Please use a PC Browser to access Register-Tadawul

Assessing UWM Holdings’ Valuation After Insider Share Sale and Mixed Earnings Results

UWM Holdings Corp. Class A UWMC | 4.62 | -3.75% |

UWM Holdings (UWMC) just saw a meaningful insider move, with major shareholder SFS Holding unloading stock and converting paired interests, shortly after mixed third quarter results that beat on revenue but missed on earnings.

At around $5.80, the recent insider sales and mixed earnings land against a backdrop where short term share price returns have been choppy, but the three year total shareholder return remains solidly positive, suggesting momentum has cooled rather than disappeared.

If you want to see how other financial names are setting up after earnings season, it might be worth exploring fast growing stocks with high insider ownership as a way to spot the next potential standout.

So with insiders cashing out, revenue rebounding, and earnings still lagging, is UWM’s valuation overly pessimistic relative to its long term track record, or is the market already correctly pricing in its future growth potential?

Most Popular Narrative Narrative: 17.1% Undervalued

With UWM Holdings closing at $5.80 against a narrative fair value of $7.00, the prevailing view leans toward upside potential grounded in long term earnings power.

UWM's large scale, tech forward business model positions it to benefit from digital and regulatory transformation in mortgage markets, with its superior capital resources and automation enabled underwriting/processes likely to reinforce pricing power and net margin resilience as industry consolidation continues. Bringing servicing in house is anticipated to generate cost efficiencies and enhance customer lifetime value by improving borrower loyalty and repeat/referral business for brokers, expected to benefit both net margins and revenues beginning in 2026 and beyond.

Want to see what kind of revenue lift and margin shift are baked into that fair value? The narrative leans on surprisingly aggressive profitability math.

Result: Fair Value of $7 (UNDERVALUED)

However, if mortgage volumes stall or brokers migrate toward retail and fintech rivals, UWM’s tech heavy, wholesale focused model could struggle to earn its narrative premium.

Another View: Multiples Flash a Very Different Signal

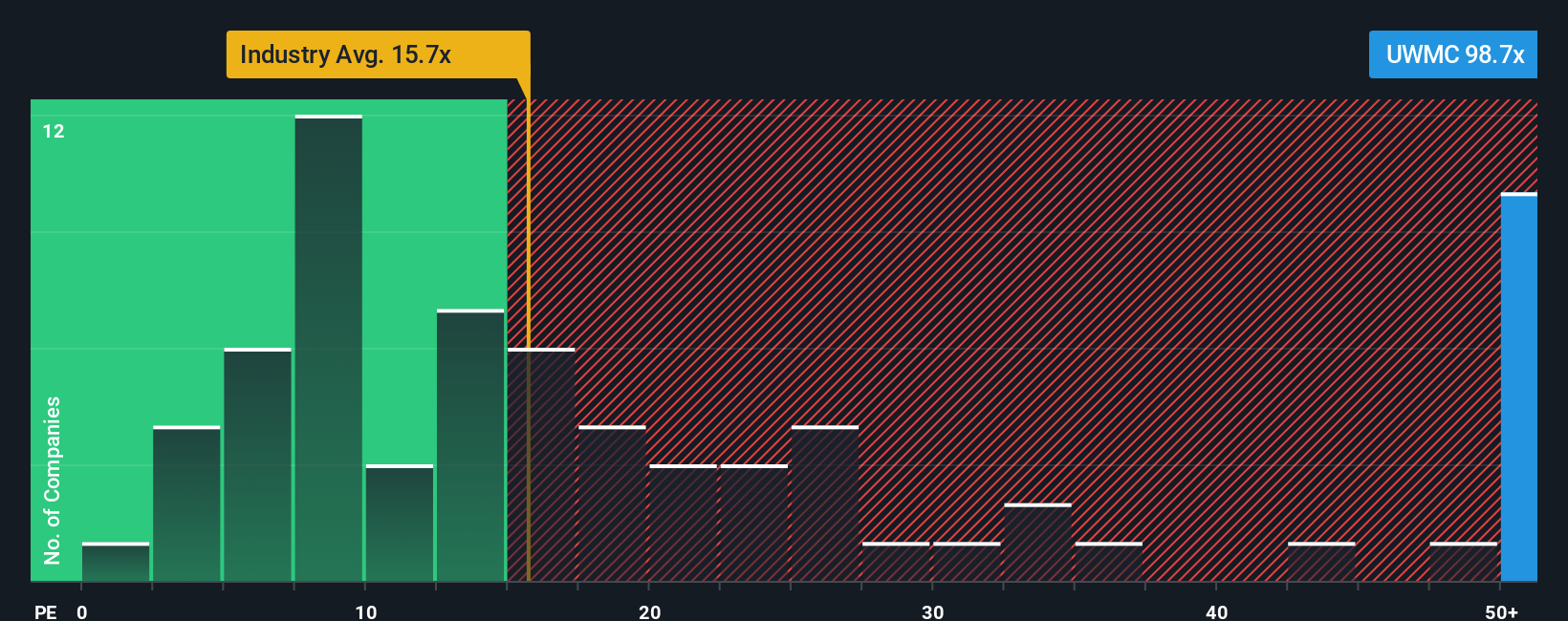

While the crowd narrative points to upside, the current price implies a price to earnings ratio of 87.5 times, far above peers at 9.7 times, the industry at 13.7 times, and even our fair ratio of 35.6 times. This raises real questions about valuation risk if sentiment cools.

Build Your Own UWM Holdings Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in under three minutes: Do it your way.

A great starting point for your UWM Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop with a single idea when the market is full of opportunities. Use the Simply Wall Street Screener to uncover more potential winners today.

- Capture potential mispricings by scanning these 910 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations others may be overlooking.

- Ride structural shifts in healthcare by targeting these 30 healthcare AI stocks that harness data and automation to reshape patient outcomes and profitability.

- Position yourself for the next wave of digital finance by zeroing in on these 81 cryptocurrency and blockchain stocks shaping payments, infrastructure, and blockchain ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.