Please use a PC Browser to access Register-Tadawul

Assessing Uranium Energy (UEC) Valuation After New US$90.24 Million Shelf Registration And Anticipated EPS Loss

Uranium Energy Corp. UEC | 16.25 | +0.87% |

Uranium Energy (UEC) recently filed a shelf registration to offer up to 6,000,000 common shares, representing roughly US$90.24 million. This filing puts potential dilution and the company’s capital plans in sharper focus for shareholders.

Against this backdrop, Uranium Energy’s share price has pulled back over the past month, with a 30 day share price return of 9.71% and a 7 day share price return of 3.72%. However, the 90 day share price return of 33.91% and 1 year total shareholder return of 142.88% still point to strong longer term momentum as investors weigh the shelf registration and upcoming earnings with projected EPS of a US$0.06 loss.

If this news has you thinking more broadly about uranium and fuel supply themes, it could be a good moment to scan 85 nuclear energy infrastructure stocks as potential peers to research next.

With a projected EPS loss of US$0.06, a recent pullback, and a US$90.24 million shelf hanging in the background, is Uranium Energy now trading below its potential or is the market already pricing in future growth?

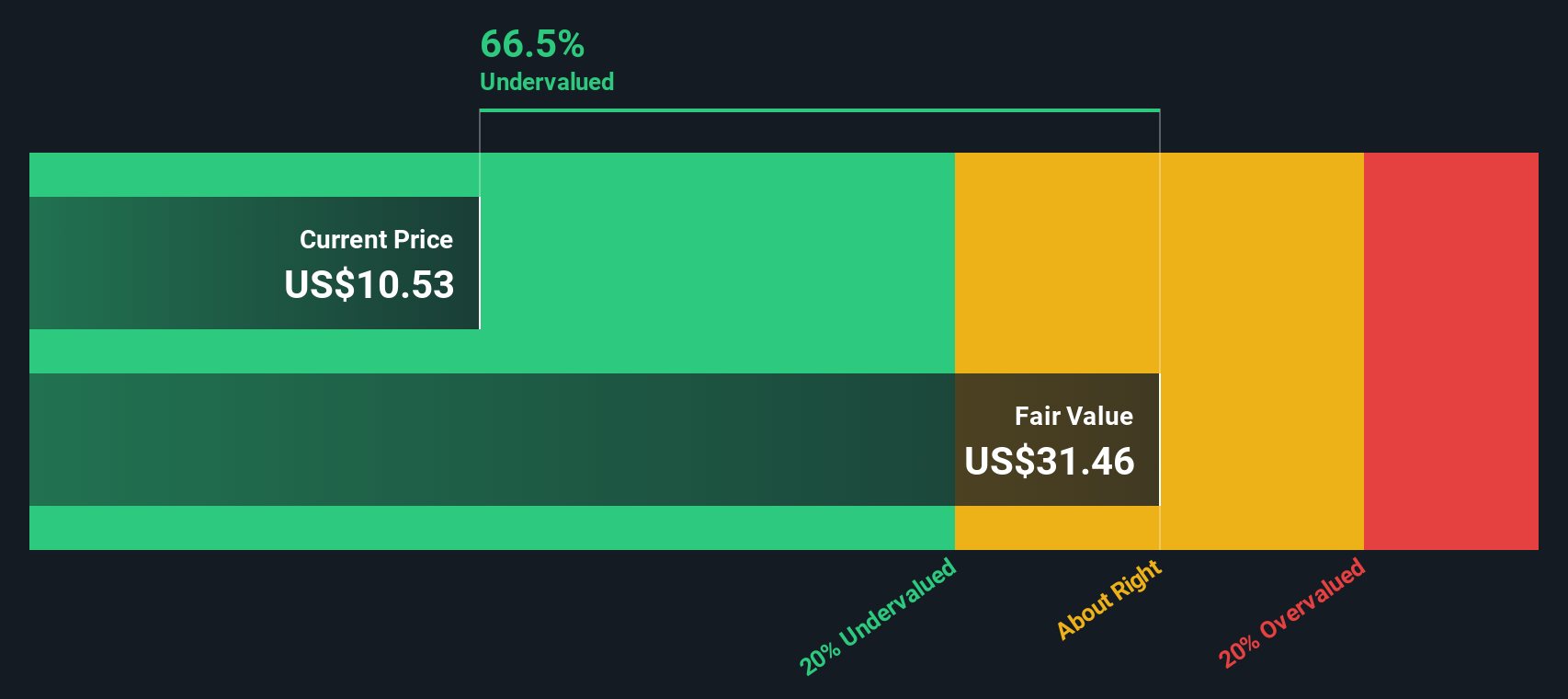

Most Popular Narrative: 6.7% Undervalued

At a last close of $15.52 versus a narrative fair value of $16.64, Uranium Energy is framed as modestly undervalued, with that view hinging on some punchy growth and margin assumptions.

Ramp up of multiple ISR hubs at Christensen Ranch, Burke Hollow and Ludeman alongside the Irigaray and Hobson plants should lift production volumes as new header houses and wellfields come online, supporting stronger revenue growth and better absorption of fixed costs, which can expand operating margins.

Want to see what kind of revenue lift and margin swing this story is built on? The most followed narrative leans on aggressive growth, rising profitability and a punchy future earnings multiple. Curious which assumptions have to land for that fair value to hold up?

Result: Fair Value of $16.64 (UNDERVALUED)

However, that story can crack if uranium prices soften for this unhedged producer, or if the new refining and conversion business runs into cost or permitting snags.

Another View: DCF Says UEC Looks Expensive

That 6.7% narrative undervaluation sits awkwardly next to the Simply Wall St DCF result, which puts fair value at $12.92 versus the current $15.52. On that basis, UEC screens as overvalued. Which perspective an investor emphasizes depends on how much future growth they consider realistic.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Uranium Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Uranium Energy Narrative

If you see the data differently or prefer to stress test every assumption yourself, you can pull the numbers, shape your own view and Do it your way in under three minutes.

A great starting point for your Uranium Energy research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you want to keep sharpening your watchlist beyond Uranium Energy, this is a good moment to cast the net wider and see what else stands out.

- Target potential mispricings by scanning 53 high quality undervalued stocks that pair solid fundamentals with prices that may not fully reflect their underlying business quality.

- Secure your income focus with 13 dividend fortresses that highlight companies offering yields of 5% or more, where stability and payouts sit front and center.

- Simplify risk control by using 85 resilient stocks with low risk scores, which is designed to surface companies with more resilient profiles when you want fewer surprises in your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.