Please use a PC Browser to access Register-Tadawul

Assessing Tower Semiconductor (NasdaqGS:TSEM) Valuation as Barclays Highlights Growth Ambitions and Strategic Partnerships

Tower Semiconductor Ltd TSEM | 114.86 | -2.87% |

Barclays initiated coverage on Tower Semiconductor (NasdaqGS:TSEM), highlighting its active role in fast-growing technologies such as Silicon Photonics and Silicon Germanium. The report also emphasized Tower’s international partnerships and expansion strategy.

Tower Semiconductor’s recent coverage by Barclays comes at a moment when its momentum is starting to rebuild, as shown by a 1-year total shareholder return just under 1% and a 5-year total return approaching 3%. While the share price itself has posted only modest movement lately, investor interest appears to be warming as the company pursues growth in advanced chip segments and strengthens global collaborations.

If innovative chipmakers like Tower have your attention, it could be an ideal time to see which other fast-growing semiconductor or AI companies are attracting buzz. See the full list for free.

Yet with Tower’s shares trading near recent highs and growth already in the spotlight, the key question is whether investors are looking at an undervalued opportunity or if the current price has already captured the company’s future potential.

Most Popular Narrative: 11% Overvalued

With Tower Semiconductor’s fair value in the most popular narrative landing at $67.26 and the last close above $76, analyst consensus sees the company priced a step ahead of its fundamentals. The narrative sets the stage by tying future gains to a sharp acceleration in revenues, margins, and industry leadership.

The rapid ramp-up in silicon photonics shipments, including expansion from transmit-only to both transmit and receive functions, higher bandwidth modules (up to 1.6T with 3.2T on the roadmap), and adoption by Tier 1 customers, positions Tower to further penetrate the growing optical transceiver market, supporting future revenue acceleration and increased average selling prices.

Curious where all this optimism is coming from? This narrative hides ambitious revenue targets, bold profit margin hikes, and a future earnings multiple that could shake up expectations. Find out what’s driving that headline fair value.

Result: Fair Value of $67.26 (OVERVALUED)

Still, a sudden drop in demand for specialty chips or unexpected shifts in customer relationships could quickly challenge the bullish outlook for Tower Semiconductor.

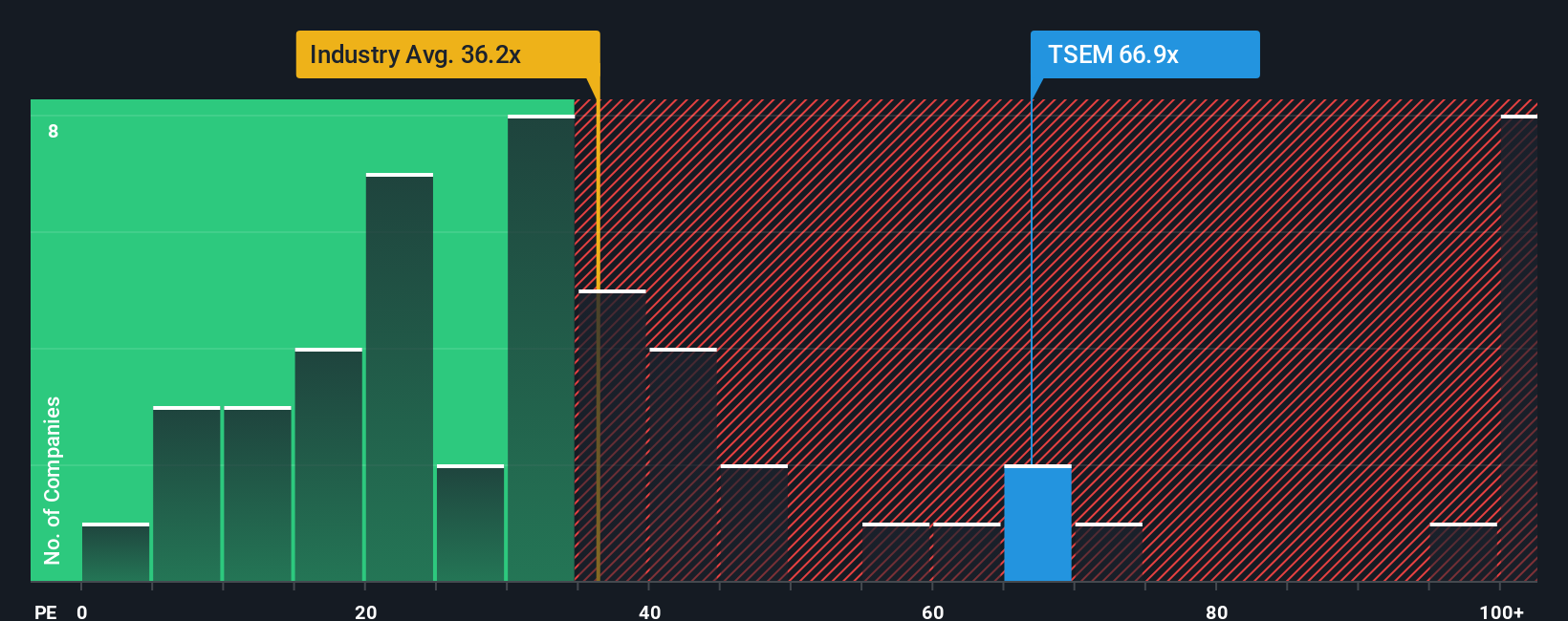

Another View: The Multiples Perspective

Looking from a different perspective, Tower Semiconductor currently trades at a price-to-earnings ratio of 43.4x, which is above both the US semiconductor industry average (37.1x) and the estimated fair ratio of 34.7x. This premium suggests investors are pricing in a lot of future growth and optimism, but it leaves less room for error. If the market grows cautious, could this high valuation multiple present a risk?

Build Your Own Tower Semiconductor Narrative

If you feel your investment story looks different or you want to dive deeper into Tower Semiconductor’s fundamentals, it only takes a few minutes to construct your own perspective in your own way. Do it your way.

A great starting point for your Tower Semiconductor research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Opportunities like Tower Semiconductor can spark great conversations. The real edge, however, comes from knowing where tomorrow’s winners are emerging next. Act quickly—the next big mover could be one you never expected!

- Catch the momentum of the AI revolution by checking out these these 24 AI penny stocks as they transform industries and redefine what's possible.

- Earn more from your holdings with a focus on income-generating plays like these these 19 dividend stocks with yields > 3%, offering robust dividends that could boost your portfolio’s returns.

- Position yourself at the forefront of innovation by investing in these 26 quantum computing stocks developing tomorrow’s quantum computing breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.