Please use a PC Browser to access Register-Tadawul

Assessing Vera Therapeutics (VERA) Valuation As Atacicept Nears FDA Decision And Commercial Leadership Shifts

Vera Therapeutics, Inc. Class A VERA | 41.76 | -0.93% |

Vera Therapeutics (VERA) is entering a key transition period after naming Matt Skelton as Chief Commercial Officer, while its lead drug candidate atacicept moves through FDA Priority Review ahead of a July 7, 2026 PDUFA decision.

At a share price of US$40.95, Vera Therapeutics has seen a 69.28% 90 day share price return and a very large 3 year total shareholder return, while the 30 day share price return of a 15.88% decline suggests recent momentum has cooled despite progress around atacicept and the new commercial leadership.

If this turning point in Vera’s story has you looking across biotech, it could be a good time to scan our screener of 26 healthcare AI stocks for other potential ideas.

With Vera shares at US$40.95, trading at a large discount to the US$75.15 analyst price target following a strong multi-year run but a recent 30-day pullback, investors may wonder whether there is still a buying opportunity or if the market is already pricing in future growth.

DCF Valuation: How Far Below Fair Value Is Vera Trading?

According to the SWS DCF model, Vera Therapeutics has an estimated future cash flow value of $248.55 per share, compared with the current share price of $40.95. That gap suggests the shares are trading at a steep discount, with the market price sitting far below this modelled fair value.

The DCF approach works by estimating the cash flows a business could generate in the future and then discounting those back to today using a required rate of return. It is essentially a way of asking what those future cash flows are worth in present dollar terms, and then comparing that to where the stock currently trades.

For a clinical stage biotech like Vera Therapeutics, which currently reports no meaningful revenue and a net loss of $251.943m, this kind of framework leans heavily on assumptions about when profitability may arrive and how earnings might evolve. The statements provided indicate forecasts for revenue growth of 53.4% per year and earnings growth of 54.57% per year, alongside expectations that the company could move toward profitability over the next few years. Those inputs can heavily influence a DCF outcome.

Given that Vera is still unprofitable and its share price has been volatile compared with the broader US market, investors often treat DCF outputs as one reference point rather than a precise target. The contrast between the current $40.95 price and the $248.55 model estimate may prompt readers to look more closely at the assumptions around future cash flows, timing of profitability and the risks associated with funding and clinical milestones.

Result: DCF Fair value of $248.55 (UNDERVALUED)

However, you still have to weigh clinical and regulatory risk around atacicept’s FDA review, along with funding needs while Vera reports a US$251.943m net loss.

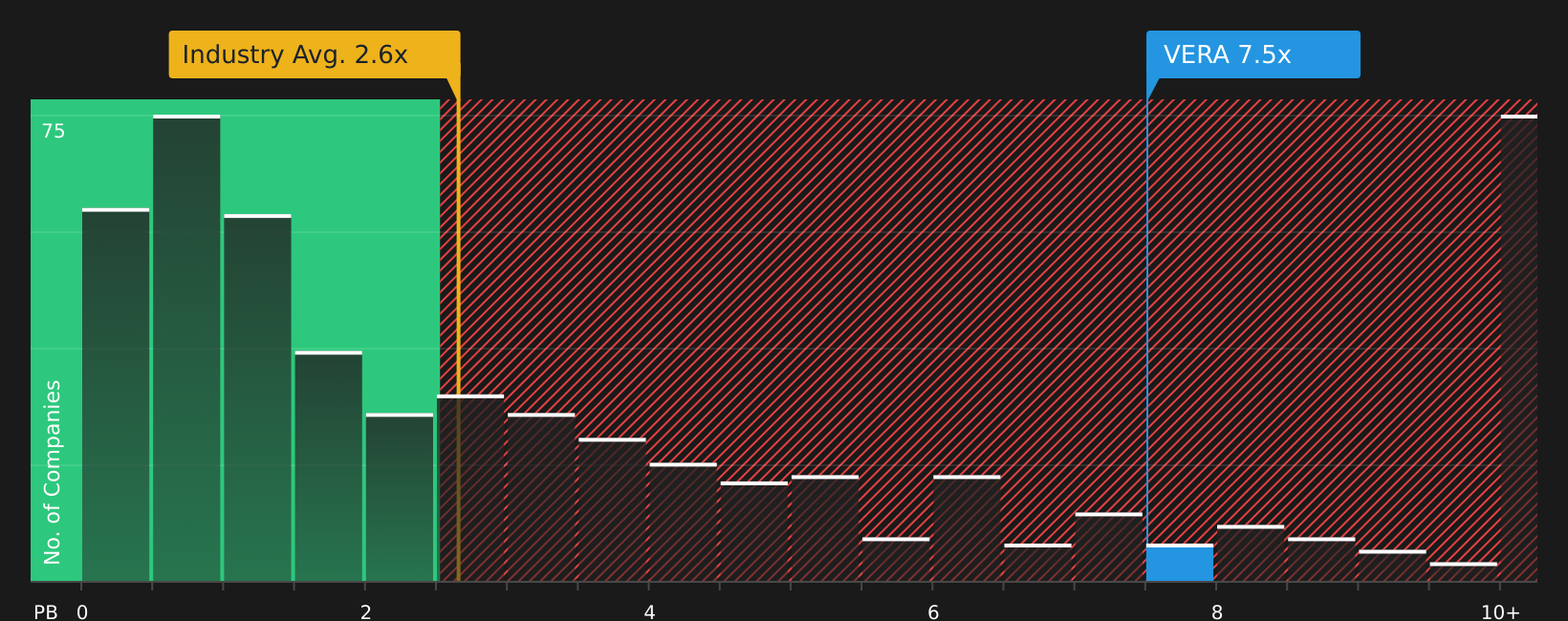

Another View: What Vera’s P/B Ratio Is Telling You

While the SWS DCF model points to upside, Vera’s P/B ratio of 7.3x looks expensive compared with the US Biotechs industry at 2.6x and peers at 7.1x. That gap suggests less room for error if the story around profitability or atacicept’s progress changes.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vera Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 53 high quality undervalued stocks. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vera Therapeutics Narrative

If you look at this and come to a different conclusion, that is fine. You can review the same data and build a tailored view of Vera in just a few minutes, then Do it your way.

A great starting point for your Vera Therapeutics research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you want to stress test your thinking beyond Vera, now is a good moment to scan other opportunities so you are not relying on a single story.

- Hunt for potential value by checking companies our screener flags as 53 high quality undervalued stocks, so you can see where expectations may be lower than the underlying fundamentals.

- Focus on resilience by reviewing stocks in our 86 resilient stocks with low risk scores that score well on risk metrics and may offer a smoother ride through market swings.

- Spot underfollowed ideas by browsing our screener containing 25 high quality undiscovered gems, where solid fundamentals have not yet attracted as much attention.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.