Please use a PC Browser to access Register-Tadawul

Assessing Tidewater (TDW) Valuation After New 2026 Revenue Guidance And Share Buyback Update

Tidewater Inc TDW | 73.38 | -0.64% |

What Triggered the Latest Move in Tidewater (TDW)?

Tidewater (TDW) is back on investor radar after management outlined 2026 revenue guidance of US$1.32b to US$1.37b, reaffirmed a US$500m share repurchase capacity, and reported improving third quarter results.

These company specific updates, supported by firmer crude prices and a soft U.S. jobs report, came alongside a 7.1% one day share price move after TDW broke above US$56, drawing fresh attention ahead of the February 26 earnings release.

Those guidance headlines and the share repurchase capacity come after a 14.3% 90 day share price return and a more modest 2.6% 1 year total shareholder return, suggesting momentum has picked up recently while longer term gains remain more measured.

If Tidewater has caught your eye, this could be a good moment to broaden your watchlist and check out aerospace and defense stocks as another pocket of opportunity in the market.

With TDW up 14.3% over 90 days but only 2.6% over 1 year, and trading below an average analyst price target, the central question is whether this represents an entry point or whether the market already reflects future growth.

Most Popular Narrative: 5.8% Undervalued

Tidewater's widely followed narrative points to a fair value of US$60 against a last close of US$56.50, indicating modest potential upside if its assumptions play out.

Persistent vessel supply constraints and robust offshore project demand are cited as factors that could support higher utilization, stronger pricing, and sustained revenue and margin growth. Fleet modernization and disciplined operational execution have coincided with three consecutive quarters of 50%+ gross margin, which some observers view as supporting the expectation of structurally higher operating margins and net earnings as the company experiences lower repair and maintenance costs and higher reliability.

The key question is what earnings profile and margin path are required for that valuation to hold. The narrative places significant emphasis on future profitability and capital discipline. Which specific revenue and earnings assumptions are most critical in this fair value case?

Result: Fair Value of $60 (UNDERVALUED)

However, this hinges on offshore demand holding up and Tidewater executing on acquisitions, because weaker project activity or mispriced deals could quickly challenge that earnings path.

Another View: Market Pricing Sends Mixed Signals

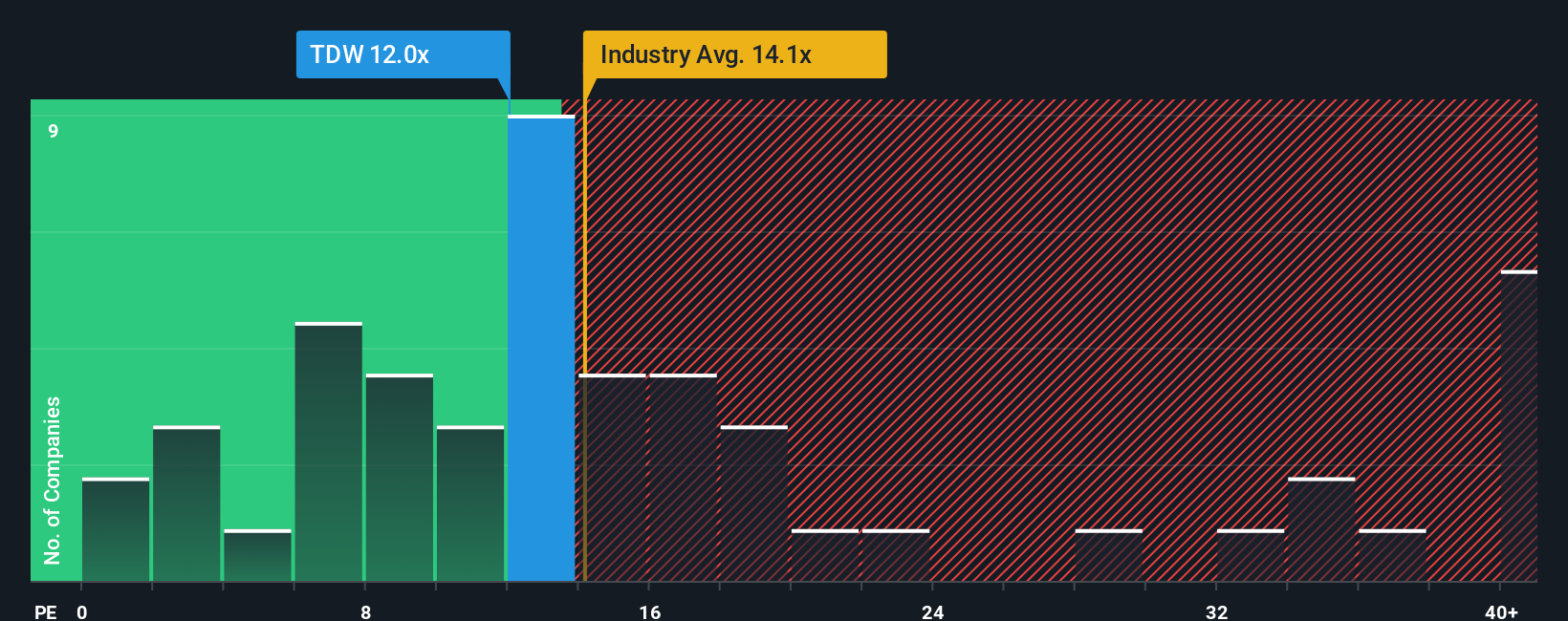

The narrative points to fair value around US$60, yet the current P/E of 18.5x sits above both Tidewater's own fair ratio of 17.4x and below the US Energy Services average of 20.9x. That split suggests some valuation risk, but also relative sector appeal. Which side of that trade-off matters more to you?

Build Your Own Tidewater Narrative

If parts of this story do not quite fit your view, or you prefer to test the assumptions yourself, you can build a custom Tidewater thesis in just a few minutes with Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Tidewater.

Looking for more investment ideas?

If Tidewater has you thinking more broadly about your portfolio, this is a smart moment to widen the net and actively search for other opportunities.

- Zero in on potential bargains by scanning these 884 undervalued stocks based on cash flows that may offer attractive pricing relative to their estimated cash flows.

- Get ahead of emerging trends by checking out these 79 cryptocurrency and blockchain stocks tied to blockchain and digital asset themes.

- Strengthen your income focus by reviewing these 12 dividend stocks with yields > 3% that could complement growth oriented holdings.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.