Please use a PC Browser to access Register-Tadawul

Assessing the Valuation of Live Oak Bancshares (LOB) After New Jobs Data Shakes Market Expectations

Live Oak Bancshares, Inc. LOB | 35.52 | +0.59% |

If you are watching Live Oak Bancshares (LOB) this week, there is no shortage of headlines catching your attention. The real trigger came from a sharp revision downward in U.S. jobs data, suggesting the labor market is much weaker than most expected. With the Federal Reserve now under pressure to ease monetary policy, shares of digital lenders like Live Oak Bancshares saw a quick reaction, dropping 3% as investors recalibrated their expectations.

This isn’t just about a single day’s volatility though. Over the past month, Live Oak Bancshares is actually up 7%, even with some recent bumps. While the broader year tells a different story, as shares are down 19%, the company has still managed to post double-digit annual growth in both revenue and net income. Against a backdrop of mounting macroeconomic concerns and Fed-watching, momentum has started shifting, and investors are debating whether this latest movement signals a change in risk or the start of something new.

After a year of heavy swings and fresh questions about the economy, is Live Oak Bancshares a bargain hiding in plain sight, or is the market already pricing in everything that’s coming?

Most Popular Narrative: 3.9% Undervalued

The prevailing view suggests that Live Oak Bancshares is trading slightly below its estimated fair value, with signs pointing to undervaluation according to the popular narrative.

Continued investment in AI, digital banking technology and process automation is enabling greater operating efficiency, improved customer and employee experiences, and potential for lower credit costs. This supports operating leverage and the potential for higher net margins over time.

What is hiding behind these valuation forecasts? The story is fueled by bold technology bets and growth assumptions that could reshape the outlook for this digital bank. Want to know which future milestones and profit drivers this narrative puts at the forefront? Uncover the numbers and big ideas setting the fair value calculation apart from the market consensus.

Result: Fair Value of $38.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, concentrated exposure to government-backed lending and mounting competition in digital banking could quickly challenge the optimistic view on Live Oak Bancshares's growth trajectory.

Find out about the key risks to this Live Oak Bancshares narrative.Another View: Valuation by Earnings

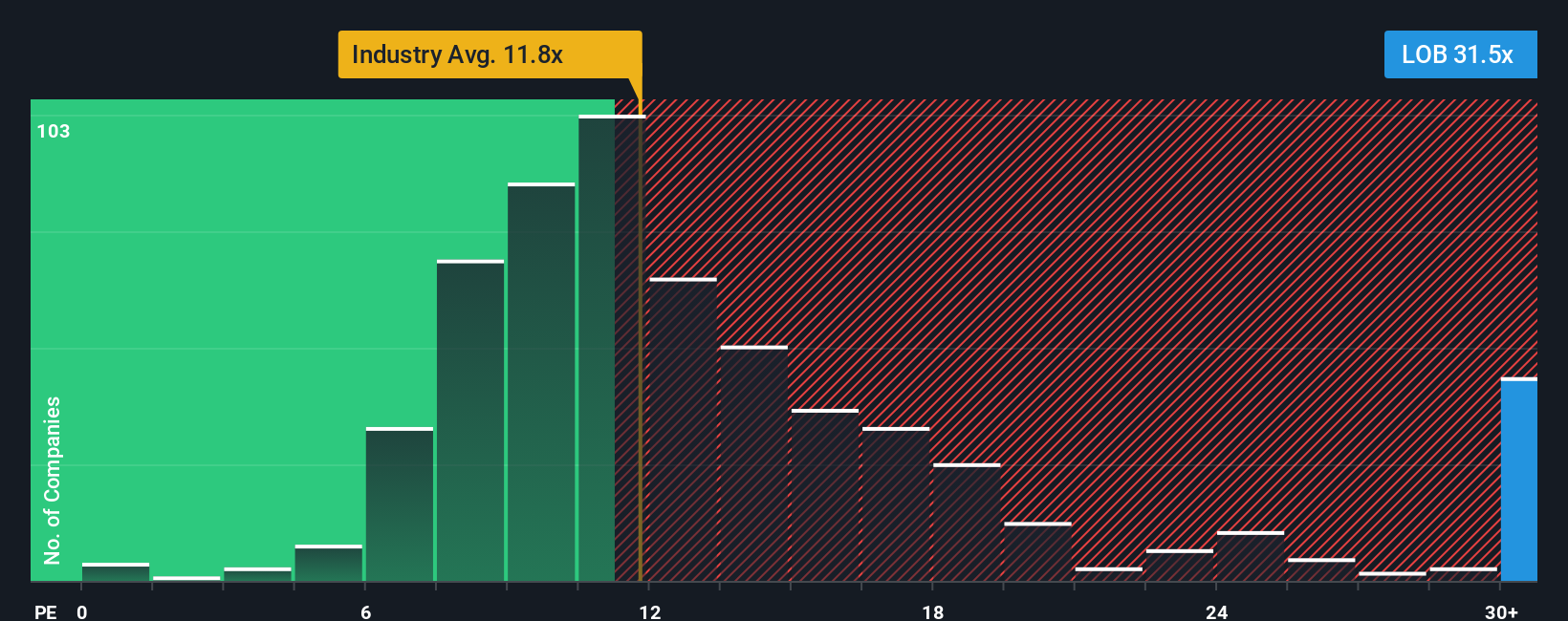

Looking from an earnings-based perspective, market pricing for Live Oak Bancshares comes in higher than industry norms, indicating a more expensive valuation. Could the market be pricing risks, or is optimism running ahead of reality?

Build Your Own Live Oak Bancshares Narrative

If you want to dig into the details yourself or think a different story stands out, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Live Oak Bancshares research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Why settle for just one story when the market is full of potential? Use the Simply Wall Street Screener to spot fresh angles and sectors on the rise so you never miss a promising trend.

- Unlock access to unique tech disruptors riding the wave of artificial intelligence updates by checking out AI penny stocks.

- Start building a portfolio of steady income with companies boasting strong yields, featured in our handpicked list of dividend stocks with yields > 3%.

- Unearth stocks trading below their true worth and get ahead of the crowd with our collection focused on undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.