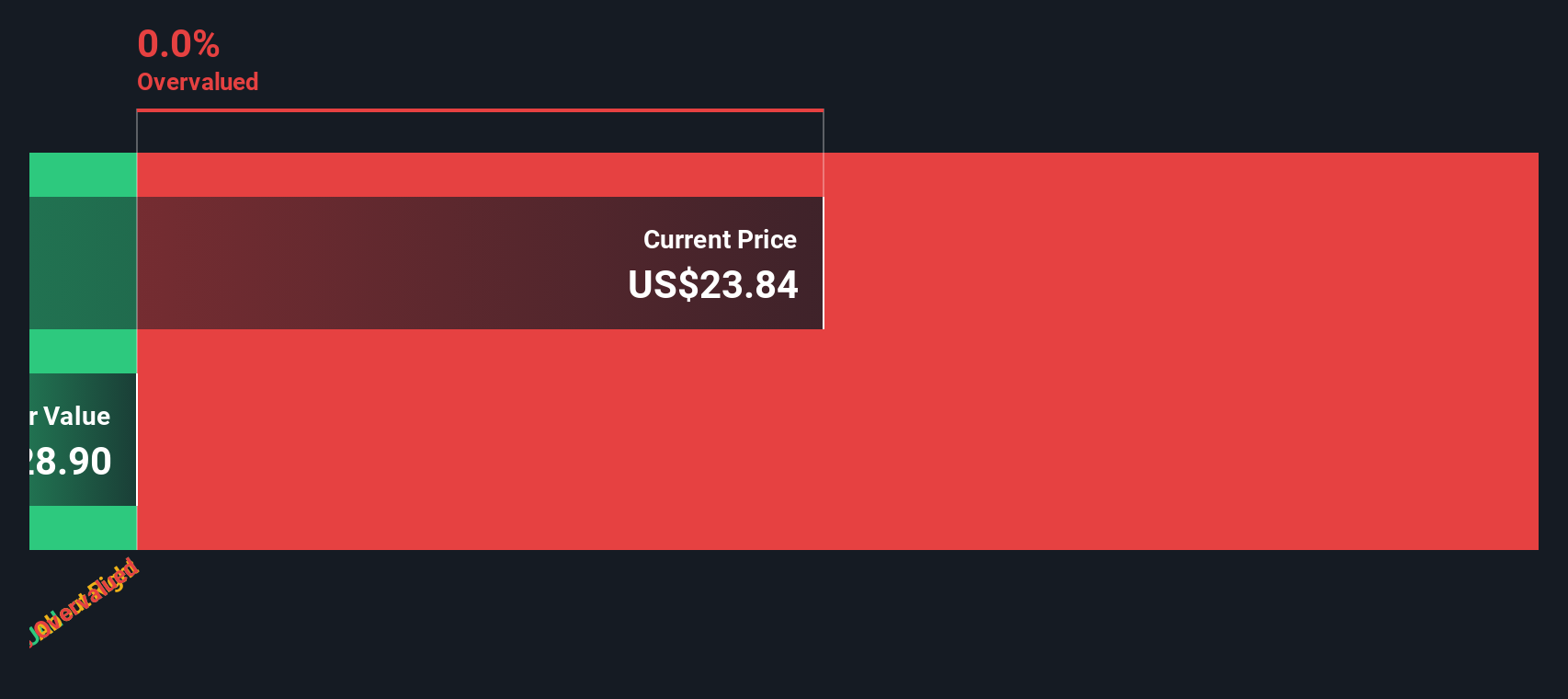

Result: Fair Value of $32.00 (OVERVALUED)

See our latest analysis for Gemini Space Station.However, a lack of sustained profitability and limited recent revenue growth remain key risks that could quickly challenge the current premium valuation.

Find out about the key risks to this Gemini Space Station narrative.Another View: SWS DCF Model Perspective

Looking at Gemini Space Station through our DCF model leads to a similar conclusion and reinforces the premium suggested by the sales-based valuation. Both approaches, although they use different inputs, tell a comparable story. Could new fundamentals change the outlook?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Gemini Space Station Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can easily build your own perspective in just a few minutes. Do it your way

A great starting point for your Gemini Space Station research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. If you want to capitalise on tomorrow’s winners, check out these powerful stock ideas and make sure you’re ahead of the curve.

- Accelerate your growth potential by targeting breakthrough companies in artificial intelligence with AI penny stocks, which are shaping the future of tech innovation.

- Build a stream of reliable returns by focusing on income-generating stocks using dividend stocks with yields > 3% to enhance yield and portfolio stability.

- Tap into companies trading below intrinsic value with undervalued stocks based on cash flows and position yourself to spot hidden gems before the rest of the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.