Please use a PC Browser to access Register-Tadawul

Assessing Thor Industries (THO) Valuation Following Higher Earnings Outlook and Strategic Expansion

Thor Industries, Inc. THO | 102.22 | +0.74% |

If you own or are eyeing shares of Thor Industries (THO), the past week probably grabbed your attention. Shares surged 3.2% in the last trading session, fueled by impressive trading volume. This move came after analysts sharply raised their earnings outlook for the company, with the consensus EPS estimate climbing 28.4% over the past month. Add in the company’s history of acquiring brands like EHG and TiffinHomes, locking down a bigger slice of the European RV market, and you can see why investors are suddenly circling.

This upswing is set against a year where Thor Industries has delivered solid, if measured, gains. The stock is up 5.6% over the past year and 11.1% year-to-date, with a noticeable acceleration in the past three months. Recent acquisitions have helped drive revenue and net income growth, supporting the view that the company is managing both expansion and profitability. Still, it's worth noting that market sentiment has been mixed, with some analysts flagging choppy conditions and no strong consensus on price direction until this latest earnings outlook revision.

With momentum building, the big question is whether current optimism signals a true bargain for buyers or if the market is already pricing in the good news. Is now the moment to step in, or has Thor’s near-term growth story already played out?

Price-to-Earnings of 25.1x: Is it justified?

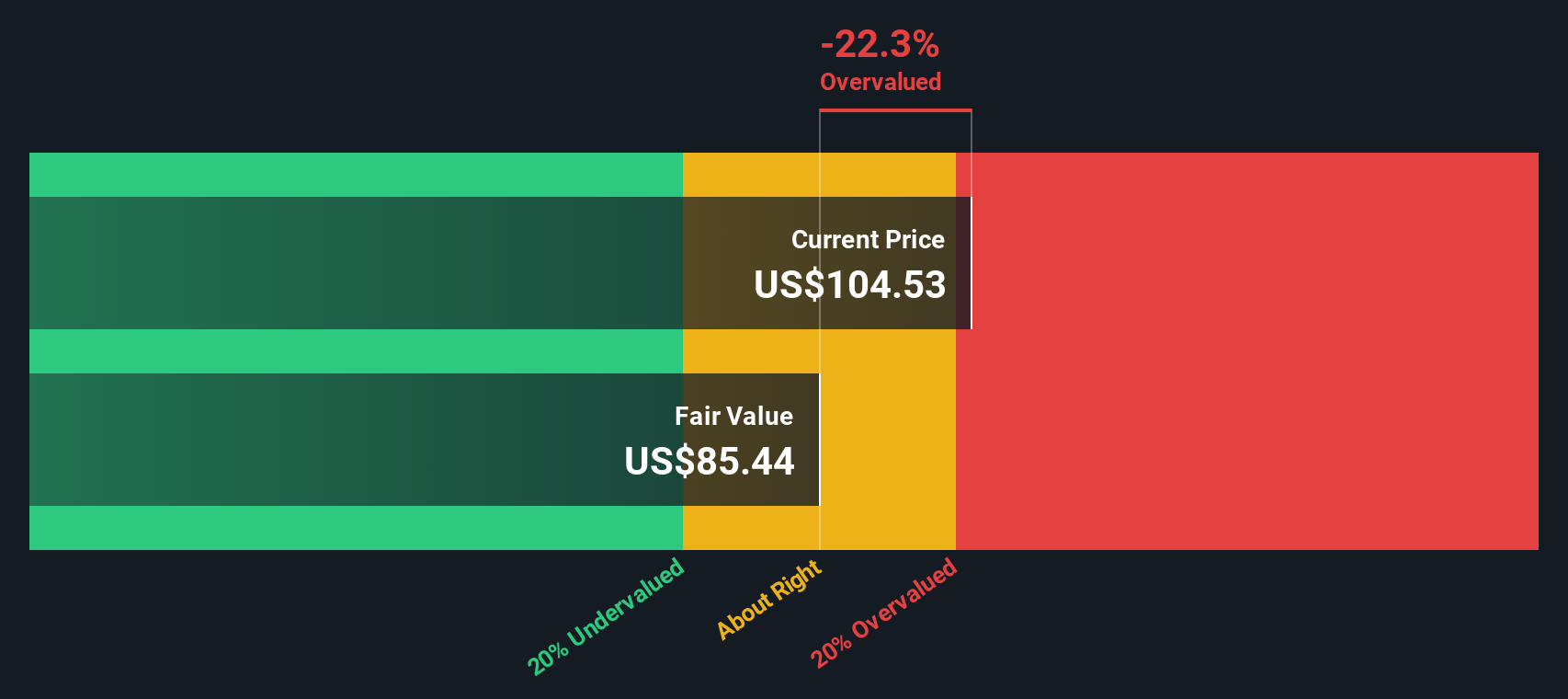

Current valuation metrics suggest Thor Industries stock is trading at a premium compared to both its peers and the broader auto industry average.

The price-to-earnings (P/E) ratio compares a company’s share price to its per-share earnings, providing a snapshot of how much investors are willing to pay for each dollar of earnings. This metric is important in the auto sector because it reflects market expectations for future growth and profitability relative to competitors.

Thor Industries' P/E ratio stands at 25.1x, which is notably higher than the global auto industry average of 18.3x and the peer group average of 15x. This suggests that the market is pricing in higher future growth or sustained earnings strength. However, it also raises questions about whether such a premium is justified given recent performance trends and earnings history.

Result: Fair Value of $94.17 (OVERVALUED)

See our latest analysis for THOR Industries.However, weak short-term returns and a persistent premium to fair value could spark a reversal if growth or earnings fail to meet expectations.

Find out about the key risks to this THOR Industries narrative.Another View: What Does the DCF Model Say?

Taking a different approach, our SWS DCF model paints a less optimistic picture than the current market price. This suggests Thor Industries could be trading above its intrinsic value. Does this method capture something that the multiples approach might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own THOR Industries Narrative

If you want to dig deeper or draw your own conclusions from the numbers, you can build a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding THOR Industries.

Looking for more investment ideas?

Stay ahead of the curve by using the Simply Wall Street Screener. Don’t let opportunities pass you by—these tools make surfacing smart investment plays easy.

- Unlock hidden gems by targeting undervalued companies and jump-start your portfolio with fresh prospects from the undervalued stocks based on cash flows.

- Capitalize on booming trends by finding high-potential enterprises transforming the future of medicine through healthcare AI stocks.

- Grow your passive income with stocks offering substantial yields, handpicked in our dividend stocks with yields > 3% selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.